Overview

The article highlights critical funding strategies for grid modernization, underscoring the essential role of:

- Public-private partnerships

- Federal grants

- State incentives

- Utility investments

- Green bonds

- Crowdfunding

- International funding sources

These strategies not only enhance financial viability but also support the transition to a more resilient energy infrastructure. By integrating innovative technologies and fostering community engagement, substantial investments and successful case studies are presented throughout the text, illustrating the effectiveness of these approaches.

Introduction

The transformation of energy infrastructure is not merely a distant aspiration; it is an urgent necessity as the world confronts the pressing challenges posed by climate change and the critical demand for sustainable energy solutions. This article explores nine innovative funding strategies that are essential for effective project financing in grid modernization. It offers valuable insights into how stakeholders can adeptly navigate the intricate financial landscape. With a wealth of opportunities available—from federal grants and public-private partnerships to green bonds and crowdfunding—the question arises: how can organizations effectively leverage these resources to ensure a resilient and modern energy grid?

Harbinger Land | Comprehensive Solutions for Land Acquisition in Grid Modernization

Harbinger Land stands as a leader in delivering comprehensive land acquisition solutions, a vital element in the modernization process. Their services encompass site and right-of-way acquisition, title research, GIS mapping, and data processing. By leveraging cutting-edge technology, including AI-driven title research software, Harbinger Land significantly enhances efficiency and boosts client satisfaction, enabling initiatives and infrastructure projects to advance without unnecessary delays. The firm's expert team is adept at rapidly mobilizing large teams to meet project demands, positioning them as an essential partner in the evolving landscape of modernization.

Recent innovations in land acquisition strategies underscore the necessity of integrating technology to streamline operations. For example, the adoption of real-time data analytics has refined decision-making processes and shortened acquisition timelines. Case studies demonstrate successful land acquisition initiatives, such as the strategic allocation of resources for major transmission line projects, which have underscored the critical role of effective land services in power initiatives.

Industry leaders emphasize that robust land acquisition strategies are fundamental for the successful execution of grid modernization funding strategies. As the demand for renewable energy sources escalates, the capability to secure land efficiently becomes increasingly vital. Harbinger Land's commitment to harnessing technology and employing skilled personnel ensures that they remain at the forefront of this essential sector, facilitating the transition to a more resilient and sustainable energy network. Reflect on how Harbinger Land's document imaging services can enhance your operational efficiency and cost-effectiveness.

