Introduction

In the intricate landscape of real estate, property valuation emerges as a pivotal element that shapes the decisions of buyers, sellers, and investors alike. This process not only determines the current worth of a property by analyzing various factors such as location, condition, and market trends, but it also serves as a cornerstone for successful transactions. As the real estate market continues to evolve, understanding property valuation becomes paramount for navigating its complexities.

From establishing fair pricing in transactions to influencing investment strategies and ensuring equitable tax assessments, accurate valuations play a crucial role in fostering informed decision-making. This article delves into the multifaceted significance of property valuation, exploring its impact across various domains within the real estate sector.

Understanding Property Valuation: A Key Component in Real Estate

Assessing the value of real estate is the procedure of establishing the current worth of an asset based on numerous elements, such as its location, condition, and industry trends. It serves as a critical component in real estate transactions, influencing decisions made by buyers, sellers, and investors alike.

Grasping real estate assessment is crucial for maneuvering through the intricacies of the real estate sector, as it offers perspectives on equitable pricing and investment opportunities. Precise assessments assist in guaranteeing that individuals engaged in a deal make informed choices, ultimately resulting in successful results in purchasing or selling real estate.

Top Reasons to Get a Property Valuation: From Transactions to Taxation

- Purchasing and Selling Real Estate: Precise assessments of assets are essential in setting realistic prices for purchasers and vendors, enabling equitable transactions. They ensure that both parties have a clear understanding of the property's worth, which is crucial in a competitive market. For instance, recent data indicates that in a competitive acquisition, such as Presidio's consideration of Franklin's Tower, precise assessment at $315k per unit heavily influences the decision-making process. Furthermore, the case study of the 121 West Wacker acquisition illustrates how accurate assessments can lead to successful transactions, as RCS's strategic method in leveraging capital and making prompt decisions resulted in a profitable buyout by its partners in 2020.

- Investment Decisions: Investors rely on accurate property assessments to evaluate potential returns, significantly influencing their purchasing choices. Presidio, for instance, aims for a minimum levered internal rate of return (IRR) of 15% on its investments, highlighting the importance of comprehensive assessments to achieve investment benchmarks. As mentioned by a Presidio Acquisitions Professional, "Presidio aims for a minimum levered IRR of 15% on its investments," emphasizing the essential role that precise assessments play in directing strategic investment decisions.

- Financing and Mortgages: Lenders often need assessments of real estate to establish loan amounts and evaluate related risks. This assessment process is essential for securing financing, as it provides lenders with a clear picture of the asset’s worth and its ability to generate income. Without an accurate appraisal, the financing landscape can become uncertain, putting both lenders and borrowers at risk.

- Tax Assessments: Real estate appraisals are essential for establishing taxes, ensuring that assessments represent true market values. This is particularly important for local governments to maintain equitable tax systems. Precise valuations assist in avoiding over-assessment, which can result in disputes and financial strain for owners.

- Insurance Purposes: Valuations are crucial in establishing appropriate coverage amounts for real estate insurance policies. An accurate appraisal ensures that assets are neither over-insured nor underinsured, which can lead to significant financial repercussions during claims. Accurate assessment safeguards both the insurer and the insured, fostering a balanced risk environment.

- Estate Planning: Precise property assessments are indispensable for effective estate planning and settling estates, ensuring that all assets are accounted for correctly. This process facilitates fair distribution among heirs and can also influence tax liabilities, making it a critical component of comprehensive financial planning.

The Role of Property Valuation in Buying and Selling

Property assessments are essential in the buying and selling process, serving as a cornerstone for establishing fair market value. For sellers, a precise assessment can lead to a competitive listing price, which not only attracts potential buyers but also maximizes profit margins. Recent advancements in real estate analysis suggest that assets with accurate estimates often fetch higher selling prices, especially as we near 2024.

For example, the recent purchase of a 25,000 SF warehouse in Queens, NY, by Seagis Property Group demonstrates how precise asset assessments can impact market dynamics and selling prices. Buyers, conversely, gain significantly from grasping a real estate's true worth, which aids them in avoiding overpayment and guarantees wise investments. According to Harbor Capital, a prominent real estate investment firm, accurate assessments of assets are essential for making informed decisions during negotiations.

