Overview

The article emphasizes the critical importance of risk-adjusted scheduling frameworks in enhancing project management effectiveness, particularly within the energy sector. These frameworks integrate advanced tools and methodologies, such as Monte Carlo simulations and risk-driven earned value management, enabling managers to proactively identify and mitigate potential risks. This proactive approach ensures that projects are completed on time and within budget, addressing the complexities that often hinder project success.

By utilizing these innovative strategies, project managers can navigate the intricate landscape of risk management. The integration of sophisticated methodologies not only streamlines processes but also empowers teams to make informed decisions. As a result, the potential for delays and budget overruns is significantly reduced, fostering a more reliable project delivery environment.

Ultimately, the adoption of risk-adjusted scheduling frameworks presents a compelling case for energy sector professionals seeking to enhance their project management capabilities. By prioritizing risk management, organizations can achieve greater efficiency and effectiveness in their operations, positioning themselves for long-term success in a competitive landscape.

Introduction

In the dynamic landscape of project management, the integration of risk-adjusted strategies has emerged as a critical factor for success, particularly in the energy sector. Organizations are increasingly turning to innovative solutions that not only enhance scheduling accuracy but also mitigate potential pitfalls throughout the project lifecycle.

From advanced software tools that leverage data analytics to comprehensive frameworks that emphasize risk-sharing, the focus is on fostering resilience and adaptability. As project teams navigate complex regulatory environments and strive to meet ambitious timelines, understanding and implementing these risk-adjusted methodologies becomes paramount.

This article delves into various approaches and tools that empower project managers to optimize performance, reduce costs, and ultimately drive successful project outcomes in an ever-evolving industry.

Harbinger Land: Comprehensive Solutions for Risk-Adjusted Scheduling in Energy Projects

Harbinger Land stands at the forefront of providing comprehensive solutions for risk-adjusted scheduling in energy initiatives. The complexities of land acquisition, including legal and regulatory challenges, demand a robust approach. Their services encompass:

- Site and right-of-way acquisition

- Advanced title research

- GIS mapping—each vital for the early detection of potential issues throughout the lifecycle of projects.

By leveraging highly integrated GIS modeling services and AI-powered title research software, Harbinger Land significantly enhances efficiency and accuracy. This ensures that tasks adhere to timelines, even when faced with challenges.

This proactive strategy empowers clients to adeptly navigate intricate regulatory frameworks and engage with stakeholders, effectively reducing delays and minimizing cost overruns. Recent statistics indicate that teams require a timeline that is both practical and achievable, yet demanding, with the appropriate level of contingency incorporated. This underscores the significance of Harbinger Land's strategy in promoting resilience and success. As Michelle Obama wisely stated, 'Just try new things. Don’t be afraid. Step out of your comfort zones and soar, all right?' This sentiment resonates profoundly in the context of initiative oversight, where adaptability is essential.

Moreover, Harbinger Land's effective document imaging solutions enable title agents to finalize title research and leasing in a budget-friendly manner, reinforcing the importance of organized management approaches. Case studies, such as that of VPP Partners, which focuses on recognizing and measuring uncertainties linked to Battery Energy Storage System (BESS) initiatives, further demonstrate the effectiveness of these strategies. These examples highlight the comprehensive solutions provided by Harbinger Land, making it evident that their expertise is indispensable in the energy sector.