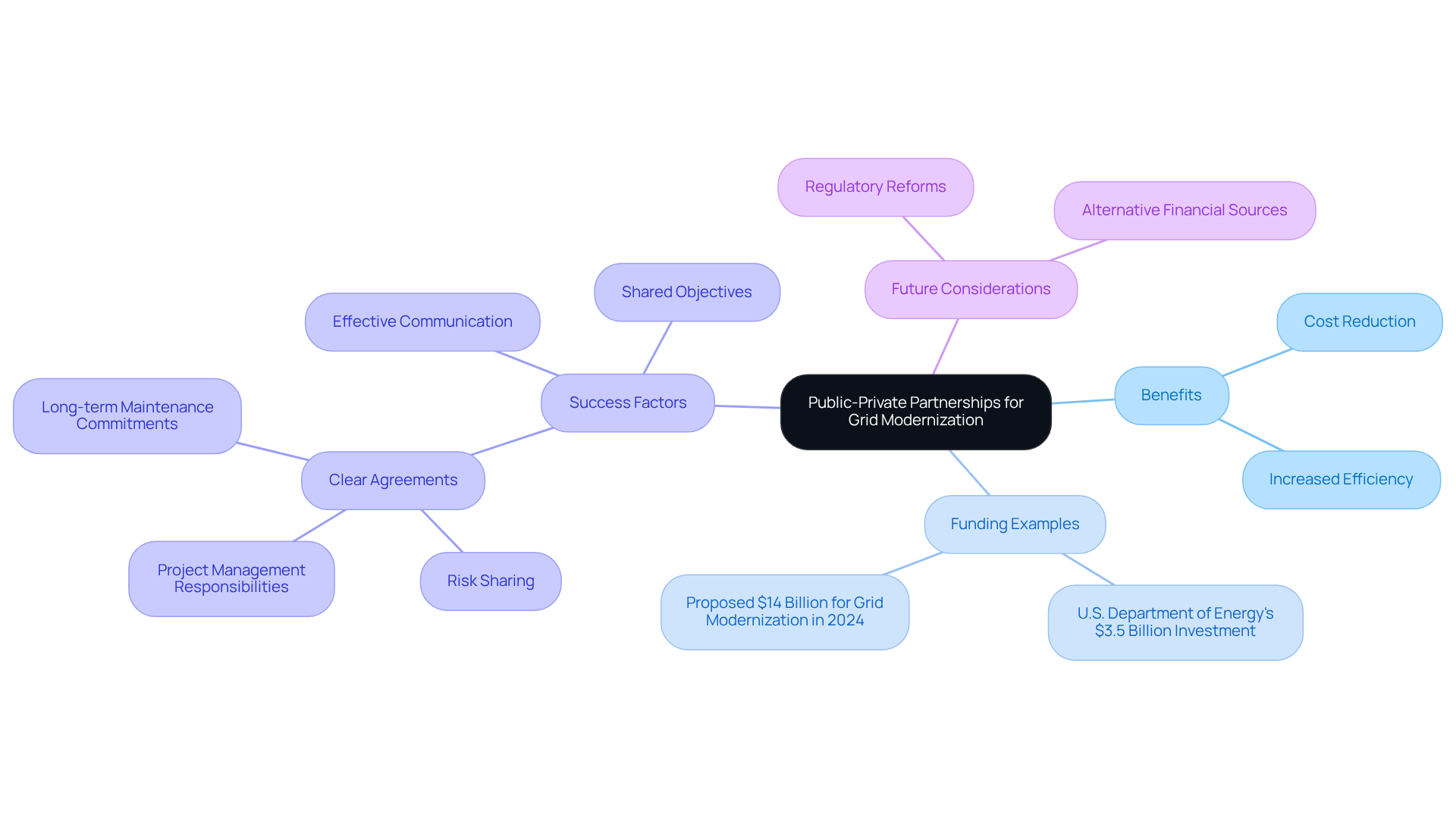

Public-Private Partnerships: Collaborative Funding for Grid Modernization

Public-private partnerships (PPPs) are essential for implementing grid modernization funding strategies, seamlessly integrating public resources with the innovation and efficiency of the private sector. These partnerships significantly reduce costs and expedite timelines, positioning themselves as a strategic choice for enhancing system resilience and reliability. For instance, states can harness federal funding alongside private investments to improve infrastructure, as exemplified by the U.S. Department of Energy's $3.5 billion investment in grid resilience initiatives and the proposed $14 billion for grid modernization funding strategies in 2024.

Successful PPPs are defined by clear agreements that delineate risk-sharing, project management responsibilities, and long-term maintenance commitments, ensuring mutual benefits for all stakeholders. Recent initiatives demonstrate that collaboration between public entities and private companies can yield exceptional outcomes, such as increased efficiency and reduced operational costs. Notably, AI-driven grid management solutions are anticipated to save the power sector $10 billion annually by 2030.

The success of these partnerships is further bolstered by effective communication and shared objectives, which are crucial for navigating the complexities of power projects. As the demand for modernized energy infrastructure escalates, grid modernization funding strategies will become increasingly critical in shaping a sustainable energy future. Utilities must also explore alternative financial sources and consider regulatory reforms to facilitate these partnerships.

