Overview

The article underscores the critical role of wind energy ROI studies in shaping informed development decisions for renewable energy projects. These studies are essential, providing vital insights into the financial viability and long-term advantages of wind energy investments. Supported by data on job creation, tax contributions, and technological advancements, they enhance profitability and sustainability within the sector. In an era where renewable energy is paramount, understanding these dynamics is not just beneficial but necessary for strategic decision-making.

Introduction

The renewable energy sector is witnessing remarkable growth, with wind energy leading this transformation. As investments in wind projects escalate, comprehending the return on investment (ROI) is essential for stakeholders navigating this intricate landscape. This article explores ten pivotal wind energy ROI studies, providing insights into the financial advantages, technological innovations, and economic repercussions that can aid in strategic decision-making.

What challenges and opportunities await investors in this dynamic market, and how can they utilize these studies to optimize their returns?

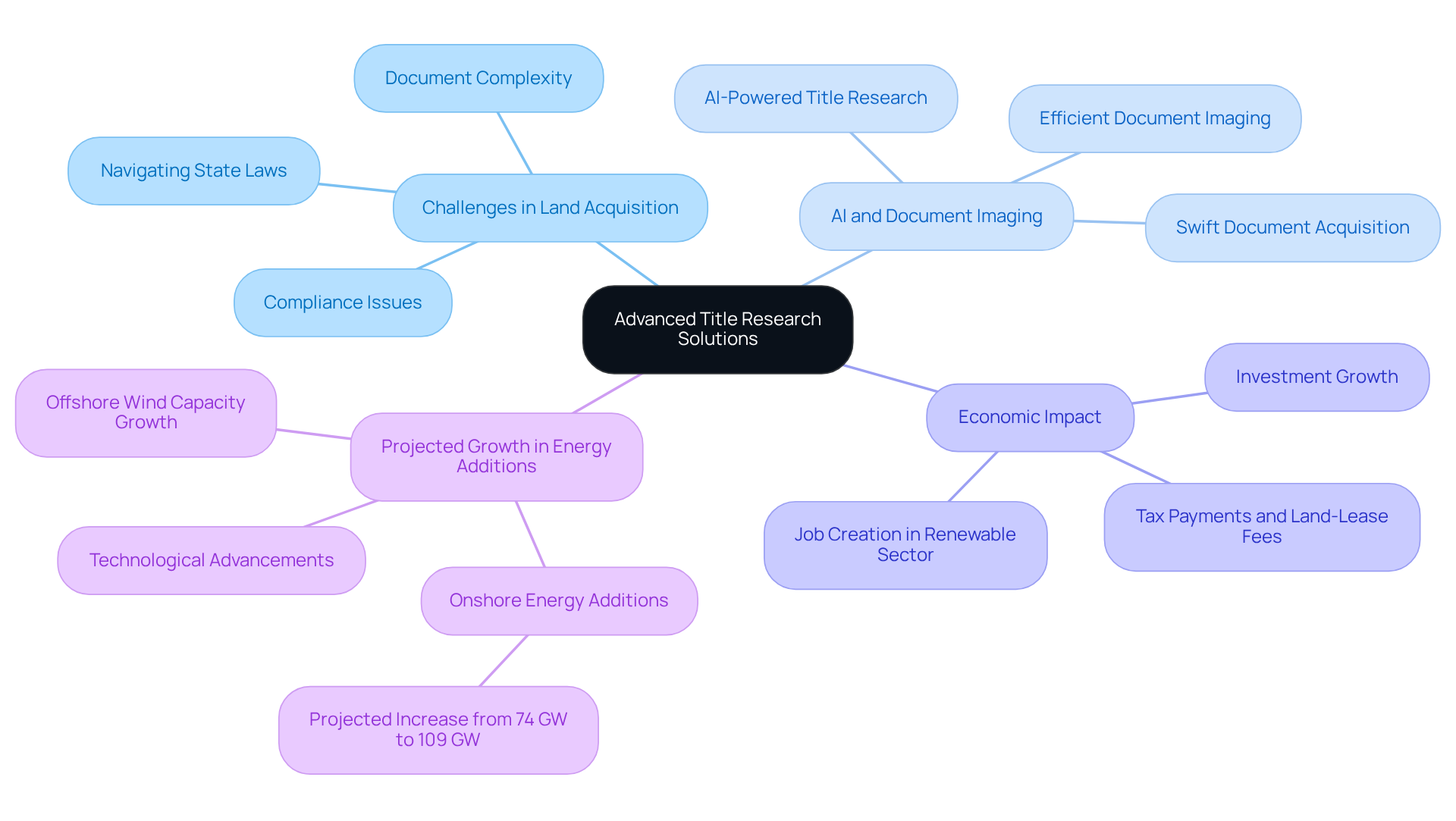

Harbinger Land | Advanced Title Research Solutions for Wind Energy Projects

Harbinger Land stands at the forefront of innovative title research solutions, meticulously crafted for renewable projects. In an industry where land acquisition is fraught with complexities, our AI-powered title research software and efficient document imaging services enhance both efficiency and accuracy, ensuring compliance with all legal and regulatory requirements. This capability is vital in the energy sector, where navigating a myriad of state laws and land use regulations is often a daunting task.

By digitizing property data, Harbinger Land enables title agents to conduct title research and leasing in a cost-effective manner. Consider the projection for onshore energy additions, expected to surge from 74 GW in 2021 to 109 GW by 2027. This statistic underscores the growing necessity for effective land acquisition services. Furthermore, renewable energy initiatives contribute over $2 billion in state and local tax payments and land-lease fees, illustrating the significant economic impact of these endeavors.

Harnessing advanced technology, including deploying imaging agents to courthouses for swift document acquisition, Harbinger Land empowers clients to adeptly navigate these challenges. This approach streamlines project development and minimizes delays associated with title issues. Successful applications of our AI-driven methodology reveal its transformative potential in the land acquisition process, rendering it more responsive and reliable for renewable initiatives.

Industry specialists emphasize that integrating AI and effective document imaging in title research is essential for meeting the escalating demands of the renewable sector. With Harbinger Land, clients gain a trusted partner in overcoming the complexities of land acquisition, ensuring their projects are positioned for success.

National Renewable Energy Laboratory: Comprehensive ROI Analysis of Wind Energy Investments

The National Renewable Resources Laboratory (NREL) is essential in evaluating the financial feasibility of breeze power investments through wind energy ROI studies. These studies reveal significant long-term benefits associated with renewable projects, including reduced operational costs and enhanced production efficiency.

For instance, the domestic land-based renewable power sector supports 125,580 jobs, underscoring the industry's contribution to economic growth. By employing robust economic models, NREL equips stakeholders with crucial insights into potential returns, which are vital for wind energy ROI studies, facilitating the acquisition of funding and support for new initiatives.

Successful case studies, particularly wind energy ROI studies, demonstrate that investments in renewable sources yield substantial financial returns while also fostering job creation and economic development, thereby increasing the attractiveness of such initiatives in the current energy landscape.

As Paul Polman noted, renewable resources can decrease emissions while generating employment, further emphasizing the significance of these investments. As the sector evolves, the financial benefits of renewable initiatives are expected to become even more pronounced, making them an appealing choice for investors and developers alike.