Real estate agents utilize these assessments to guide their clients, offering data-driven insights that enable improved deals. Without precise assessments of real estate, both sellers and buyers risk entering agreements that may not represent the asset's true value, potentially leading to significant financial losses.

Additionally, the sale of a light industrial project in Dallas/Ft. Worth by Birtcher Anderson & Davis and Belay Investment Group further illustrates the essential function of asset assessments in attaining successful transactions. The recent acquisition of a 51,710-square-foot industrial facility in the Dallas-Fort Worth Metroplex by Harbor Capital also highlights how a well-evaluated asset can enhance investment portfolios and support strategic growth.

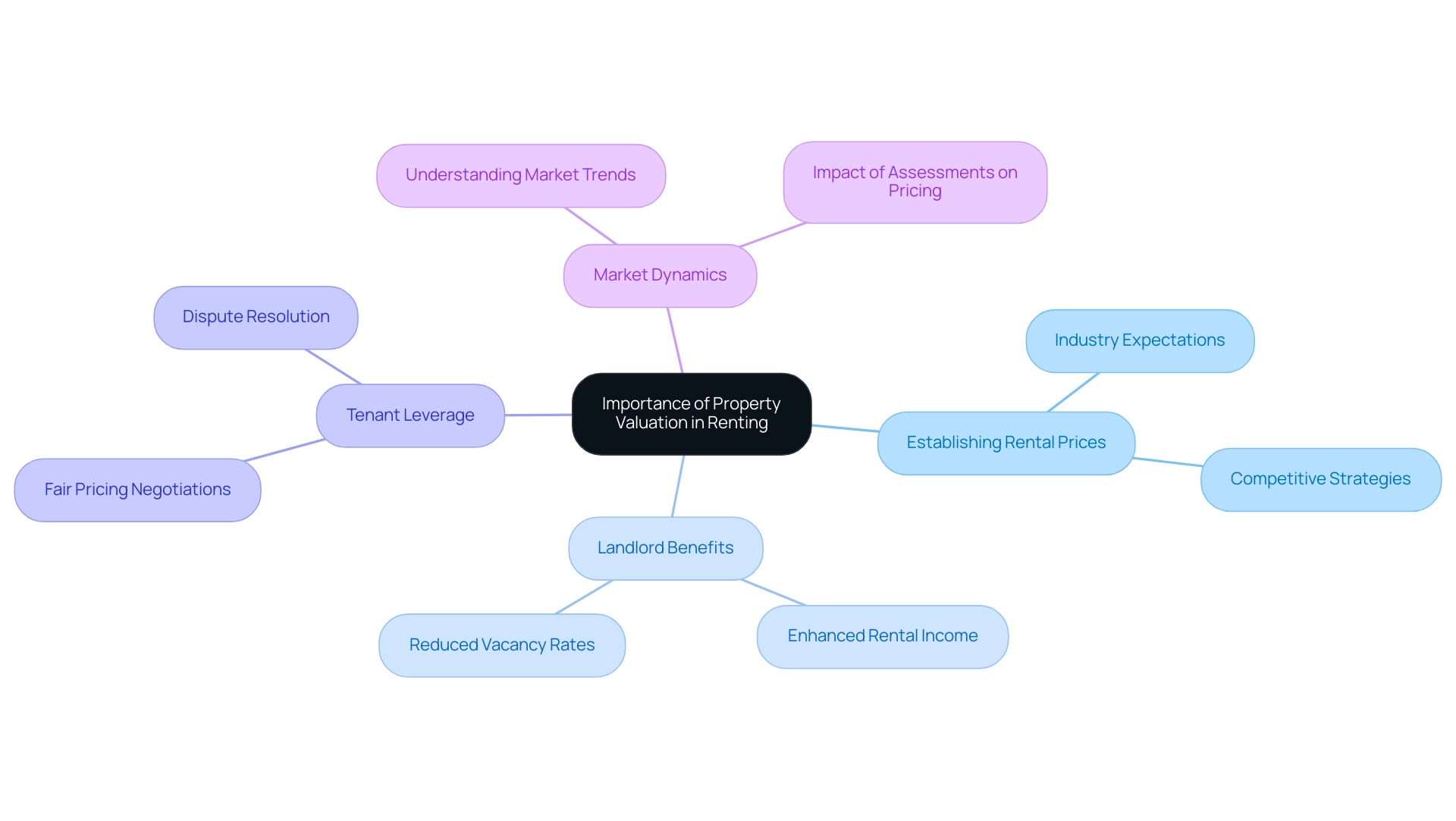

Why Property Valuation Matters for Renting

Assessments of real estate are essential in the leasing sector, acting as a basis for owners to establish suitable rental prices that represent present conditions and characteristics of the assets. Based on recent data, properties that undergo comprehensive assessment are 30% more likely to reach rental prices consistent with industry expectations. By performing precise assessments, landlords can enhance their rental income while remaining competitive within the business environment.

As mentioned by Kuen Wei Tham, Managing Partner at MV Valuers & Estate Agents, any existing, historical future related value the agreed rental lease considered for the assessment directly serves as the basis for determining rental. This understanding demonstrates how assessments are not simply figures; they represent the actual worth of an asset in relation to tenant expectations and market dynamics.

For renters, a strong understanding of real estate assessment can provide leverage during negotiations, ensuring they pay a fair price for their living situation. Furthermore, real estate assessments can act as an essential resource in settling disagreements over rental rates, promoting a clear comprehension between landlords and tenants concerning the asset's value.

In 2024, comprehending average rental rates based on asset appraisals will be crucial, as landlords progressively depend on these assessments to establish competitive pricing strategies, ensuring both parties are informed and aligned in the rental agreement process.

Case studies, like the examination of rental pricing strategies in high street retail environments, illustrate how effective assessment can lead to enhanced tenant satisfaction and reduced vacancy rates. Moreover, tenant perspectives indicate that a clear comprehension of asset assessments boosts their confidence in negotiations, further highlighting the significance of openness in rental contracts.

Property Valuation and Its Impact on Taxation