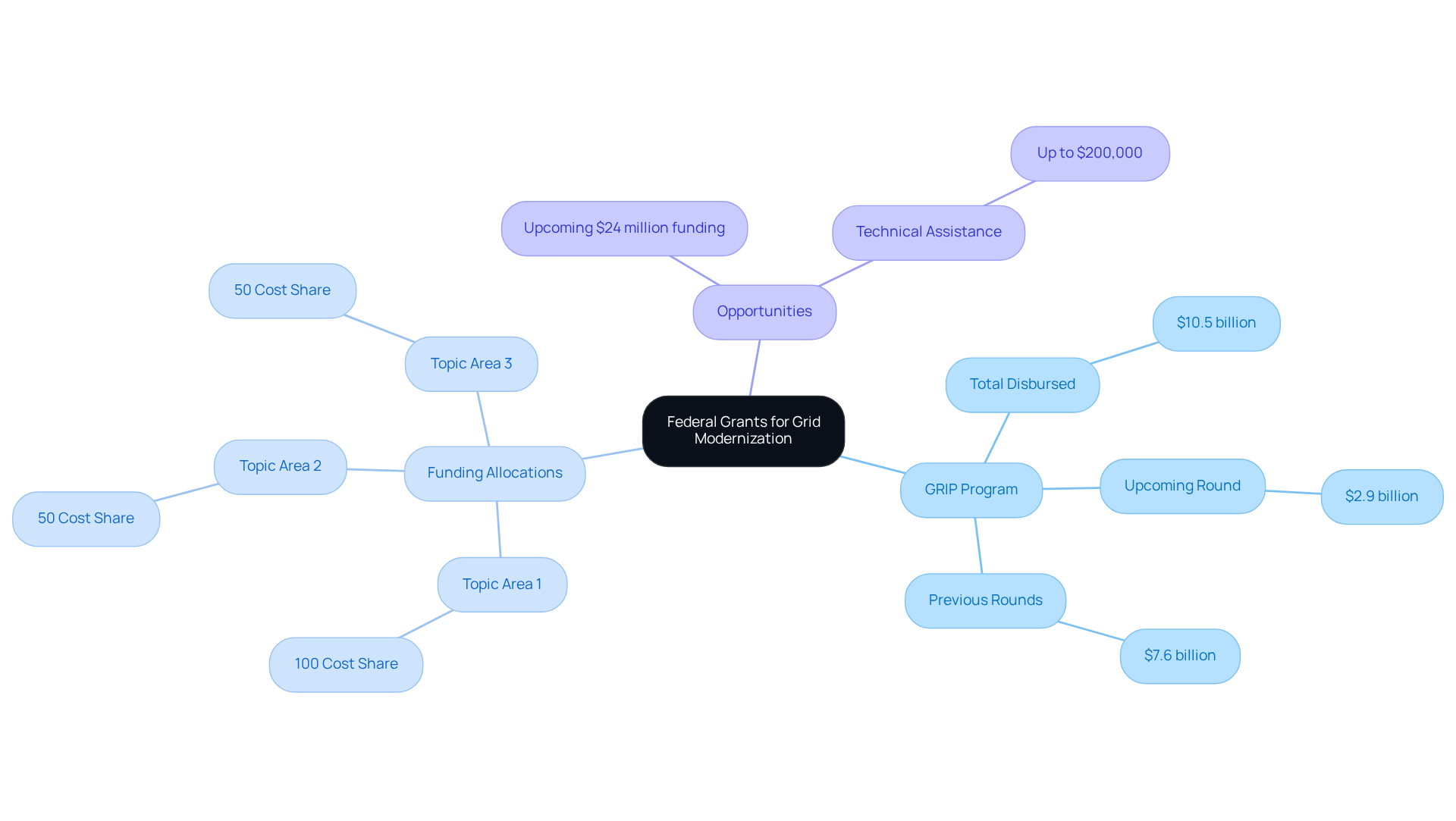

Federal Grants: Unlocking Financial Resources for Grid Modernization

Federal grants are crucial in developing grid modernization funding strategies. Programs like the Grid Resilience and Innovation Partnerships (GRIP) allocate substantial resources to advance grid modernization funding strategies. To date, the GRIP program has disbursed $7.6 billion across two successful funding rounds, with an expected $2.9 billion available in the upcoming third round, contributing to a total grant allocation of $10.5 billion for the program. Stakeholders must remain vigilant about funding opportunities and application deadlines, as these resources can significantly alleviate costs.

Effective funding requests typically require detailed proposals that clearly articulate the anticipated enhancements in network reliability and resilience. Notably, initiatives funded under GRIP have included advanced weather monitoring systems and sectionalization improvements, showcasing their transformative potential on resilience efforts. Furthermore, it is essential to recognize that Topic Area 1 mandates a 100% cost share from applicants, while Topic Area 2 requires a 50% cost share.

As the demand for clean energy solutions escalates, understanding the complexities of federal financial processes and grid modernization funding strategies becomes imperative for organizations aiming to enhance their infrastructure in response to climate challenges. Michelle Isenhouer emphasizes the importance of early planning, as the timeline for submitting concept papers is tight and the competition is fierce. Additionally, a $24 million funding opportunity is expected to be available this summer for modernization initiatives, providing further avenues for stakeholders to explore.