Deltek Acumen: Advanced Risk-Adjusted Scheduling Tools for Project Management

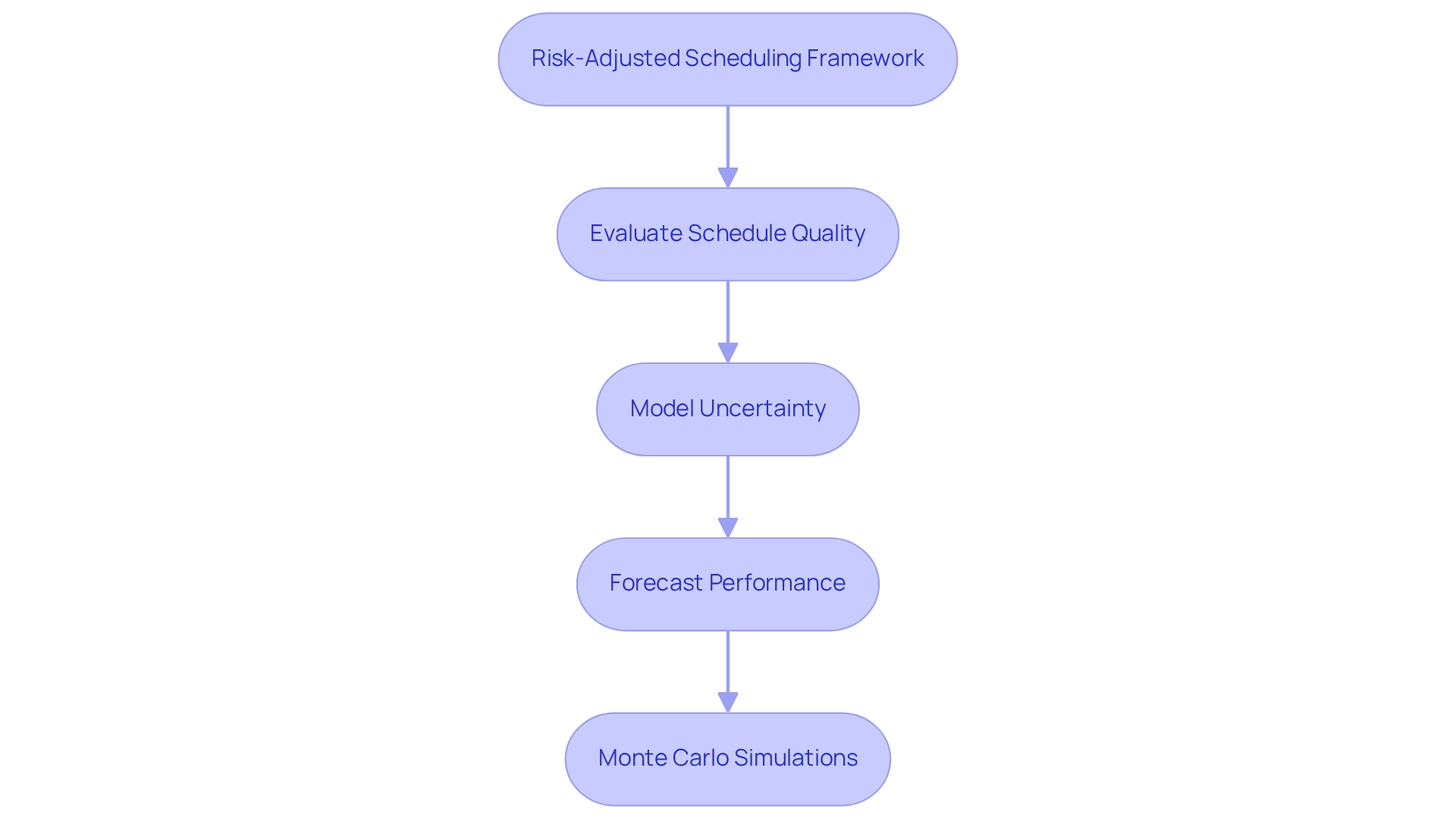

Deltek Acumen offers sophisticated risk-adjusted scheduling frameworks that empower managers to scrutinize and refine their timelines. The Acumen Suite includes features for evaluating schedule quality, modeling uncertainty, and forecasting performance. By utilizing Monte Carlo simulations, managers can visualize potential hazards and their impacts on timelines, enabling informed adjustments. This proactive strategy for mitigating challenges ensures that projects are completed on time and within budget, even when faced with unforeseen obstacles.

As IBM emphasizes, 'In a business where time-to-market is a key differentiator, this has direct business value.' While Monte Carlo Analysis presents numerous advantages, such as offering objective data for decision-making, it also has limitations, notably its dependence on precise input data. Furthermore, as the methodology evolves with technological advancements, Deltek Acumen's tools are becoming increasingly sophisticated, empowering managers to implement risk-adjusted scheduling frameworks to navigate the complexities of scheduling and remain competitive in a rapidly changing environment.

Intaver Institute: Risk-Driven Earned Value Management Framework for Enhanced Scheduling

The Intaver Institute's risk-focused earned value management (EVM) framework revolutionizes scheduling by seamlessly integrating assessments into performance metrics. This innovative approach empowers managers to monitor both cost and schedule discrepancies while proactively addressing potential challenges. By implementing this framework, teams can swiftly identify deviations, enabling timely corrective actions that keep projects aligned with their objectives.

Consider the current landscape:

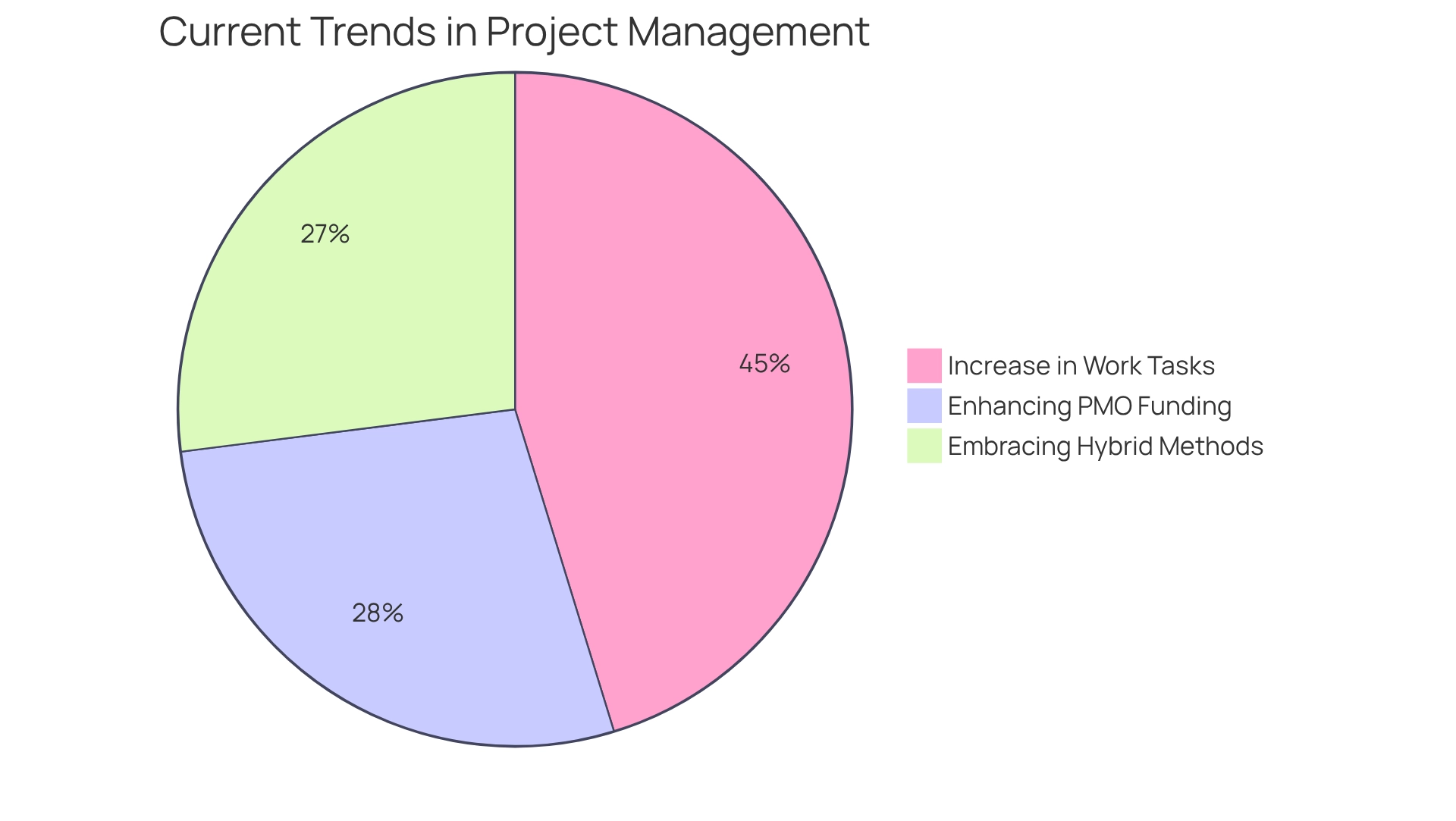

- 62% of organizations foresee an increase in work tasks

- 37% are embracing hybrid methods in construction endeavors

- 38% of organizations are planning to enhance their PMO funding this year

It is evident that adapting risk-adjusted scheduling frameworks is crucial for navigating the complexities of modern projects, which face greater risks due to their extensive scope and intricacies. This methodology is not just beneficial; it is essential for achieving goals efficiently in an increasingly complex environment. How prepared is your organization to tackle these challenges? Embrace the EVM framework and position your team for success amidst the evolving demands of the industry.

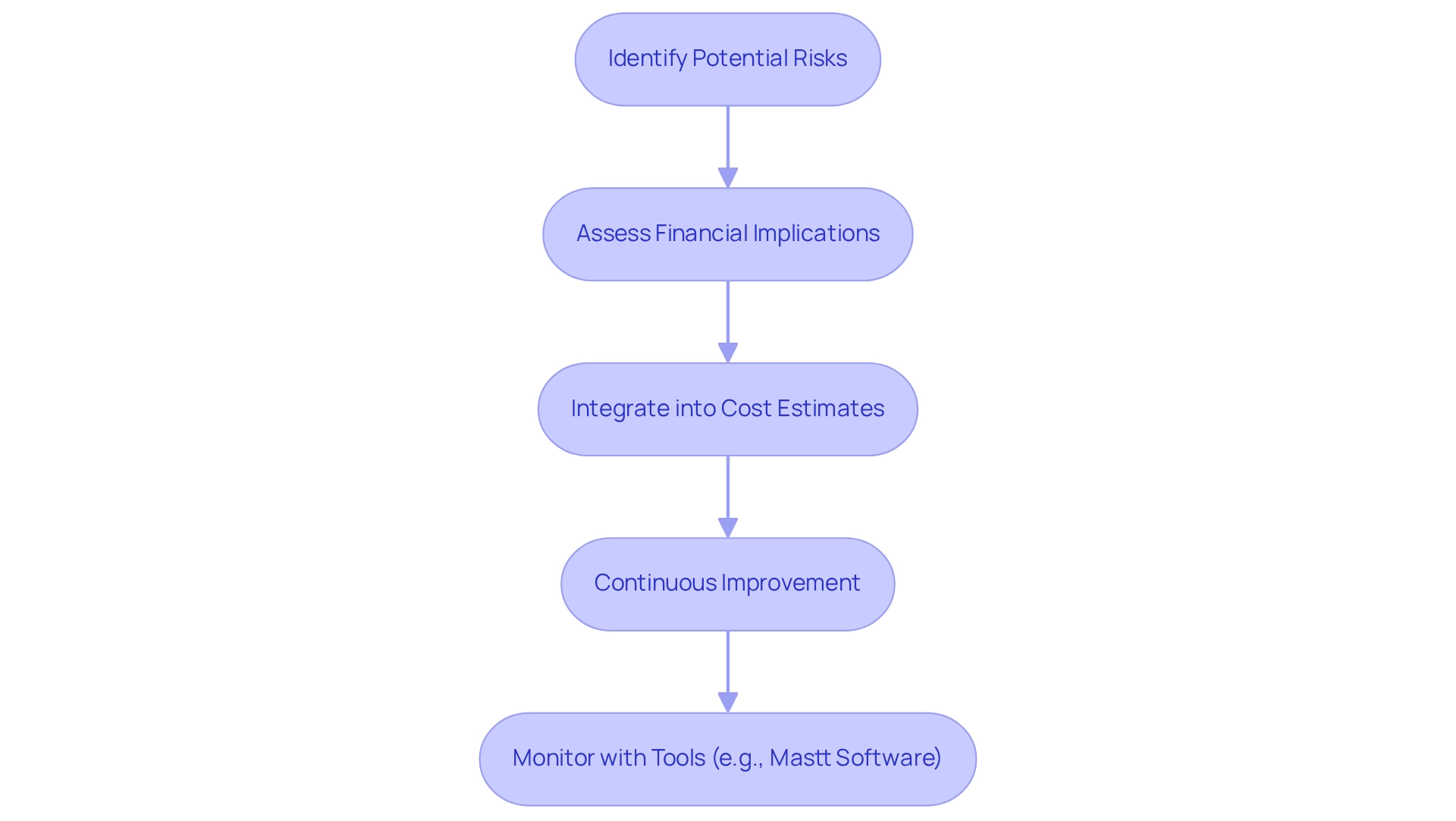

Project Management Institute: Risk-Adjusted Project Cost Estimation Methodologies

The Project Management Institute (PMI) emphasizes the critical importance of risk-adjusted scheduling frameworks for initiatives. These methodologies encompass the identification of potential threats and their financial implications during the budgeting process. By integrating risk factors into cost assessments, managers can formulate more precise budgets that account for uncertainties. This proactive approach not only facilitates the acquisition of essential funding but also prepares teams for potential financial challenges throughout the project lifecycle. Continuous improvement is a vital element in effective project oversight, ensuring that strategies evolve to meet changing demands.

For instance, a recent study revealed that an initiative could yield a net gain of $170,000, calculated by subtracting $500,000 in expenses and $30,000 in uncertainty costs from $700,000 in savings. Such findings illuminate the financial benefits of adopting risk-adjusted scheduling frameworks. Furthermore, tools like Mastt software enhance this process by automating evaluations and providing real-time cost monitoring, thereby simplifying financial oversight. As Benjamin Franklin wisely noted, "If you fail to plan, you are planning to fail!"