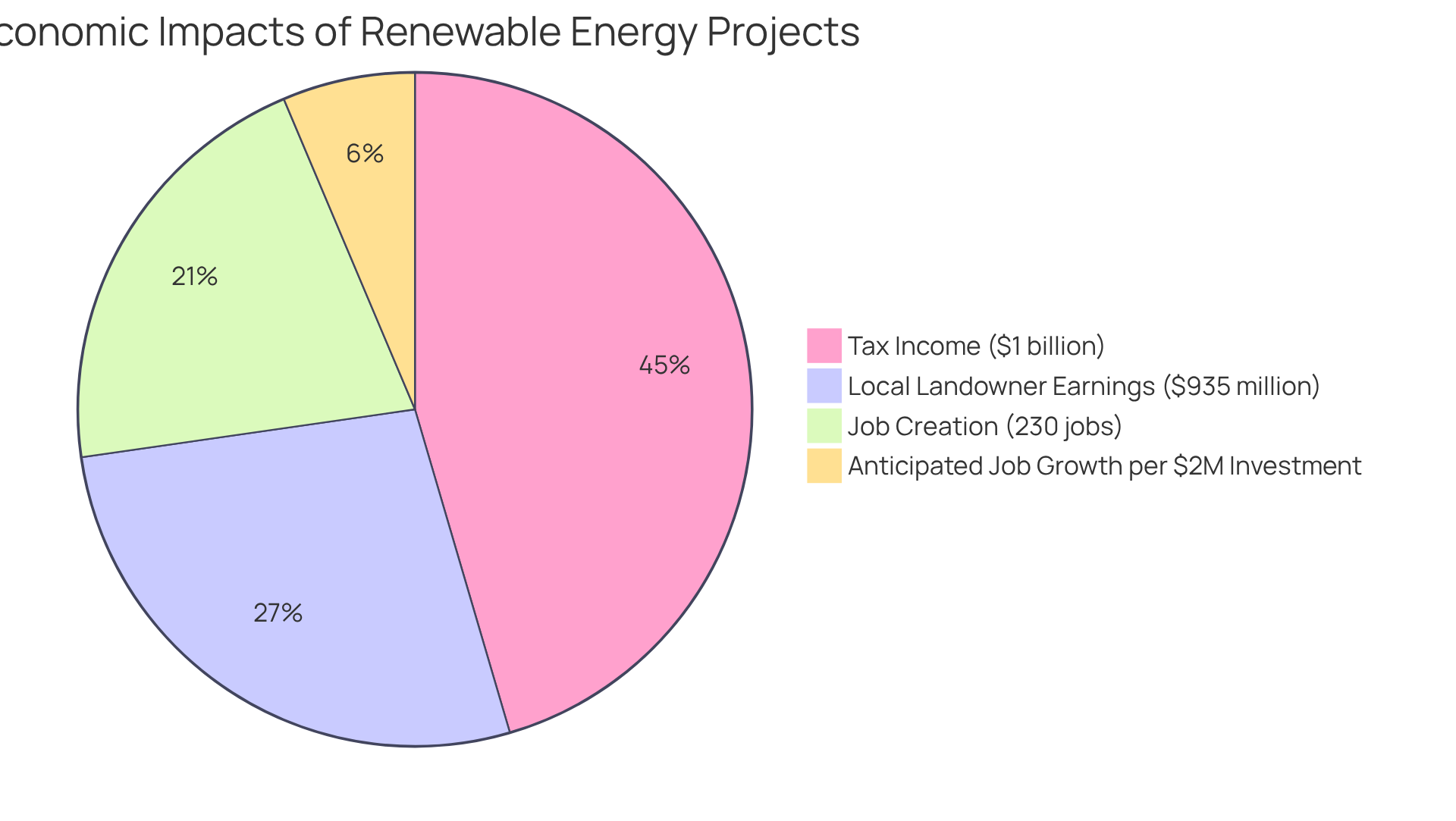

University of California: Economic Impact Studies of Wind Farms on Local Economies

Research from the University of California highlights the substantial impact of energy farms on local economies. These studies reveal that renewable energy initiatives not only generate employment but also enhance local tax income and stimulate economic development in surrounding areas. Notably, job growth of about 0.4% has been recorded within 20 miles of active renewable energy sites, leading to approximately 230 positions created throughout the initiative's duration. Importantly, this job growth persists for six years following the commencement of construction, underscoring the enduring benefits of renewable energy projects. Furthermore, the U.S. renewable energy sector contributed an estimated $1 billion in state and local taxes in 2022, emphasizing its ongoing role in bolstering local government revenues.

The economic advantages extend beyond immediate job creation; they also encompass increased income for local landowners through lease agreements, which totaled approximately $935 million in payments in 2022. Additionally, job growth is anticipated at one local full-time equivalent (FTE) for every $2 million invested in renewable energy initiatives, illustrating the economic return on investment in this sector. Case studies indicate that communities hosting energy projects experience improved economic diversification, particularly in rural areas where traditional economic activities may be limited.

Overall, the findings from the University of California provide a robust foundation for understanding the positive effects of renewable sources, as highlighted by wind energy ROI studies, on community development, which is crucial for fostering local support for new initiatives. As noted in their study, 'The development of onshore renewable sources can be associated with various potential local economic effects, such as job creation, tax income, local landowner earnings, and alterations to home sale values.