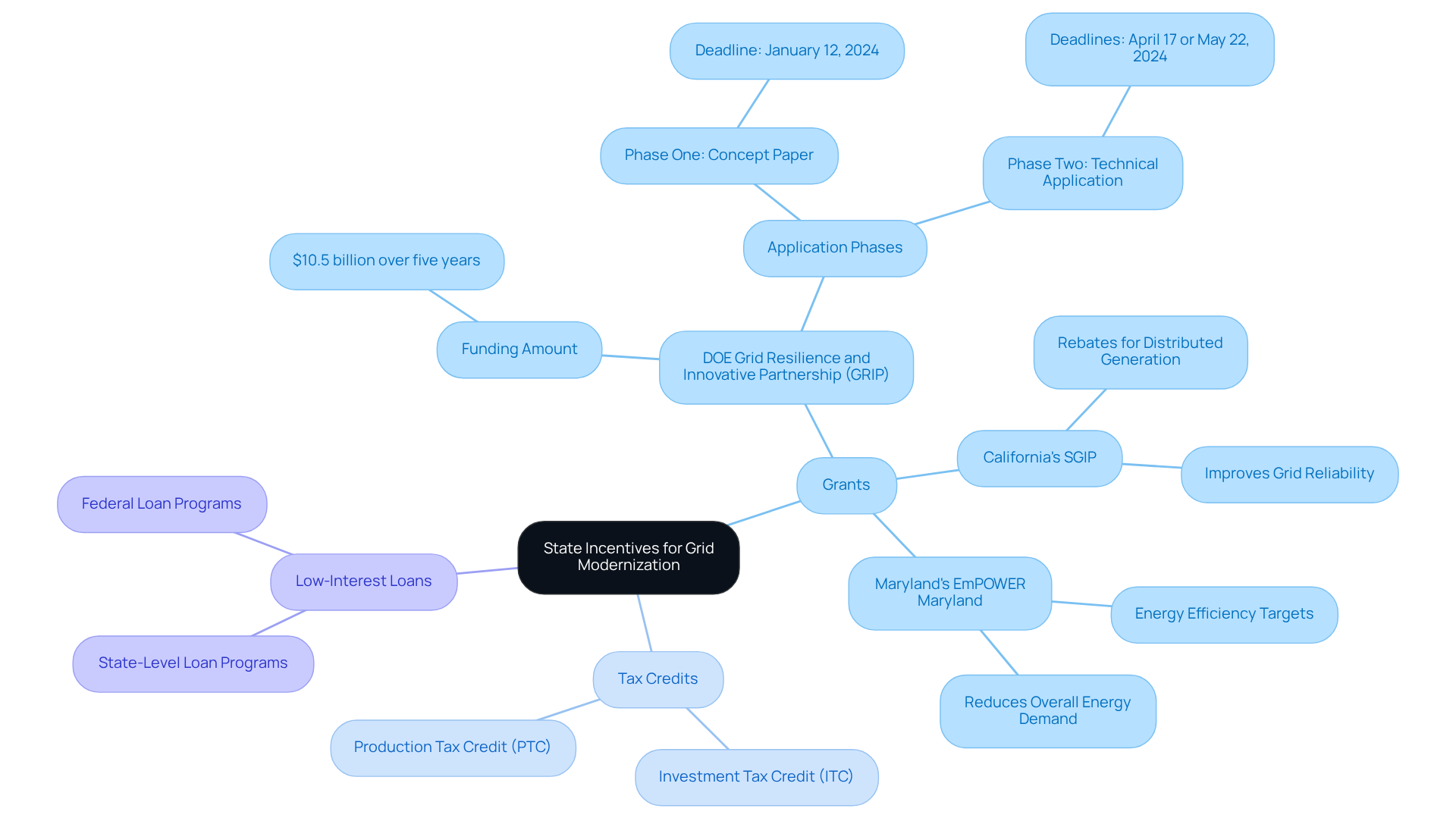

State Incentives: Boosting Funding Opportunities for Grid Modernization

States across the U.S. are actively promoting grid modernization through a variety of financial incentives, including:

- Grants

- Tax credits

- Low-interest loans

These programs significantly enhance the financial feasibility of power projects. For instance, New York's Reforming the Energy Vision (REV) initiative offers performance-based incentives and financial support for distributed generation and microgrids, fostering innovation in energy systems. Similarly, California's Self-Generation Incentive Program (SGIP) provides rebates for distributed generation technologies, effectively reducing peak demand and improving grid reliability.

In 2023, the Federal Energy Regulatory Commission projected a 4.7% increase in national power demand over the next five years, underscoring the necessity for robust financial strategies. Stakeholders should proactively explore these state-level opportunities, ensuring they comprehend the specific eligibility requirements to maximize their funding potential. Engaging with local authorities and leveraging successful case studies can significantly enhance the likelihood of securing essential financial backing for modernization initiatives.