In 2025, it is paramount to incorporate risk-adjusted scheduling frameworks into budget plans, as financial challenges continue to persist in management. Experts advocate for a systematic approach to budgeting that includes comprehensive financial impact assessments, ensuring that initiatives remain viable despite uncertainties. By leveraging expert insights and case studies, such as 'Using Technology for Cost Risk Analysis,' managers can refine their budgeting strategies, ultimately leading to more successful outcomes.

Lumify 360: Insights into Risk-Adjusted KPIs for Project Performance Monitoring

Lumify 360 provides essential insights into the application of risk-adjusted key performance indicators (KPIs), which are vital for effective performance monitoring. By recalibrating KPIs to account for uncertainty, managers gain a more nuanced understanding of their initiatives' status, facilitating data-informed decision-making. This proactive approach allows for the early identification of potential issues, enabling swift actions that can mitigate risks before they escalate.

The use of risk-adjusted KPIs not only aligns teams with their objectives but also enhances their ability to navigate uncertainties adeptly. In 2025, the importance of KPIs in managing initiatives is underscored by the potential for sales growth KPIs to be established between 12% and 14%, highlighting the necessity for robust performance metrics that can adapt to uncertainties.

Moreover, the integration of risk oversight with KPI systems has proven to support a holistic view of performance, ultimately improving decision-making processes. This integration is exemplified in case studies, such as the 'Integration of Risk Oversight with KPIs,' where effective interventions have employed risk-adjusted scheduling frameworks to improve outcomes, demonstrating the value of this approach in contemporary practices.

As Tom Landry aptly stated, "The secret to winning is constant, consistent management," emphasizing the pivotal role of management in achieving success.

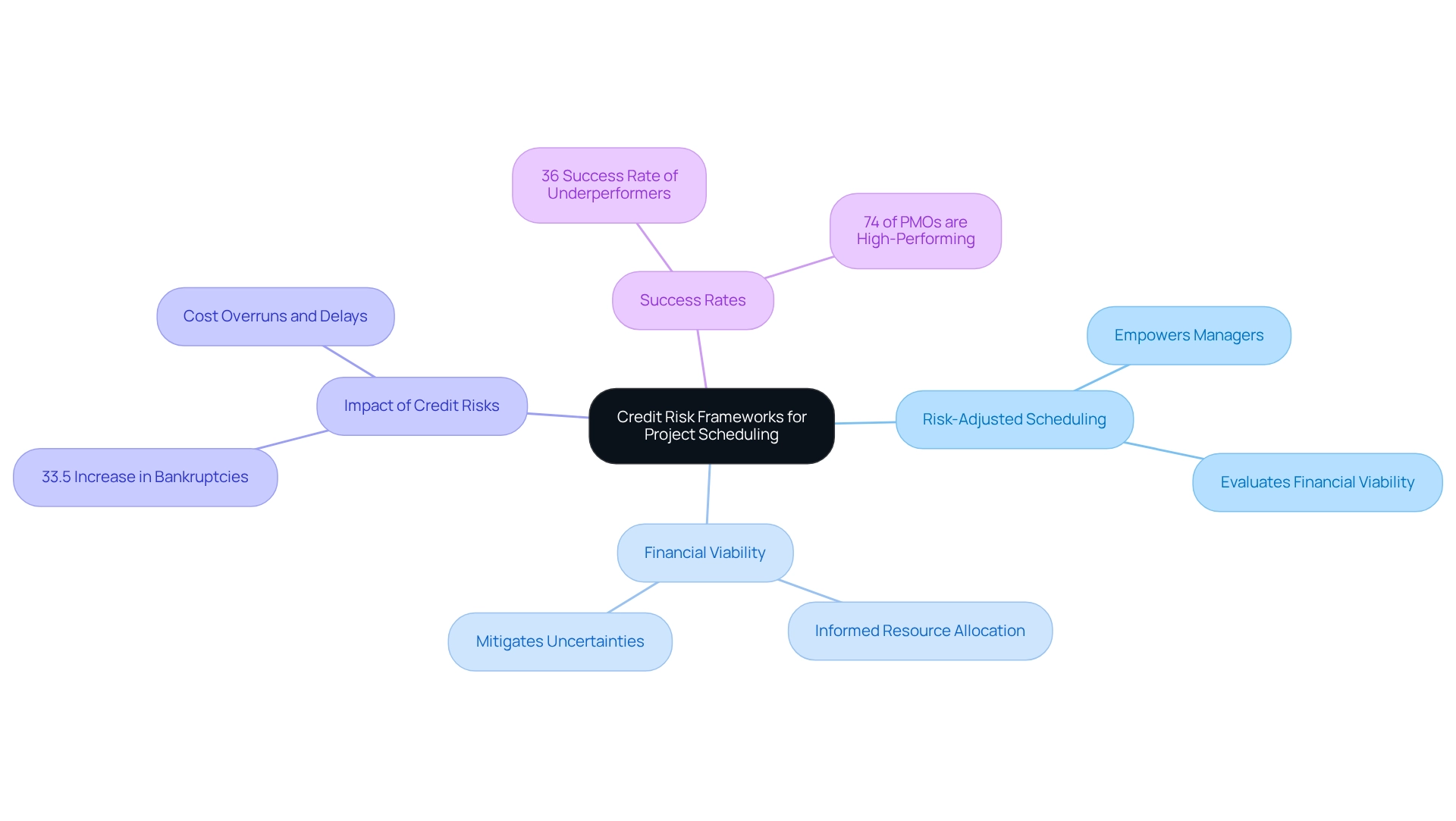

Phoenix Strategy Group: Building Credit Risk Frameworks for Project Scheduling

Phoenix Strategy Group stands at the forefront of developing risk-adjusted scheduling frameworks that are essential for the effective scheduling of initiatives. The risk-adjusted scheduling frameworks empower managers to evaluate the financial viability of their projects by scrutinizing potential credit risks linked to delays and cost overruns.

A systematic approach to credit management that incorporates risk-adjusted scheduling frameworks enables teams to make informed decisions regarding resource allocation and financing. This strategic foresight markedly increases the probability of success, particularly in a landscape where business bankruptcy filings surged by 33.5% in the year ending September 2024.