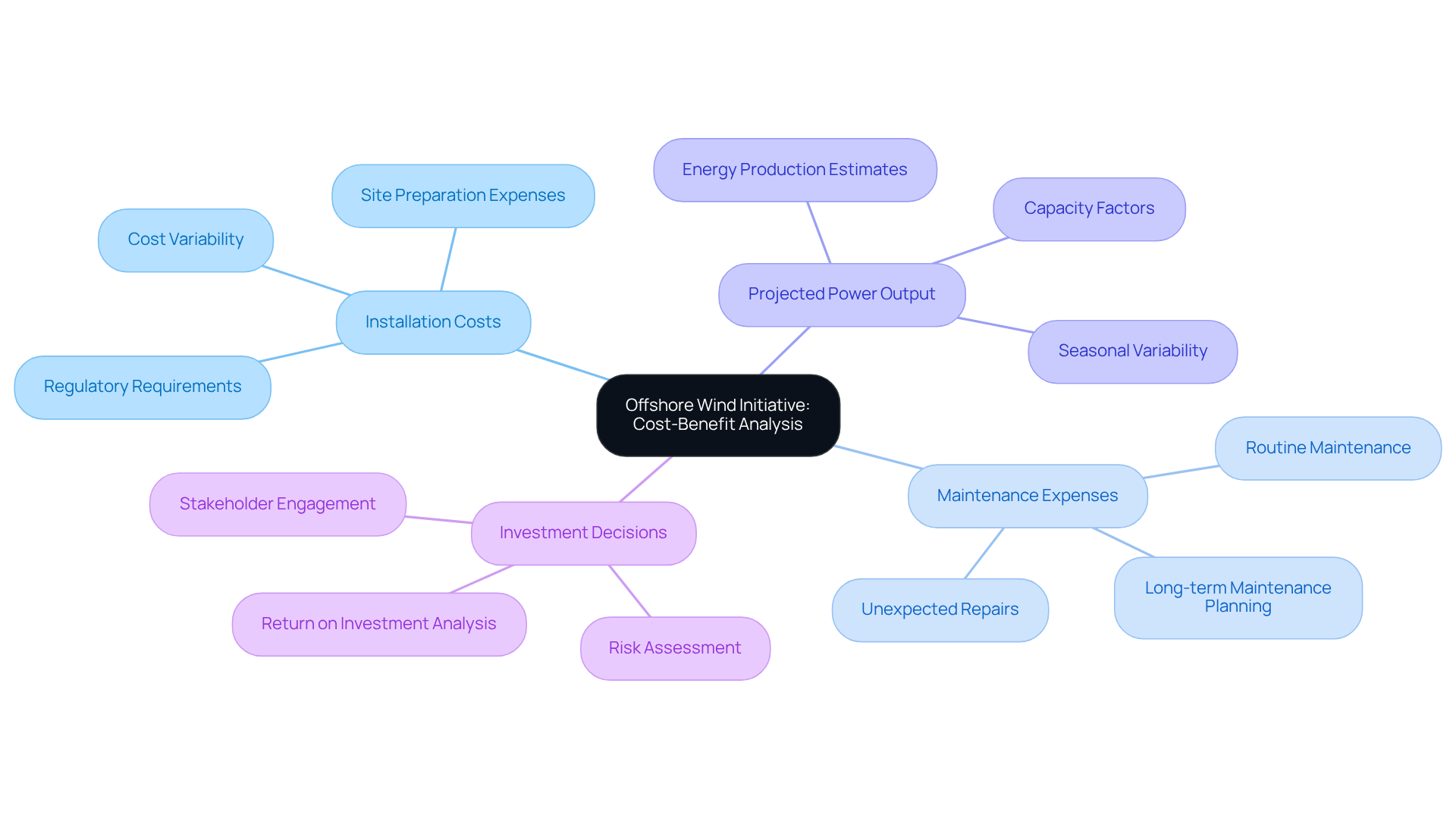

Offshore Wind Initiative: Cost-Benefit Analysis of Offshore Wind Energy Projects

The Offshore Wind Initiative conducts comprehensive cost-benefit assessments as part of its wind energy ROI studies to evaluate the economic viability of offshore renewable projects. These analyses consider critical factors such as installation costs, maintenance expenses, and projected power output. By delivering an in-depth overview of the economic landscape, the initiative empowers stakeholders to make informed investment decisions regarding offshore turbines based on wind energy ROI studies. This component is increasingly recognized as vital to the renewable energy mix.

In an era where renewable energy is paramount, understanding the financial implications of offshore projects is essential for wind energy ROI studies. Stakeholders face complex challenges, including fluctuating costs and regulatory hurdles. The Offshore Wind Initiative stands as a beacon of clarity, guiding investors through these intricacies with precise evaluations.

The initiative not only aids in navigating these complexities but also highlights the potential for substantial returns on investment as demonstrated by wind energy ROI studies. By showcasing the benefits of offshore wind energy, it creates a compelling case for stakeholders to engage actively in this burgeoning sector.

Ultimately, the Offshore Wind Initiative is more than an analytical body; it is a crucial partner in the journey toward sustainable energy solutions. Stakeholders are encouraged to leverage these insights to drive their investments forward, ensuring they remain at the forefront of the renewable energy revolution.

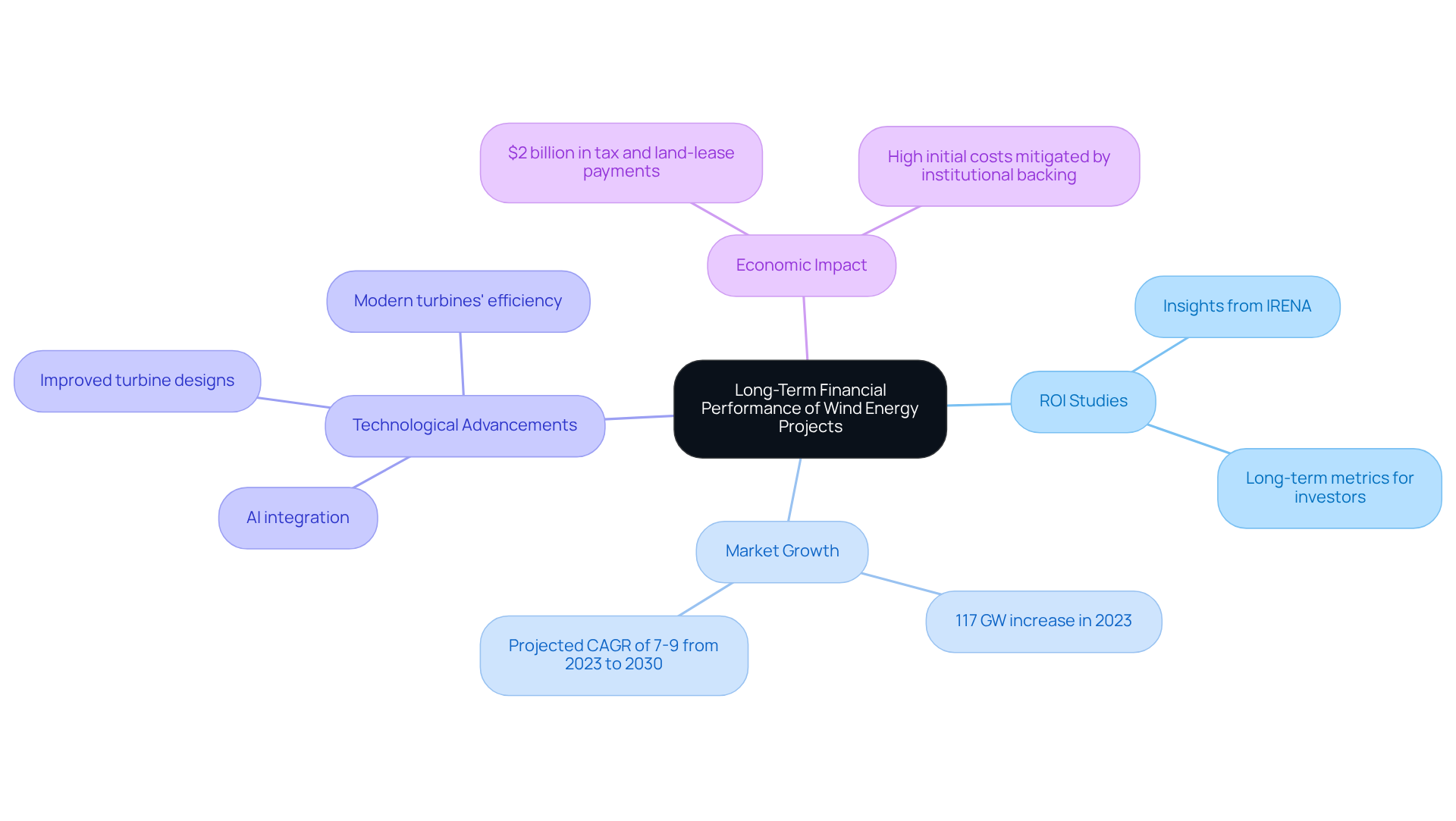

International Renewable Energy Agency: Long-Term Financial Performance of Wind Energy Projects

The International Renewable Energy Agency (IRENA) provides critical insights into the long-term financial performance of wind initiatives, particularly through wind energy ROI studies. Their comprehensive reports analyze trends in energy prices, operational costs, and technological advancements that significantly impact profitability. By understanding the long-term metrics highlighted in wind energy ROI studies, investors can more effectively assess the sustainability of their investments and make informed strategic decisions regarding future projects. Notably, contemporary turbines are capable of producing usable electricity over 90% of the time each year, which greatly enhances their efficiency and reliability.

In 2023, the global renewable power market witnessed an unprecedented increase of 117 GW, underscoring a robust demand for sustainable resources despite challenges such as elevated commodity costs and supply chain disruptions. This growth illustrates the resilience of the energy sector, which continues to thrive in a complex investment landscape.