Utility Company Investments: Driving Financial Support for Grid Modernization

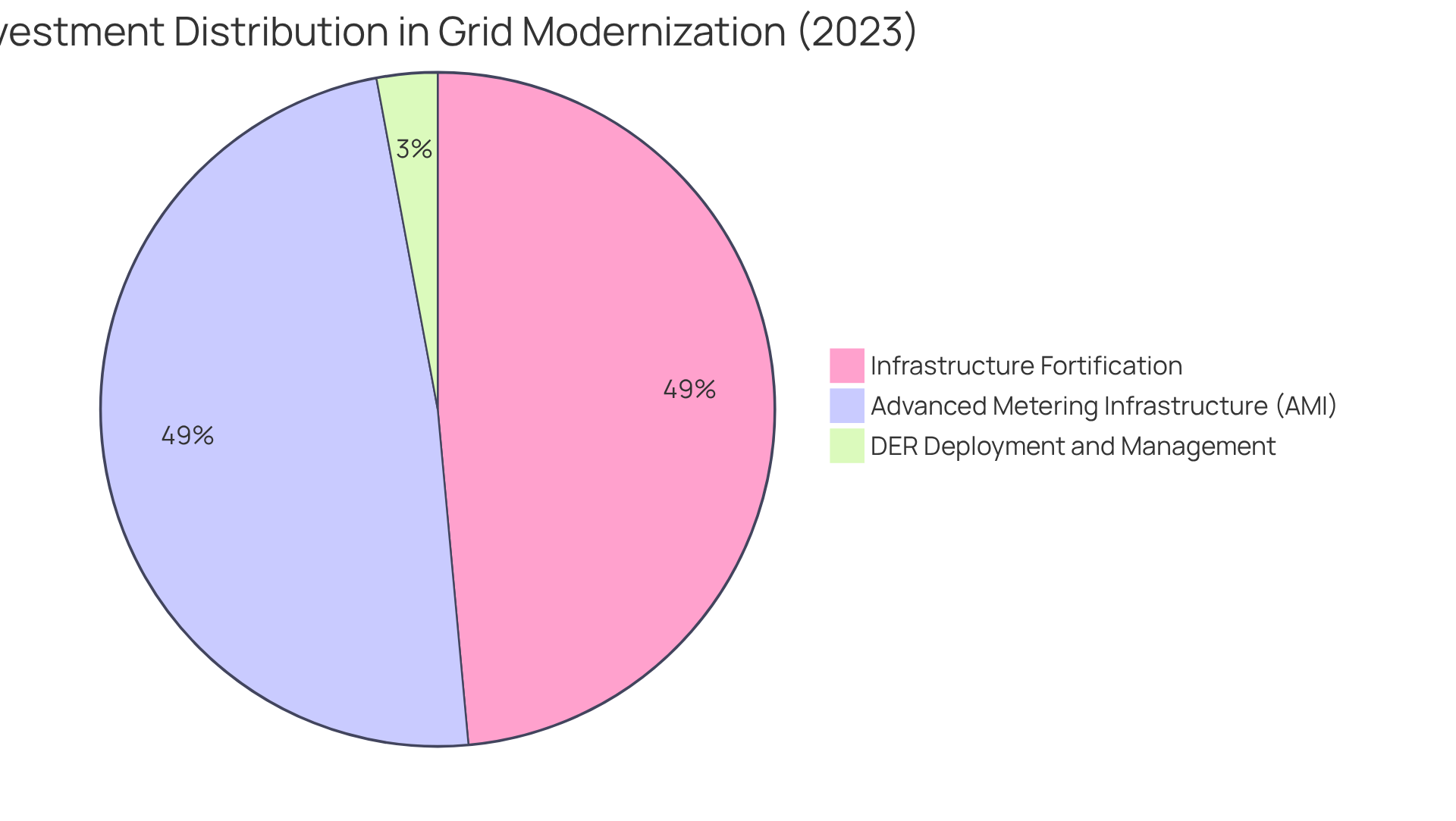

Utility firms are significantly increasing their investments in infrastructure modernization, with a focus on enhancing reliability and facilitating the integration of renewable power sources. In 2023 alone, investor-owned electric companies allocated $30 billion for transmission investments, underscoring a growing commitment to infrastructure enhancements, intelligent network technologies, and energy storage solutions. Collaborating with utilities allows developers to align their initiatives with utility goals, potentially leading to additional funding and support. For instance, utilities are increasingly offering incentives for projects that boost network efficiency and lower operational costs.

Recent trends reveal that infrastructure fortification and advanced metering infrastructure (AMI) constitute 80% of current modernization investments, boasting a compound annual growth rate of 37% since 2012. This surge in investment is driven by the need to adapt to the increasing unpredictability of distributed resource systems (DERs), which are anticipated to play a crucial role in future network strategies. Notably, investment in DER deployment and management stands at a mere 2.4%, indicating substantial growth potential in this sector. As utilities navigate these changes, they are also exploring grid modernization funding strategies to support renewable energy integration, ensuring that funding is available for initiatives that align with their modernization objectives.

As Fahimeh Kazempour, head of network modernization for Wood Mackenzie, notes, "Utilities are citing DER integration and market enablement as the main motivator for their grid modernization funding strategies." This perspective highlights the importance of aligning objectives with utility strategies to secure essential financial backing.

Green Bonds: Innovative Financing for Sustainable Grid Modernization

Green bonds represent a transformative financial tool aimed at fostering initiatives that yield positive environmental outcomes, particularly in network modernization. These instruments are increasingly attractive to investors eager to support sustainable projects. By leveraging green bonds, organizations can efficiently raise funds through grid modernization funding strategies, specifically allocated for enhancing network resilience and integrating renewable energy sources.