Notably, among all underperforming companies, only 36% of teams are completing their assignments successfully, underscoring the critical role of robust credit management systems in improving success rates. Furthermore, the consulting sector showcases the highest-performing PMOs, with 74% classified as high-performing, indicating that strong oversight practices, including credit assessments, correlate with overall success.

By prioritizing evaluations of financial feasibility and leveraging the expertise of certified professionals, organizations can mitigate uncertainties and enhance outcomes, ensuring they remain competitive and adaptable in a challenging economic climate.

ResearchGate: Access to Risk Management Frameworks for Scheduling Best Practices

ResearchGate serves as an essential resource for accessing management frameworks that inform best practices in scheduling. By delving into academic literature and case studies, managers can uncover effective strategies for identifying and mitigating risks. These risk-adjusted scheduling frameworks serve as a foundation for developing robust scheduling practices that drive improved outcomes. Leveraging research findings empowers teams to proactively address potential challenges, thereby enhancing their project coordination processes.

As Guido Laures, CTO at Spreadshirt, articulates, "If failing is an accepted part of doing business and the blame game is not embedded in the organization, uncertainty is not perceived as a threat anymore." This perspective underscores the importance of fostering a culture that embraces learning from setbacks when navigating uncertainties.

Furthermore, insights gleaned from the case study on Management Offices (PMOs) reveal that structured frameworks can lead to significant improvements in delivery and alignment with organizational strategy.

Medium: Agile Frameworks Incorporating Risk Adjustments for Project Management

Agile frameworks that accommodate uncertainties are essential for effective project oversight. Recent discussions within industry circles have underscored this necessity. These methodologies prioritize adaptability and responsiveness, making the integration of management practices vital. By anticipating potential challenges during sprint planning and adjusting priorities accordingly, teams can sustain their momentum while adeptly managing uncertainties. This proactive approach not only enhances adaptability but also cultivates a culture of continuous improvement.

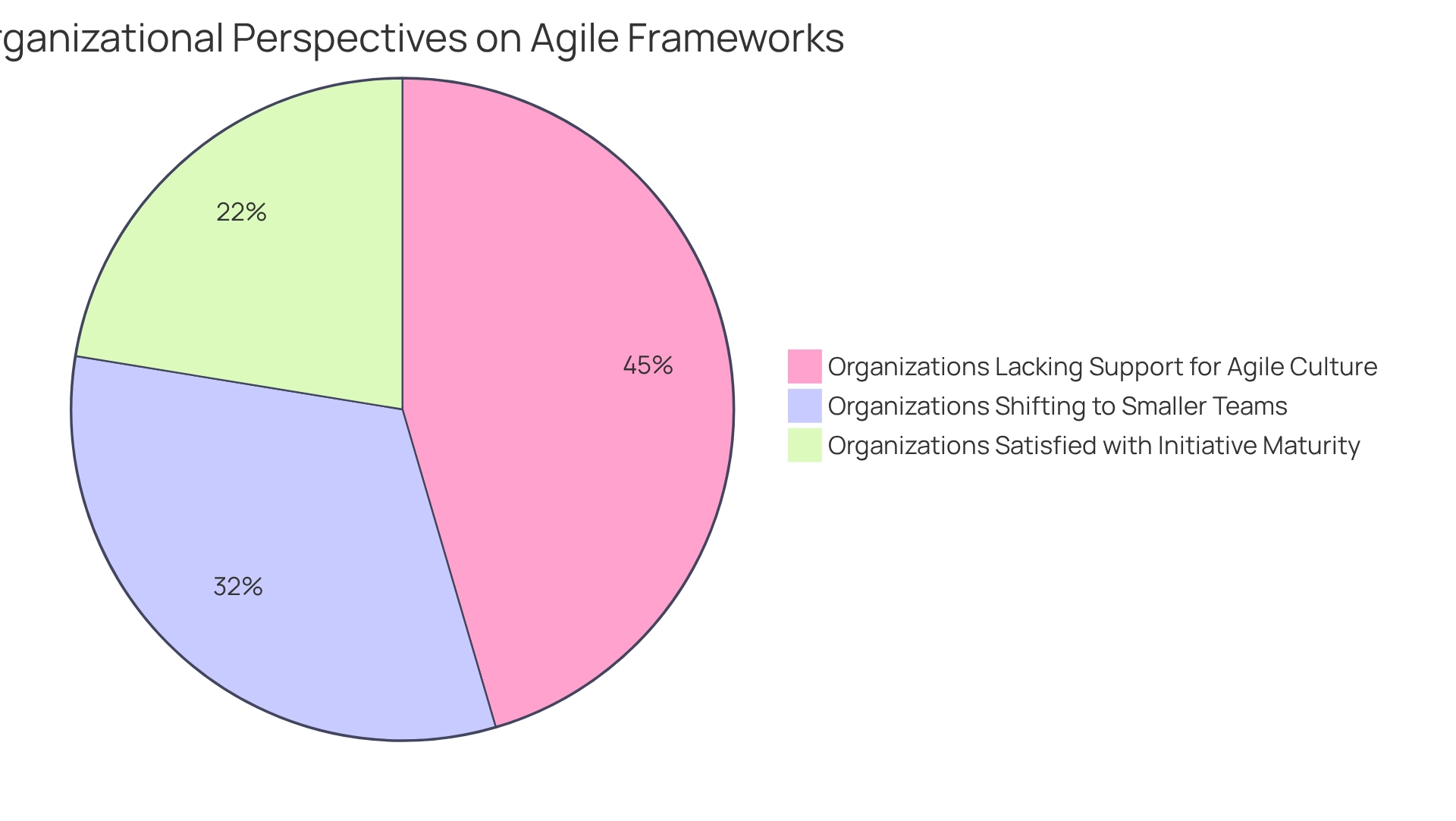

As organizations increasingly recognize the imperative for agility—53% of which foresee a shift towards operating in smaller, more flexible teams—the ability to confront challenges by identifying and addressing uncertainties becomes a foundational element of successful execution. Furthermore, nearly 75% of participants indicate that their organization lacks adequate support for fostering an Agile culture, underscoring the critical importance of integrating risk-adjusted scheduling frameworks into risk management practices. Additionally, a mere 37% of organizations express satisfaction with their initiative maturity, underscoring the pressing need for organizations to reassess their practices and elevate their maturity levels.