Moreover, case studies and wind energy ROI studies reveal that renewable energy initiatives contributed over $2 billion in state and local tax payments and land-lease payments last year, highlighting their economic impact and the potential for long-term financial returns. Furthermore, expert opinions suggest that while initial costs for offshore energy projects remain high, financial backing from institutional investors can mitigate these expenses, thereby creating avenues for sustainable profitability.

As the market evolves, the integration of advanced technologies, including AI and improved turbine designs, is expected to further enhance the efficiency and profitability of renewable projects. The renewable power market is projected to expand at a compound annual growth rate (CAGR) of 7-9% from 2023 to 2030, indicating strong future growth potential. Investors who stay informed about these trends can make strategic decisions that align with the shifting dynamics of the power sector, ensuring the sustainability of their investments in renewable sources.

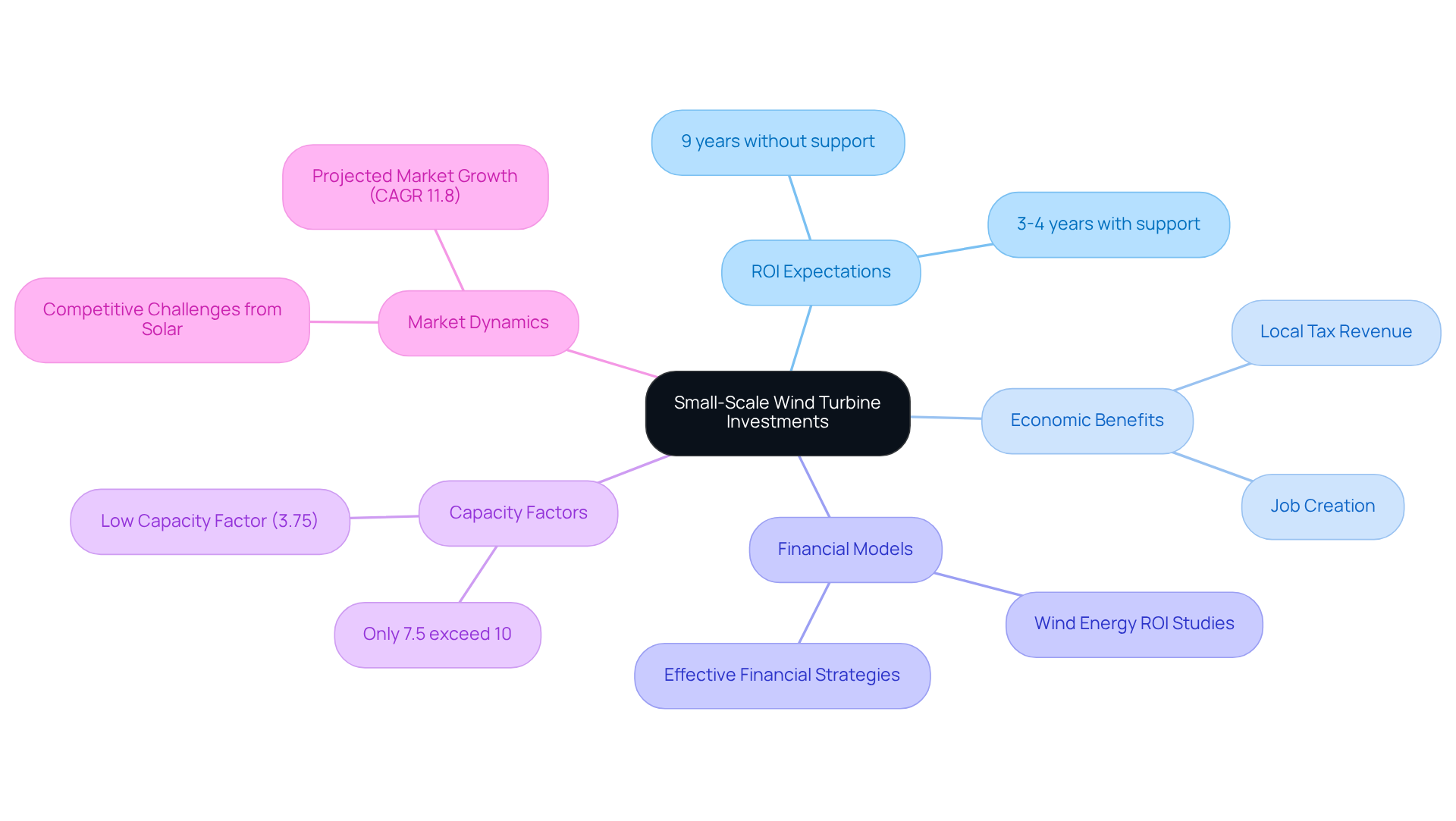

American Wind Energy Association: ROI Studies for Small-Scale Wind Turbines

The American Wind Energy Association (AWEA) conducts comprehensive ROI studies focused on small-scale turbines, providing crucial insights into the returns that homeowners and small enterprises can anticipate from such investments. These studies highlight successful instances where small-scale renewable solutions have yielded not only substantial financial benefits but also fostered local autonomy and sustainability.

Homeowners investing in small turbine systems can expect a return period of approximately 9 years without assistance, which can be significantly reduced to 3-4 years with support. Furthermore, the typical self-consumption rate for renewable sources across various locations stands at 42.3%, enhancing the economic viability of these initiatives.

AWEA's research underscores the importance of implementing effective financial models, including Wind energy ROI studies, that demonstrate the long-term profitability of small-scale renewable investments, thereby promoting broader acceptance and contributing to a cleaner energy future. Additionally, renewable energy initiatives generate economic benefits such as job creation and local tax revenue, which are essential for community development.

However, it is vital to recognize that only 7.5% of locations achieve a capacity factor exceeding 10%, which can influence the overall feasibility of small turbine projects. The average capital expenditure (CAPEX) for small turbines is around 6500 EUR, providing potential investors with a clearer financial perspective.

As the solar power sector continues to grow, it presents competitive challenges for small turbines, making it imperative for stakeholders to stay informed about market dynamics. Industry leaders assert the potential of renewable resources as a sustainable investment, emphasizing that transitioning to alternative sources is not only environmentally responsible but also financially advantageous.