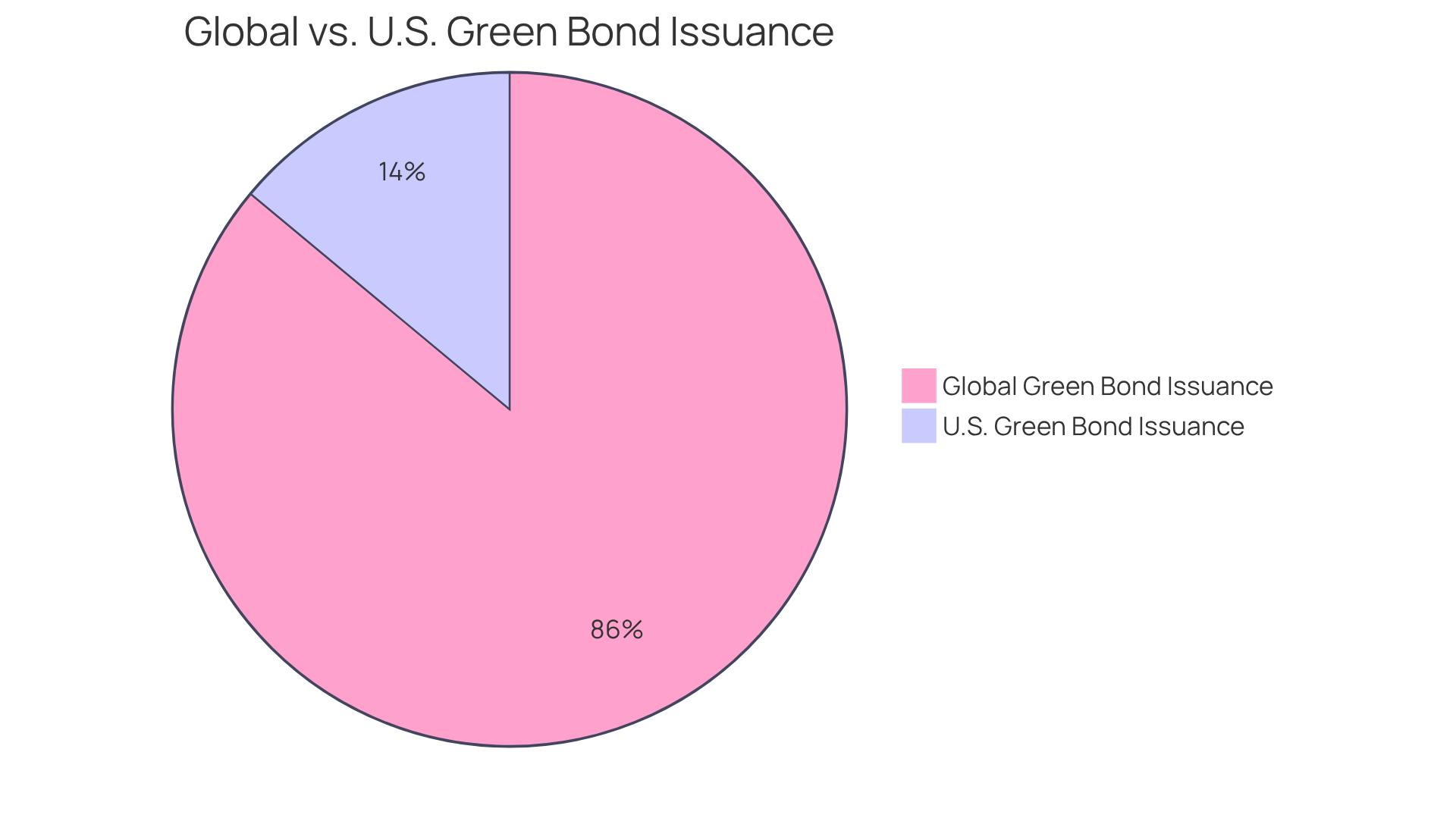

Recent trends reveal a substantial surge in investor interest in sustainable grid initiatives; notably, North American sustainable bond issuance surged by 60% in 2024, underscoring green bonds as a preferred funding option. The global issuance of green bonds has reached approximately $2.8 trillion, with the U.S. accounting for $454 billion of that total, emphasizing their growing importance in financing infrastructure projects.

Importantly, successful initiatives funded by green bonds have demonstrated their capacity to drive innovation within energy systems, showcasing how grid modernization funding strategies can effectively facilitate a transition to a more sustainable energy landscape. Stakeholders are urged to consider green bonds as a viable financing strategy, especially as the demand for sustainable investments continues to escalate.

However, it is crucial to remain cognizant of challenges such as regulatory compliance and market perception.

Crowdfunding: Engaging Communities in Grid Modernization Funding

Crowdfunding has emerged as a powerful financial strategy for grid modernization funding strategies, enabling communities to invest directly in their local infrastructure. By leveraging online platforms, developers can expand their reach and actively involve community members in the financial process. Successful campaigns often emphasize community benefits, fostering a sense of ownership and support that is crucial for enduring success.