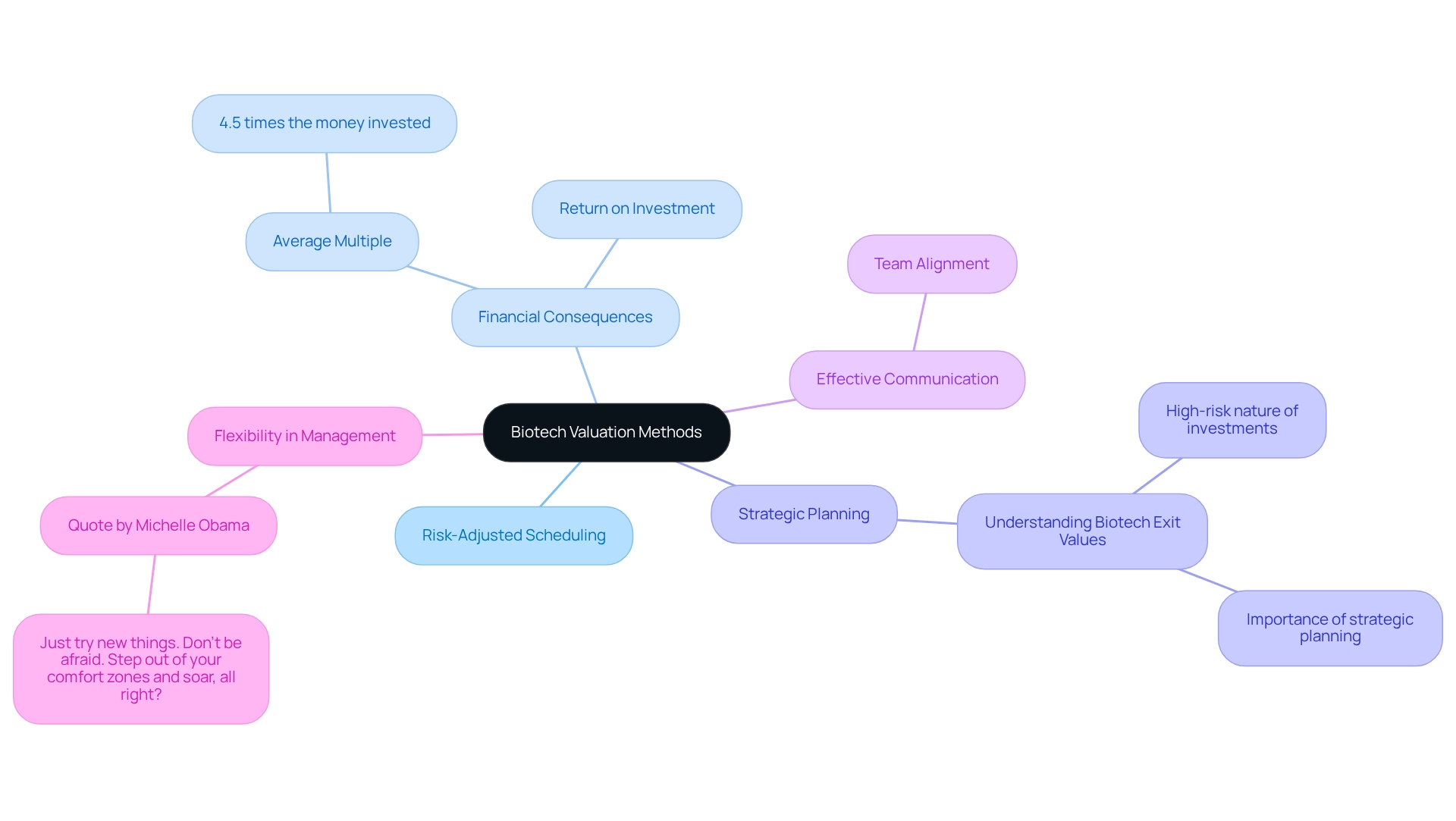

ExitWise: Biotech Valuation Methods Adapted for Risk-Adjusted Scheduling

ExitWise investigates biotech valuation techniques that can be adapted for risk-adjusted scheduling frameworks in management. These methods provide a robust framework for evaluating the financial consequences of scheduling choices, enabling managers to assess the potential return on investment for different timelines. Notably, the average multiple for exited biotech companies is 4.5 times the money invested, underscoring the significant financial stakes involved. By integrating risk-adjusted scheduling frameworks, teams can make informed choices that align with their financial goals while effectively managing timelines.

As Michelle Obama wisely stated, "Just try new things. Don’t be afraid. Step out of your comfort zones and soar, all right?" This sentiment emphasizes the necessity for flexibility in overseeing tasks.

Furthermore, the case study titled "Understanding Biotech Exit Values" illustrates the high-risk nature of biotech investments and highlights the importance of strategic planning. Effective communication among team members is also vital, ensuring that all stakeholders are aligned and informed throughout the initiative lifecycle.