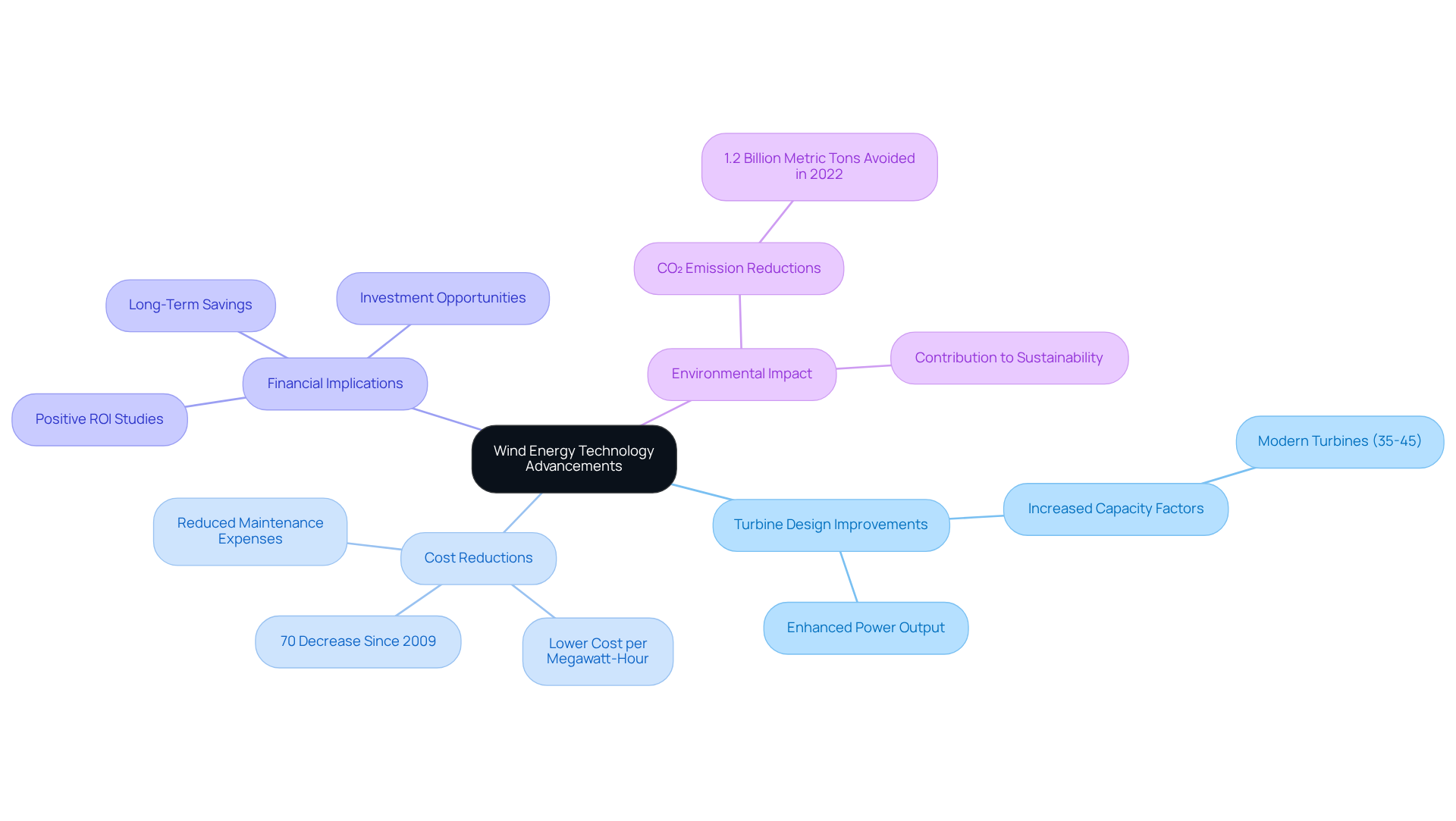

Wind Energy Technology Advancement: ROI Implications of Innovative Solutions

Recent advancements in turbine technology, particularly in design and power storage solutions, are reshaping the financial landscape of the sector. Enhanced turbine designs have led to a significant increase in power output, with modern turbines operating at capacity factors of 35-45%. This improvement greatly enhances efficiency and reduces the cost per megawatt-hour, resulting in lower maintenance expenses and heightened overall productivity. Consequently, this renewable energy source becomes a more attractive investment according to wind energy ROI studies.

The financial implications of these innovations are substantial. For instance, the cost of renewable energy has decreased by approximately 70% since 2009, driven by technological advancements and supportive government regulations. This decline not only enhances the feasibility of wind projects but also positively influences the results of wind energy ROI studies. Stakeholders should meticulously evaluate these financial implications, as the adoption of cutting-edge technologies can yield significant long-term savings and increased profitability.

Moreover, the integration of advanced power storage solutions further enhances the benefits of improved turbine designs. By effectively managing power supply and demand, these solutions ensure a more stable and reliable output, which is crucial for maximizing the findings from wind energy ROI studies. As the global renewable power market continues to expand, with total installed capacity nearing 906 GW, focusing on innovative solutions will be vital for maintaining competitive advantages in this rapidly evolving industry.

Industry leaders underscore the importance of these developments:

"Investing in workforce training, turbine innovation, and supply chain optimization will be essential to remaining competitive," emphasizing the need for businesses to adapt and innovate to thrive in the renewable sector. Additionally, the contribution of this renewable resource to environmental sustainability is noteworthy, having prevented approximately 1.2 billion metric tons of CO₂ emissions in 2022, further enhancing its appeal to environmentally conscious investors.

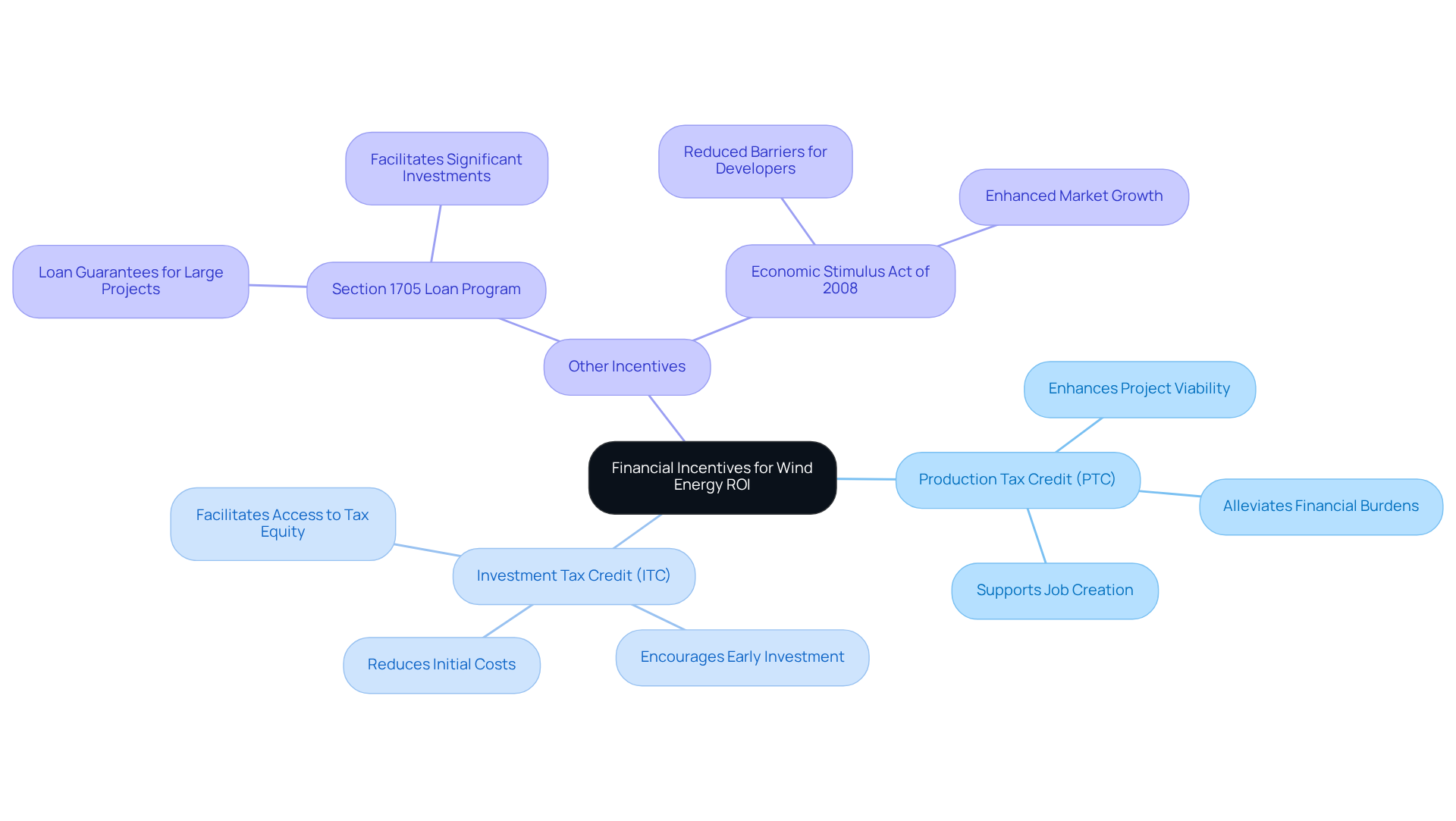

U.S. Department of Energy: Financial Incentives and Their Impact on Wind Energy ROI