Real estate evaluations act as a fundamental component in the computation of levies, with assessments generally reliant on the estimated value of an asset. Precise assessments are crucial to guarantee that asset owners are taxed fairly, representing the actual worth of their holdings.

For instance, if the average residential tax bill sees an 11% increase next year, compounded by last year's 21% hike, homeowners could end up facing a staggering cumulative increase of 34%. Furthermore, reducing the conversion rate from 1.35% to 1.11% could greatly affect residential taxes, highlighting the essential role that precise assessments of real estate play in tax evaluations.

Such inaccuracies can lead to over assessment, burdening owners with inflated tax bills, or under assessment, which may deprive municipalities of critical revenue needed for public services. As Lila Mills, Editor-in-Chief, aptly states, "All this to say we’re here for Clevelanders every day," underscoring the necessity for fair assessments that support community needs.

Comprehending the assessment process enables real estate owners to challenge evaluations they consider as erroneous, reducing the risk of excessive taxation. Furthermore, precise valuations of real estate not only benefit individual homeowners but also support overall economic stability by ensuring that tax revenues align appropriately with real estate values, which is essential for funding infrastructure development.

A pertinent case study is the proposed Homestead Exemption, which seeks to lower residential levies on primary residences by transferring the financial burden to second homes and vacation rentals. This proposal could potentially lower homeowners' property taxes by an estimated 15%, although the long-term effects on future tax increases remain uncertain.

Hence, the importance of precise valuations in achieving fair tax assessments and supporting infrastructure development cannot be overstated.

Conclusion

Understanding the significance of property valuation is essential for anyone engaged in the real estate market, whether as a buyer, seller, investor, or property manager. This process not only establishes the current worth of a property but also plays a pivotal role in facilitating successful transactions. Accurate valuations are instrumental in determining fair pricing, guiding investment decisions, securing financing, and ensuring equitable tax assessments.

As demonstrated through various case studies, properties that are accurately valued tend to attract better offers and achieve higher selling prices, underscoring the impact of precise valuations on market dynamics.

Moreover, property valuation is crucial in the rental market, where it helps landlords set competitive rental rates that reflect market conditions. Accurate assessments benefit both landlords and tenants by promoting transparency and fairness in rental agreements. Additionally, the role of property valuation extends to taxation, where it ensures that property taxes align with true market values, thus supporting local governments and community services.