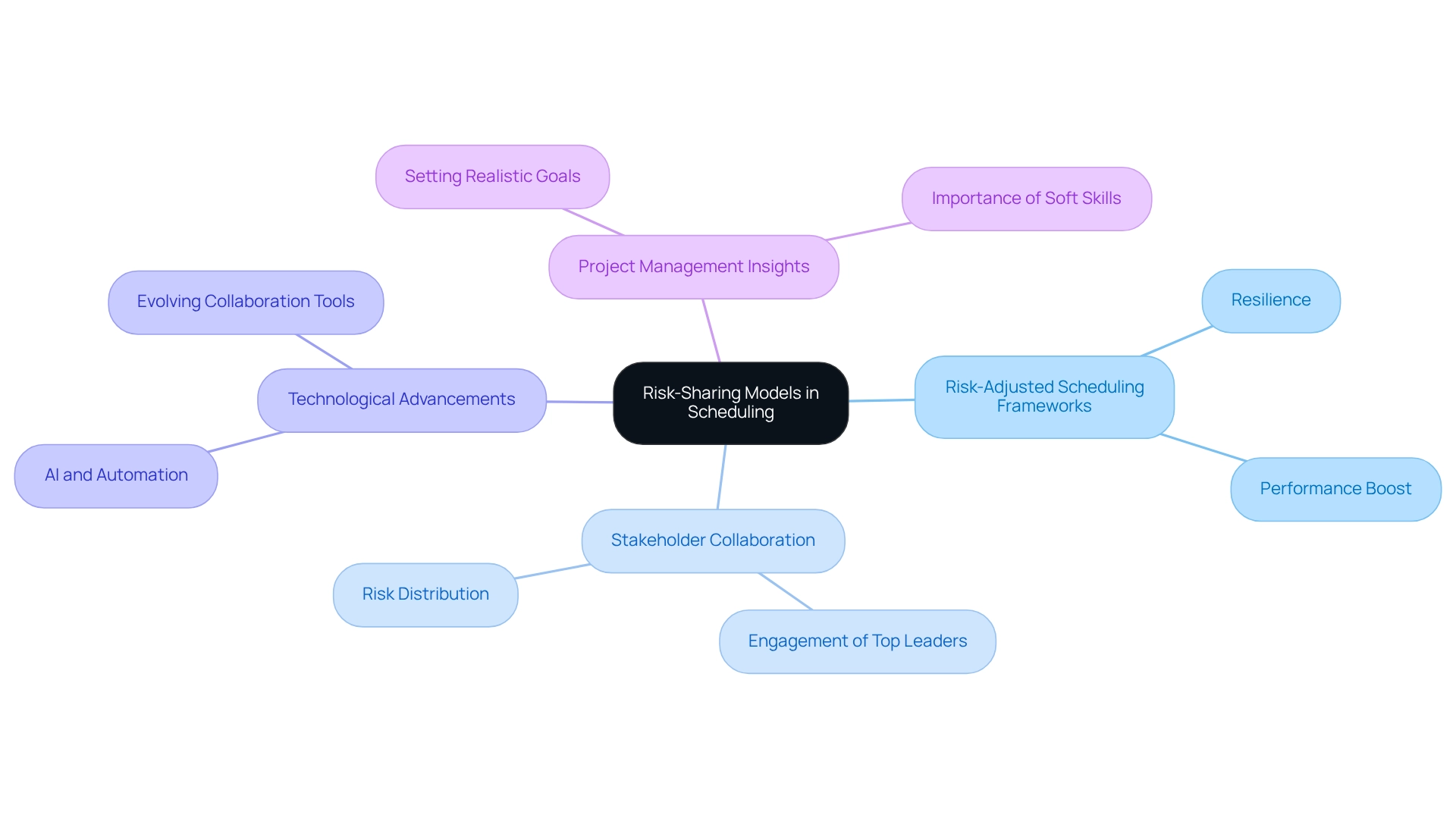

SAGE Journals: Research on Risk-Sharing Models for Enhanced Scheduling Strategies

Research from SAGE Journals underscores the critical role of risk-adjusted scheduling frameworks in enhancing scheduling strategies within management. These models introduce innovative methods for distributing risks among stakeholders, thereby bolstering initiative resilience. By effectively understanding and implementing risk-adjusted scheduling frameworks, managers can develop more resilient schedules that proactively address potential uncertainties. This collaborative approach not only fortifies partnerships among stakeholders but also significantly boosts overall performance, ensuring that projects are completed on time and within budget.

As the global online task coordination software market is projected to reach $13.7 billion by 2030, the demand for efficient scheduling tactics becomes increasingly essential. Steve McConnel emphasizes that a well-formed estimate provides a clear perspective of the situation, empowering leadership to make informed decisions. Additionally, Venus Williams advocates for setting attainable objectives and maintaining consistency, which are vital for effective management.

Insights from the case study titled 'Future of Project Management' reveal that technological advancements and collaboration tools will shape future practices, highlighting the necessity of adapting to these changes. Furthermore, it is noteworthy that fewer than a third of IT projects fail due to inadequate involvement from top leaders, underscoring the critical need for stakeholder engagement in risk-sharing models.

Conclusion

The integration of risk-adjusted strategies in project management, particularly within the energy sector, stands as a pivotal advancement for enhancing project outcomes. Key players such as Harbinger Land, Deltek Acumen, and the Intaver Institute exemplify how innovative tools and methodologies can effectively mitigate risks, optimize scheduling, and ensure that projects remain on track despite inevitable challenges. By leveraging advanced technologies, including AI-powered solutions and Monte Carlo simulations, project managers can achieve heightened accuracy in risk assessment and performance forecasting.

Moreover, the emphasis on risk-adjusted project cost estimation methodologies by organizations like the Project Management Institute underscores the necessity of proactive budgeting practices. By incorporating potential risks into financial planning, teams not only secure necessary funding but also prepare for unforeseen financial challenges. The insights gained from risk-adjusted key performance indicators and credit risk frameworks further reinforce the imperative for a structured approach to project management that prioritizes adaptability and resilience.

As the landscape of project management evolves, the adoption of agile frameworks and risk-sharing models emerges as essential strategies for fostering collaboration and enhancing scheduling practices. The collective findings from various studies and case examples highlight that successful project management hinges on the ability to anticipate and navigate risks effectively. By embracing these methodologies, organizations can significantly improve project performance and ensure sustainable success in an increasingly complex and competitive environment.

Frequently Asked Questions

What services does Harbinger Land provide for energy initiatives?

Harbinger Land offers comprehensive solutions for risk-adjusted scheduling, including site and right-of-way acquisition, advanced title research, and GIS mapping. These services are essential for early detection of potential issues throughout project lifecycles.

How does Harbinger Land enhance efficiency and accuracy in project management?

Harbinger Land leverages integrated GIS modeling services and AI-powered title research software to significantly enhance efficiency and accuracy, ensuring that project tasks adhere to timelines despite challenges.

What is the significance of Harbinger Land's proactive strategy?