The U.S. Department of Energy (DOE) provides crucial monetary incentives that significantly enhance the findings of wind energy ROI studies for wind power initiatives. Among these, the Production Tax Credit (PTC) and the Investment Tax Credit (ITC) stand out, effectively alleviating the financial burdens faced by developers. Established by the Energy Policy Act of 1992, the PTC offers a production-based tax incentive for renewable power sources, while the ITC extends a credit for investment expenses incurred at the inception of the initiative.

As we look to 2025, these incentives remain vital, as they help mitigate the substantial initial costs associated with renewable installations, which can range from $1,200 to $1,800 per kilowatt for land-based setups. Furthermore, the average cost of energy purchase agreements has decreased, now falling below 2 cents per kilowatt-hour in recent years, thereby enhancing the economic viability of new projects.

Successful initiatives have effectively leveraged DOE tax credits and grants to bolster their financial prospects. For instance, the Section 1705 Loan Program, which provided loan guarantees for wind projects exceeding 1,000 megawatts, has facilitated significant investments in the sector. Additionally, the Economic Stimulus Act of 2008 played a pivotal role in supporting the renewable resources sector by implementing measures that reduced barriers for new developers, enabling access to tax equity and fostering market growth.

The impact of these financial incentives is profound, as they not only enhance the feasibility of initiatives but also contribute to job creation and local economic development. Wind power initiatives have been shown to sustain over 300,000 jobs across the U.S., while also generating income for local farmers and ranchers through land lease payments and tax revenues. By strategically utilizing these incentives, stakeholders can significantly improve the ROI of their renewable initiatives, which is supported by wind energy ROI studies, ensuring sustainable growth in this essential sector.

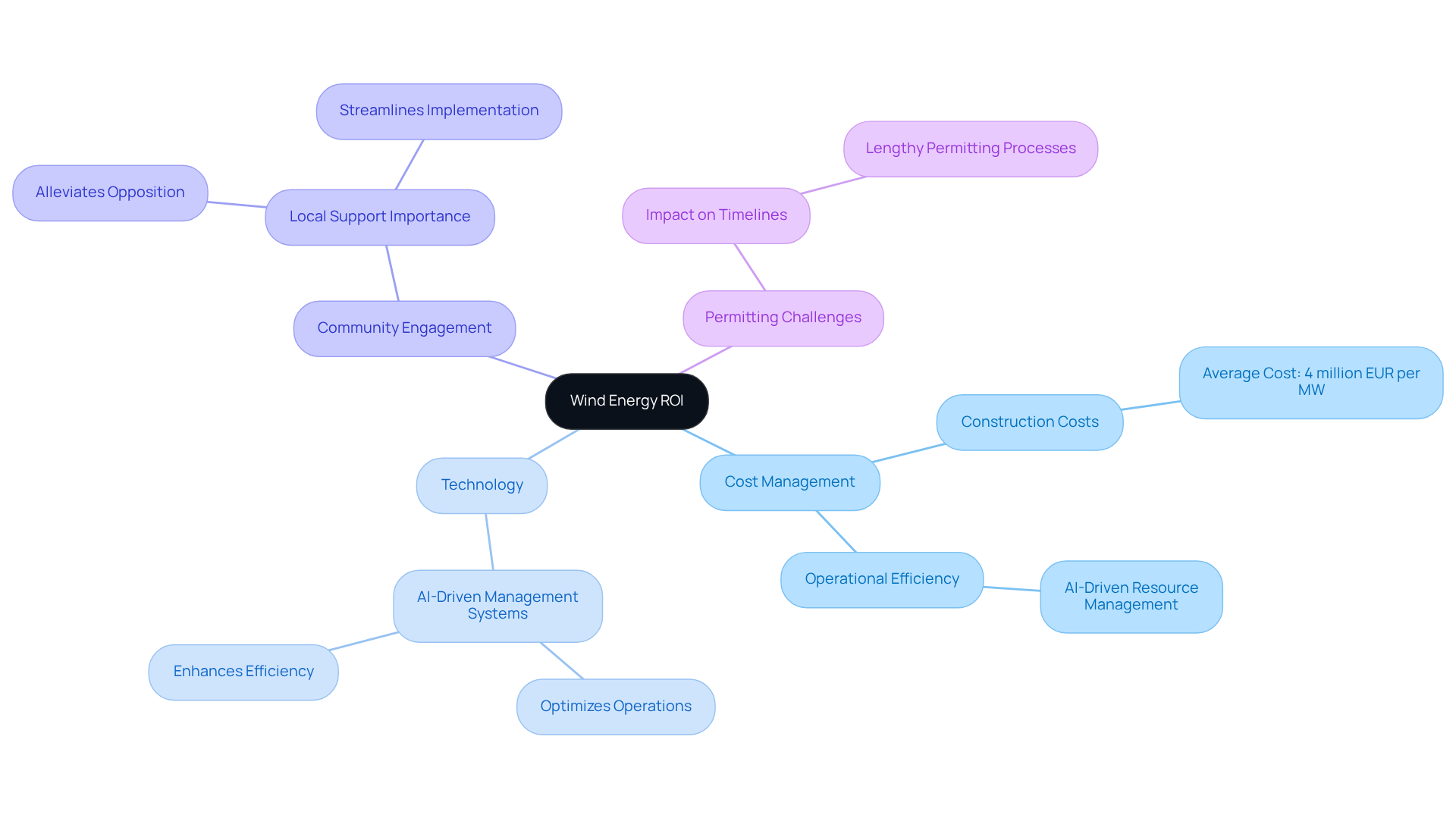

Case Study: Successful Wind Energy Projects and Their Return on Investment

An examination of successful wind initiatives reveals critical insights that can be drawn from wind energy ROI studies to optimize return on investment (ROI). Projects that effectively managed costs, leveraged advanced technologies, and fostered strong community engagement consistently reported higher outcomes in wind energy ROI studies.

For example, the incorporation of AI-driven resource management systems, as highlighted in a case study, has demonstrated the ability to optimize operations and enhance efficiency, leading to significant cost savings. Furthermore, community participation in planning phases, emphasized in another case study, has proven essential for garnering local support, which can alleviate potential opposition and streamline project implementation.

By analyzing these case studies, stakeholders can identify best practices and strategies applicable to future energy developments, as highlighted in wind energy ROI studies, ultimately improving their prospects for success.

It is also important to note that the typical expense of constructing a power farm is approximately 4 million EUR per MW of installed capacity, underscoring the importance of effective cost management.