The implications of inaccurate valuations can be significant, leading to financial strain for property owners or lost revenue for municipalities.

In conclusion, a comprehensive understanding of property valuation is indispensable for navigating the complexities of real estate. It not only aids in making informed decisions but also fosters a fair and efficient market environment. As the real estate landscape continues to evolve, the importance of accurate property valuations will only become more pronounced, reinforcing their role as a cornerstone of successful real estate transactions and sustainable economic growth.

Frequently Asked Questions

What is the purpose of assessing the value of real estate?

Assessing the value of real estate involves determining the current worth of an asset based on factors such as location, condition, and industry trends. This process is critical in real estate transactions, helping buyers, sellers, and investors make informed decisions.

Why is understanding real estate assessment important?

Understanding real estate assessment is crucial for navigating the complexities of the real estate market, as it provides insights into fair pricing and investment opportunities, ensuring informed choices that lead to successful transactions.

How do accurate assessments affect purchasing and selling real estate?

Accurate assessments help set realistic prices for buyers and sellers, facilitating equitable transactions. They provide both parties with a clear understanding of a property's worth, which is especially important in competitive markets.

What role do property assessments play in investment decisions?

Investors rely on accurate property assessments to evaluate potential returns, influencing their purchasing choices. For instance, Presidio aims for a minimum levered internal rate of return (IRR) of 15% on its investments, highlighting the importance of thorough assessments.

How do lenders utilize real estate assessments?

Lenders require assessments to determine loan amounts and assess risks. Accurate appraisals provide a clear picture of an asset's worth, which is essential for securing financing and mitigating risks for both lenders and borrowers.

Why are real estate appraisals important for tax assessments?

Real estate appraisals are vital for establishing fair tax values, ensuring that assessments reflect true market conditions. This helps local governments maintain equitable tax systems and avoid disputes over over-assessment.

How do property valuations impact insurance?

Valuations are crucial in determining appropriate coverage amounts for real estate insurance policies. An accurate appraisal prevents over-insurance or underinsurance, protecting both insurers and insured parties during claims.

What is the significance of property assessments in estate planning?

Precise property assessments are essential for effective estate planning and settling estates, ensuring accurate accounting of assets and facilitating fair distribution among heirs, which can also influence tax liabilities.

How do assessments affect rental pricing in the leasing sector?

Assessments help landlords establish suitable rental prices that reflect current market conditions. Properties with thorough assessments are more likely to achieve competitive rental prices, enhancing landlords' income while ensuring fair rates for tenants.

What are the consequences of inaccurate property assessments for taxes?

Inaccurate assessments can lead to over-assessment, resulting in inflated tax bills for owners, or under-assessment, which can deprive municipalities of necessary revenue. Fair assessments are crucial for ensuring proper funding of public services and community needs.

List of Sources

- Top Reasons to Get a Property Valuation: From Transactions to Taxation

- Case Study #1 - Presidio (Case + Solution, Updated May 2024) (https://adventuresincre.com/case-study-1-presidio)

- Case Studies - Real Capital Solutions (https://realcapitalsolutions.com/case-studies)

- The Role of Property Valuation in Buying and Selling

- nar.realtor (https://nar.realtor/magazine/real-estate-news)

- All Real Estate Transactions News and Press Releases from PR Newswire (https://prnewswire.com/news-releases/general-business-latest-news/real-estate-transactions-list)

- Why Property Valuation Matters for Renting

- researchgate.net (https://researchgate.net/publication/335604178_Commercial_Property_Valuation_Methods_and_Case_studies)

- (PDF) Key Considerations for Landlords in Valuation of Rental and Leasing values (https://researchgate.net/publication/381105375_Key_Considerations_for_Landlords_in_Valuation_of_Rental_and_Leasing_values)

- Property Valuation and Its Impact on Taxation

- Property values rising across Cuyahoga County (https://signalcleveland.org/property-values-are-going-up-across-cuyahoga-county-see-what-that-means-for-next-years-tax-bills)

- Revenue department says Montana property taxes could rise again (https://ktvq.com/news/montana-news/revenue-department-says-montana-property-taxes-could-rise-again)