Their proactive strategy helps clients navigate complex regulatory frameworks and engage with stakeholders, which effectively reduces delays and minimizes cost overruns in energy projects.

What role does document imaging play in Harbinger Land's services?

Harbinger Land's document imaging solutions allow title agents to finalize title research and leasing in a budget-friendly manner, emphasizing the importance of organized management approaches.

Can you provide an example of how Harbinger Land's strategies have been effective?

A case study of VPP Partners highlights the effectiveness of Harbinger Land's strategies in recognizing and measuring uncertainties associated with Battery Energy Storage System (BESS) initiatives.

What is Deltek Acumen, and how does it support project managers?

Deltek Acumen provides sophisticated risk-adjusted scheduling frameworks that enable managers to evaluate schedule quality, model uncertainty, and forecast performance using Monte Carlo simulations to visualize potential hazards and their impacts on timelines.

What are the limitations of Monte Carlo Analysis in project management?

While Monte Carlo Analysis offers objective data for decision-making, its limitations include a reliance on precise input data, which can affect the accuracy of its forecasts.

How does the Intaver Institute's EVM framework benefit project management?

The EVM framework integrates risk assessments into performance metrics, allowing managers to monitor cost and schedule discrepancies and enabling timely corrective actions to keep projects aligned with their objectives.

What trends are organizations currently experiencing in project management?

Current trends indicate that 62% of organizations foresee an increase in work tasks, 37% are adopting hybrid methods in construction, and 38% plan to enhance their PMO funding this year.

Why is adapting risk-adjusted scheduling frameworks essential in modern projects?

Adapting these frameworks is crucial for managing the complexities and risks associated with modern projects, which have extensive scopes and intricacies, ensuring efficient goal achievement in a challenging environment.

List of Sources

- Harbinger Land: Comprehensive Solutions for Risk-Adjusted Scheduling in Energy Projects

- Quantitative Schedule Risk Analysis (https://tensix.com/quantitative-schedule-risk-analysis)

- 139 Project Management Quotes to Inspire Your Next Project (https://plaky.com/blog/project-management-quotes)

- 34 of the Best Planning Quotes (https://projectmanager.com/blog/planning-quotes)

- Understanding Risk-Adjusted Returns for BESS Projects (https://linkedin.com/pulse/understanding-risk-adjusted-returns-bess-projects-vpp-partners-b73ac)

- Deltek Acumen: Advanced Risk-Adjusted Scheduling Tools for Project Management

- Monte Carlo Simulation: What It Is, How It Works, History, 4 Key Steps (https://investopedia.com/terms/m/montecarlosimulation.asp)

- Monte Carlo Simulation: Definition and How It Works (https://ca.indeed.com/career-advice/career-development/monte-carlo-simulation)

- Understanding the Monte Carlo Analysis in Project Management (https://proprofsproject.com/blog/monte-carlo-analysis-in-project-management)

- Intaver Institute: Risk-Driven Earned Value Management Framework for Enhanced Scheduling

- 110+ project management statistics and trends for 2025 (https://monday.com/blog/project-management/project-management-statistics)

- Blog: Project risk management and project risk analysis (https://intaver.com/blog-project-management-project-risk-analysis)

- 50+ Project Management Quotes to Learn From (https://proprofsproject.com/blog/project-management-quotes)

- Project Management Institute: Risk-Adjusted Project Cost Estimation Methodologies

- 139 Project Management Quotes to Inspire Your Next Project (https://plaky.com/blog/project-management-quotes)

- Cost Risk Analysis: Causes, Calculations, and Proven Solutions (https://mastt.com/blogs/cost-risk-analysis)

- Lumify 360: Insights into Risk-Adjusted KPIs for Project Performance Monitoring

- Key Performance Indicators (KPIs) for Data-Driven Decision Making | Lumify360 (https://lumify360.com/knowledge-hub/key-performance-indicators)

- 139 Project Management Quotes to Inspire Your Next Project (https://plaky.com/blog/project-management-quotes)

- Phoenix Strategy Group: Building Credit Risk Frameworks for Project Scheduling

- 15 Credit Risk Management Stats for CFOs (https://linkedin.com/pulse/15-credit-risk-management-stats-cfos-creditsafe-1stwe)

- Top Project Management Industry Statistics & Trends (2025) (https://plaky.com/learn/project-management/project-management-statistics)

- Project Management Statistics: 33 Most Important Stats for 2025 (https://flowlu.com/blog/project-management/project-management-statistics)

- ResearchGate: Access to Risk Management Frameworks for Scheduling Best Practices

- Top 65+ Project Management Statistics for 2024 | PPM Express (https://ppm.express/blog/project-management-statistics)

- Risk-taking quotes to inspire business leaders (https://enterprisersproject.com/article/2016/10/risk-taking-quotes-inspire-business-leaders)

- Project Management Statistics: 45 Stats You Can't Ignore (https://workamajig.com/blog/project-management-statistics)

- Project Management Statistics and Trends in 2024 | ClickUp (https://clickup.com/blog/project-management-statistics)

- Medium: Agile Frameworks Incorporating Risk Adjustments for Project Management

- 110+ project management statistics and trends for 2025 (https://monday.com/blog/project-management/project-management-statistics)

- businessmap.io (https://businessmap.io/blog/agile-statistics)

- ExitWise: Biotech Valuation Methods Adapted for Risk-Adjusted Scheduling

- Biotech Valuation: Methods, Examples, and Calculator (https://exitwise.com/blog/biotech-valuation)

- Understanding The Importance Of Project Scheduling - FasterCapital (https://fastercapital.com/topics/understanding-the-importance-of-project-scheduling.html/1)

- 139 Project Management Quotes to Inspire Your Next Project (https://plaky.com/blog/project-management-quotes)

- SAGE Journals: Research on Risk-Sharing Models for Enhanced Scheduling Strategies

- Top 65+ Project Management Statistics for 2024 | PPM Express (https://ppm.express/blog/project-management-statistics)

- 139 Project Management Quotes to Inspire Your Next Project (https://plaky.com/blog/project-management-quotes)