Nevertheless, stakeholders must remain cognizant of the challenges associated with permitting processes, as these can considerably impact timelines and the outcomes of wind energy ROI studies.

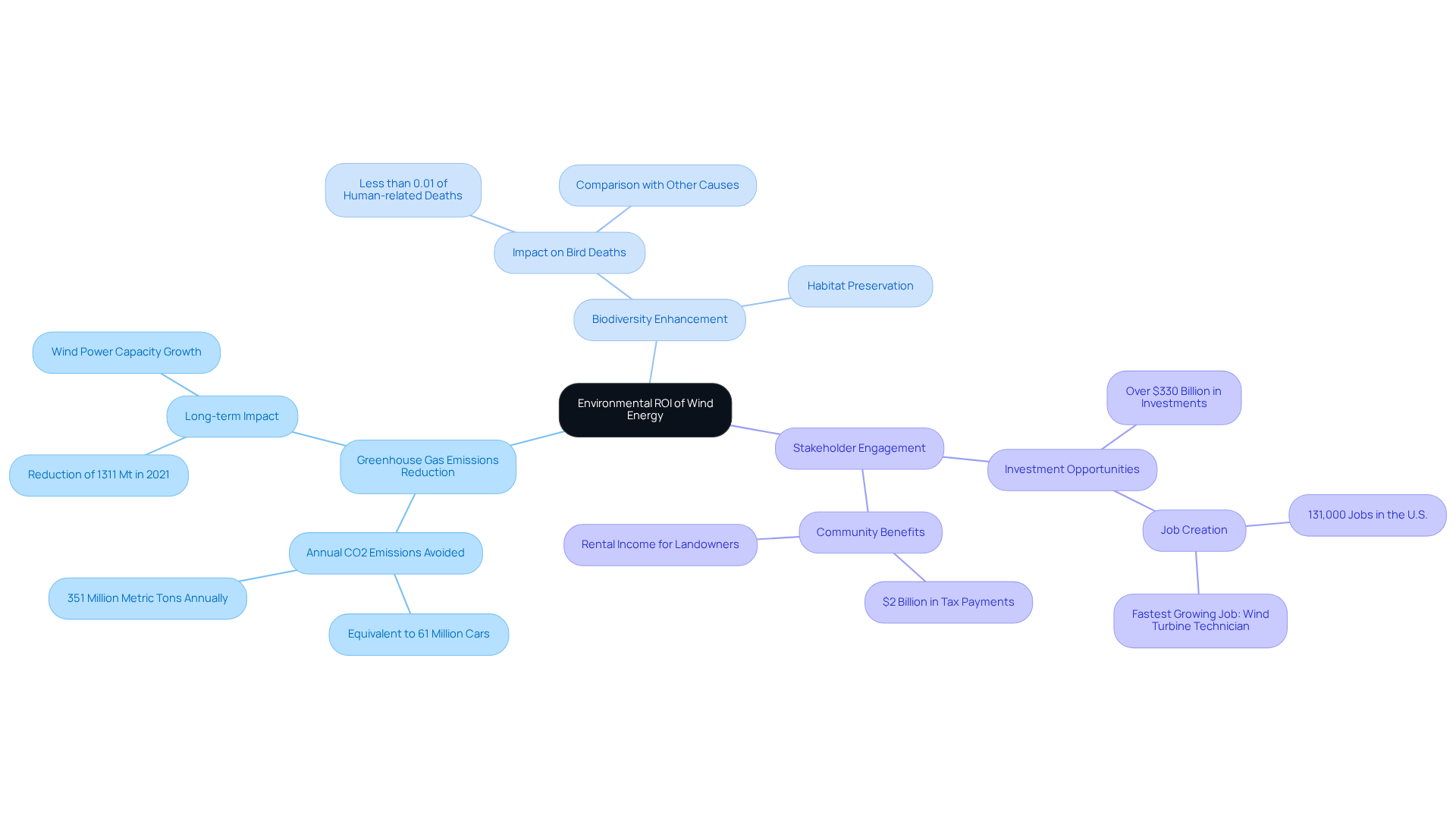

Environmental Defense Fund: Analyzing the Environmental ROI of Wind Energy Projects

The Environmental Defense Fund (EDF) critically evaluates the ecological return on investment (ROI) of turbine projects, focusing on their significant contributions to reducing greenhouse gas emissions and enhancing biodiversity. This analysis serves as a compelling case for stakeholders to invest in renewable resources, aligning with their sustainability objectives. By quantifying these ecological benefits, EDF not only underscores the financial returns highlighted in wind energy ROI studies but also emphasizes the broader environmental impacts associated with wind energy development. Such insights prompt stakeholders to consider the transformative potential of renewable energy solutions in addressing pressing ecological challenges.

Conclusion

The exploration of wind energy ROI studies reveals a compelling narrative: investing in renewable energy yields substantial financial returns while fostering economic growth and environmental sustainability. As demand for renewable resources escalates, grasping the implications of these investments becomes essential for stakeholders navigating the complexities of the energy sector.

Key insights from various studies illustrate the diverse benefits of wind energy projects. The economic impact on local communities, highlighted by the University of California, alongside technological advancements discussed by the International Renewable Energy Agency, underscores the significant contributions of wind energy initiatives to job creation, tax revenues, and long-term financial performance. Furthermore, the integration of financial incentives from the U.S. Department of Energy enhances the viability of these projects, making them an attractive option for investors.

Ultimately, the importance of wind energy investments transcends mere financial metrics. By embracing innovative technologies and leveraging financial support, stakeholders can position themselves at the forefront of the renewable energy revolution. This commitment not only drives economic prosperity but also addresses pressing environmental challenges. Engaging with insights from these ROI studies is imperative for anyone seeking to make informed decisions in the evolving landscape of wind energy development.

Frequently Asked Questions

What is Harbinger Land and what services does it provide?

Harbinger Land offers advanced title research solutions specifically designed for renewable projects, particularly in the wind energy sector. Their services include AI-powered title research software and document imaging services that enhance efficiency and accuracy in land acquisition.

How does Harbinger Land's technology benefit title agents?

By digitizing property data, Harbinger Land enables title agents to conduct title research and leasing in a cost-effective manner, streamlining the process and minimizing delays associated with title issues.

What is the projected growth of onshore energy additions from 2021 to 2027?

The projection for onshore energy additions is expected to increase from 74 GW in 2021 to 109 GW by 2027, highlighting the growing necessity for effective land acquisition services.

What economic impact do renewable energy initiatives have?

Renewable energy initiatives contribute over $2 billion in state and local tax payments and land-lease fees, indicating their significant economic impact.

What role does the National Renewable Energy Laboratory (NREL) play in wind energy investments?

The NREL evaluates the financial feasibility of wind energy investments through ROI studies, providing insights into long-term benefits such as reduced operational costs and enhanced production efficiency.

How many jobs does the domestic land-based renewable power sector support?

The domestic land-based renewable power sector supports approximately 125,580 jobs, contributing to economic growth.

What are the expected financial returns from investments in renewable energy?

Investments in renewable energy sources yield substantial financial returns while fostering job creation and economic development, making them attractive for investors and developers.

What economic impacts do wind farms have on local economies according to the University of California?

Wind farms generate employment, enhance local tax income, and stimulate economic development. Job growth of about 0.4% has been recorded within 20 miles of active renewable energy sites.

How much did the U.S. renewable energy sector contribute to state and local taxes in 2022?

The U.S. renewable energy sector contributed an estimated $1 billion in state and local taxes in 2022.