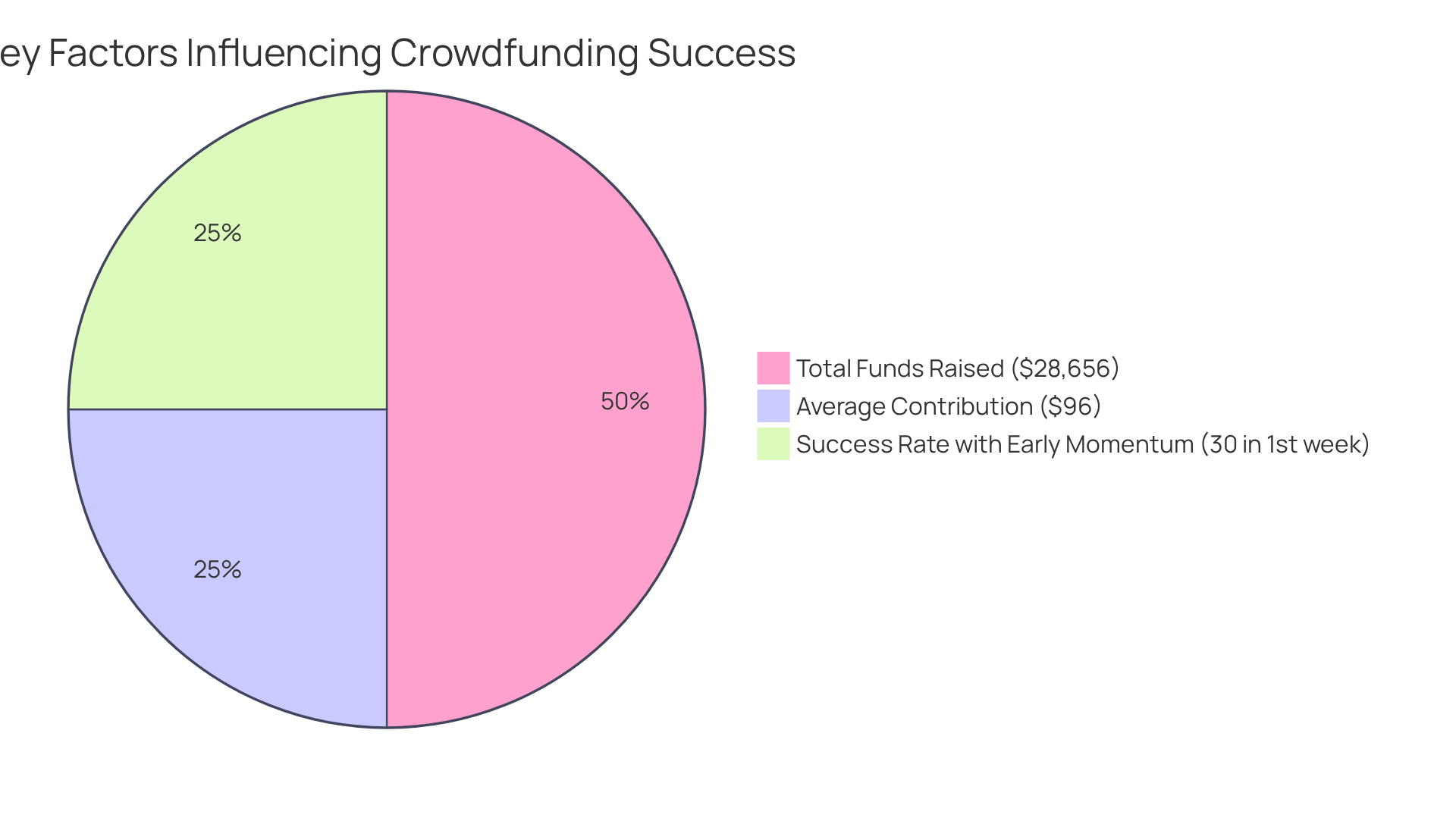

For example, successful crowdfunding initiatives raise an average of approximately $28,656, demonstrating the potential for significant contributions. Moreover, projects that secure at least 30% of their financial goal within the first week are more likely to achieve their overall targets, underscoring the importance of early momentum. Stakeholders should also recognize that campaigns providing regular updates to their followers can generate 126% more funding than those that do not, highlighting the necessity of continuous engagement.

Additionally, with an average pledge amount of $96 for successful campaigns, it is evident that numerous small contributions are vital in meeting financial objectives. Integrating crowdfunding into financial strategies not only enhances community participation but also plays a crucial role in grid modernization funding strategies to ensure the sustainability of energy infrastructure improvements.