What is the anticipated job growth related to investments in renewable energy?

Job growth is anticipated at one local full-time equivalent (FTE) for every $2 million invested in renewable energy initiatives, showcasing the economic return on investment in this sector.

List of Sources

- Harbinger Land | Advanced Title Research Solutions for Wind Energy Projects

- Wind - IEA (https://iea.org/energy-system/renewables/wind)

- Wind Market Reports: 2023 Edition (https://energy.gov/eere/wind/wind-market-reports-2023-edition)

- Wind Energy Statistics By Industry Jobs, Operating Capacity, Technology And Facts (2025) (https://sci-tech-today.com/stats/wind-energy-statistics-updated)

- Wind Power Facts and Statistics | ACP (https://cleanpower.org/facts/wind-power)

- WWEA Annual Report 2023: Record Year for Windpower (https://wwindea.org/AnnualReport2023)

- National Renewable Energy Laboratory: Comprehensive ROI Analysis of Wind Energy Investments

- Wind Market Reports: 2023 Edition (https://energy.gov/eere/wind/wind-market-reports-2023-edition)

- Wind Energy Market Size, Growth Outlook 2025-2034 (https://gminsights.com/industry-analysis/wind-energy-market)

- 60 Quotes About the Future of Renewable Energy (https://deliberatedirections.com/renewable-energy-quotes)

- University of California: Economic Impact Studies of Wind Farms on Local Economies

- WINDExchange: Wind Energy's Economic Impacts to Communities (https://windexchange.energy.gov/projects/economic-impacts)

- Do large-scale wind projects increase local employment? New US study says yes, and those effects last. | Energy Markets & Policy (https://emp.lbl.gov/news/do-large-scale-wind-projects-increase-local-employment-new-us-study-says-yes-and-those)

- Economic Impacts of Wind Industry (https://windustry.com/economic-impacts-of-wind-industry.htm)

- DOE Finds Record Production and Job Growth in U.S. Wind Power Sector (https://energy.gov/articles/doe-finds-record-production-and-job-growth-us-wind-power-sector)

- Offshore Wind Initiative: Cost-Benefit Analysis of Offshore Wind Energy Projects

- Case Studies | Petrokens Engineering & Consultancy (https://petrokens.com/insights/case_studies.html)

- (PDF) Cost-benefit Analysis And Comparisons For Different Offshore Wind Energy Transmission Systems (https://researchgate.net/publication/367462086_Cost-benefit_Analysis_And_Comparisons_For_Different_Offshore_Wind_Energy_Transmission_Systems)

- Cost-benefit analysis of the offshore wind power transition in the ... (https://open-research-europe.ec.europa.eu/articles/5-66)

- Case Studies Archive - THREE60 Energy (https://three60energy.com/case_studies)

- Wind Power Quotes: 16 Inspiring Picks (2025) (https://lumifyenergy.com/blog/wind-power-quotes)

- International Renewable Energy Agency: Long-Term Financial Performance of Wind Energy Projects

- Wind Energy Market Expansion: Growth, Capacity, and Investment Stats (https://patentpc.com/blog/wind-energy-market-expansion-growth-capacity-and-investment-stats)

- 2025 Renewable Energy Industry Outlook (https://deloitte.com/us/en/insights/industry/renewable-energy/renewable-energy-industry-outlook.html)

- Market and Industry Trends | Wind Power (https://ren21.net/gsr-2024/modules/energy_supply/02_market_and_industry_trends/09_windpower)

- Global Statistics (https://wwindea.org/GlobalStatistics)

- Wind Power Facts and Statistics | ACP (https://cleanpower.org/facts/wind-power)

- American Wind Energy Association: ROI Studies for Small-Scale Wind Turbines

- Small Wind Turbines Market Report 2025, Market Size, Share, Growth, CAGR, Forecast, Revenue (https://cognitivemarketresearch.com/small-wind-turbines-market-report)

- Wind Power Quotes: 16 Inspiring Picks (2025) (https://lumifyenergy.com/blog/wind-power-quotes)

- Small Wind Turbine Market Size, Share & Analysis by 2033 (https://straitsresearch.com/report/small-wind-turbine-market)

- WINDExchange: Economics and Incentives for Wind (https://windexchange.energy.gov/projects/economics)

- Energy potential and economic viability of small-scale wind turbines (https://sciencedirect.com/science/article/pii/S0360544225012502)

- Wind Energy Technology Advancement: ROI Implications of Innovative Solutions

- Wind Energy Market Expansion: Growth, Capacity, and Investment Stats (https://patentpc.com/blog/wind-energy-market-expansion-growth-capacity-and-investment-stats)

- Electricity generation from wind - U.S. Energy Information Administration (EIA) (https://eia.gov/energyexplained/wind/electricity-generation-from-wind.php)

- Wind Power Quotes: 16 Inspiring Picks (2025) (https://lumifyenergy.com/blog/wind-power-quotes)

- WWEA Annual Report 2023: Record Year for Windpower (https://wwindea.org/AnnualReport2023)

- Wind Energy Market Size & Industry Growth 2030 (https://futuredatastats.com/wind-energy-market?srsltid=AfmBOopjL-uqe2ITlmWIa9qHUc59wivMx_Sr5uzwp10pYUeJphlDwfWA)

- U.S. Department of Energy: Financial Incentives and Their Impact on Wind Energy ROI

- WINDExchange: Wind Energy Financial Incentives (https://windexchange.energy.gov/projects/incentives)

- WINDExchange: Economics and Incentives for Wind (https://windexchange.energy.gov/projects/economics)

- Funding the Future: The Impact of Federal Clean Energy Investments | Briefing | EESI (https://eesi.org/briefings/view/041224doe)

- Wind Power Facts and Statistics | ACP (https://cleanpower.org/facts/wind-power)

- Wind and Solar Tax Credits (https://instituteforenergyresearch.org/renewable/wind-and-solar-tax-credits)

- Case Study: Successful Wind Energy Projects and Their Return on Investment

- Wind Power Quotes: 16 Inspiring Picks (2025) (https://lumifyenergy.com/blog/wind-power-quotes)

- Wind Energy in Transition: Development, Socio-Economic Impacts, and Policy Challenges in Europe (https://mdpi.com/1996-1073/18/11/2811)

- (PDF) Wind Energy in Transition: Development, Socio-Economic Impacts, and Policy Challenges in Europe (https://researchgate.net/publication/392174257_Wind_Energy_in_Transition_Development_Socio-Economic_Impacts_and_Policy_Challenges_in_Europe)

- Performance and economic evaluation of a wind energy system: A case study | Request PDF (https://researchgate.net/publication/362579005_Performance_and_economic_evaluation_of_a_wind_energy_system_A_case_study)

- Environmental Defense Fund: Analyzing the Environmental ROI of Wind Energy Projects

- Wind Power Facts and Statistics | ACP (https://cleanpower.org/facts/wind-power)

- Wind Power Quotes: 16 Inspiring Picks (2025) (https://lumifyenergy.com/blog/wind-power-quotes)

- The Clean Air Benefits of Wind Energy | ACP (https://cleanpower.org/resources/the-clean-air-benefits-of-wind-energy)

- The role of global installed wind energy in mitigating CO2 emission and temperature rising (https://sciencedirect.com/science/article/abs/pii/S0959652623029360)

- Wind energy secures significant CO2 emission reductions for the U.S. (https://w3.windfair.net/wind-energy/news/15295-wind-energy-secures-significant-co2-emission-reductions-for-the-u-s)