Technology Grants: Funding Innovations in Grid Modernization

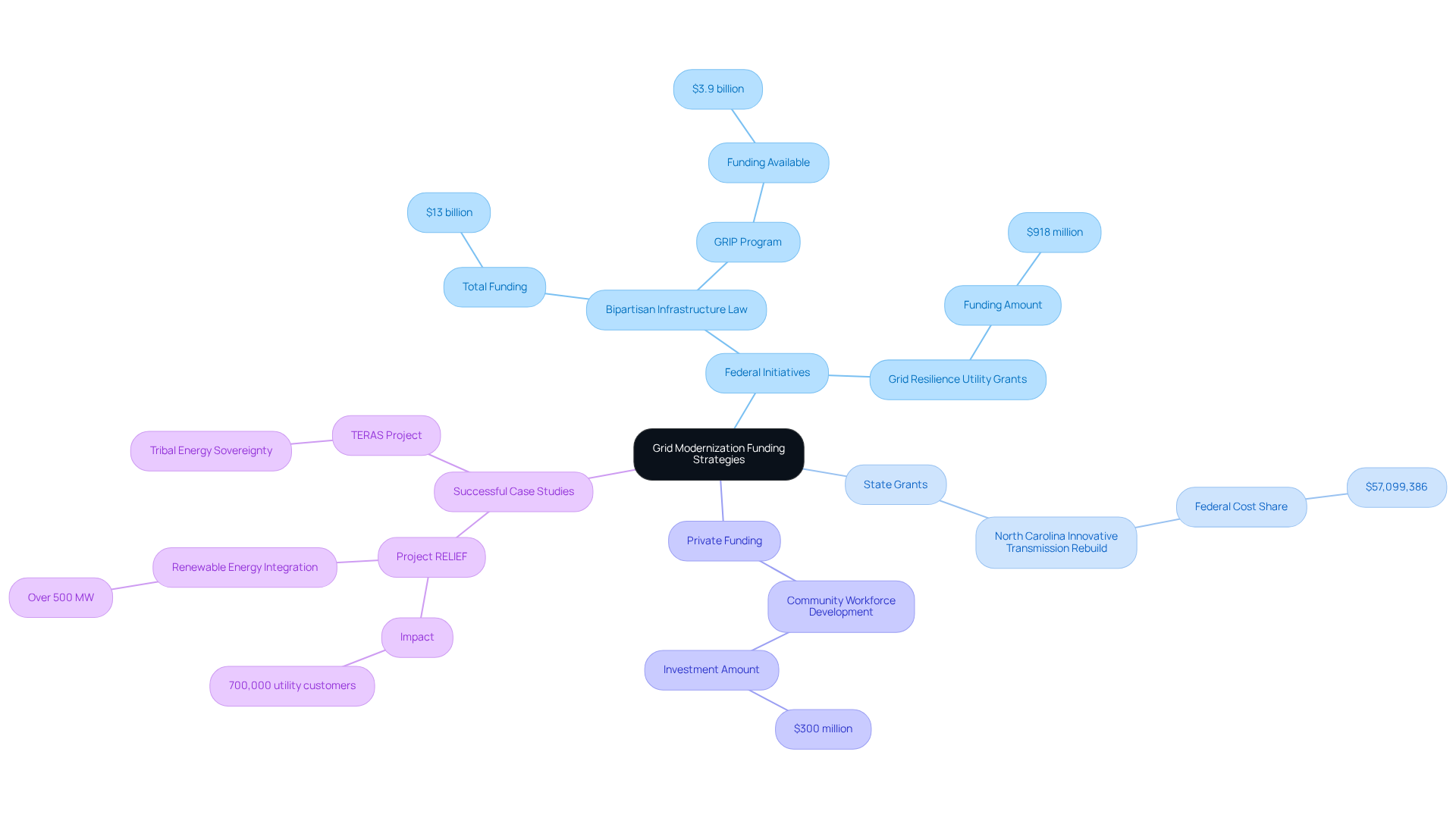

Grid modernization funding strategies are essential in driving the modernization of our networks, as they support innovative solutions that enhance efficiency and sustainability. Recent initiatives have directed significant resources toward research and development, pilot programs, and the deployment of cutting-edge technologies. For instance, the U.S. Department of Energy has committed $13 billion to upgrade the electrical network through the Bipartisan Infrastructure Law's Resilience and Innovation Partnerships (GRIP) Program, with a substantial portion allocated for technology grants that facilitate transformative projects.

Organizations must actively seek grant opportunities from federal, state, and private sources. Demonstrating the potential impact of proposed technologies on network efficiency and robustness is vital for improving funding prospects. Successful case studies, such as the Reliable Electric Lines: Infrastructure Expansion Framework (Project RELIEF), illustrate how advanced conductor cables can enhance network reliability for over 700,000 utility customers while integrating significant renewable power capacity, backed by a federal cost share of $249,557,047.

Additionally, the Grid Resilience Utility and Industry Grants, with $918 million earmarked for FY24/FY25, are designed to support grid modernization funding strategies that finance comprehensive solutions addressing hazards and enhancing community resilience. These grants not only support innovative technologies but also aim to generate good-paying jobs and promote community involvement in the development process.

With nearly 70% of the nation’s infrastructure exceeding 25 years in age, the demand for cleaner and more reliable power solutions intensifies, making it increasingly critical to implement grid modernization funding strategies to secure funding for pilot initiatives in energy-related projects. By leveraging these technology grants, organizations can foster a more interconnected and efficient power system, ultimately advancing network modernization.

Tax Credits: Enhancing Financial Viability for Grid Modernization Projects

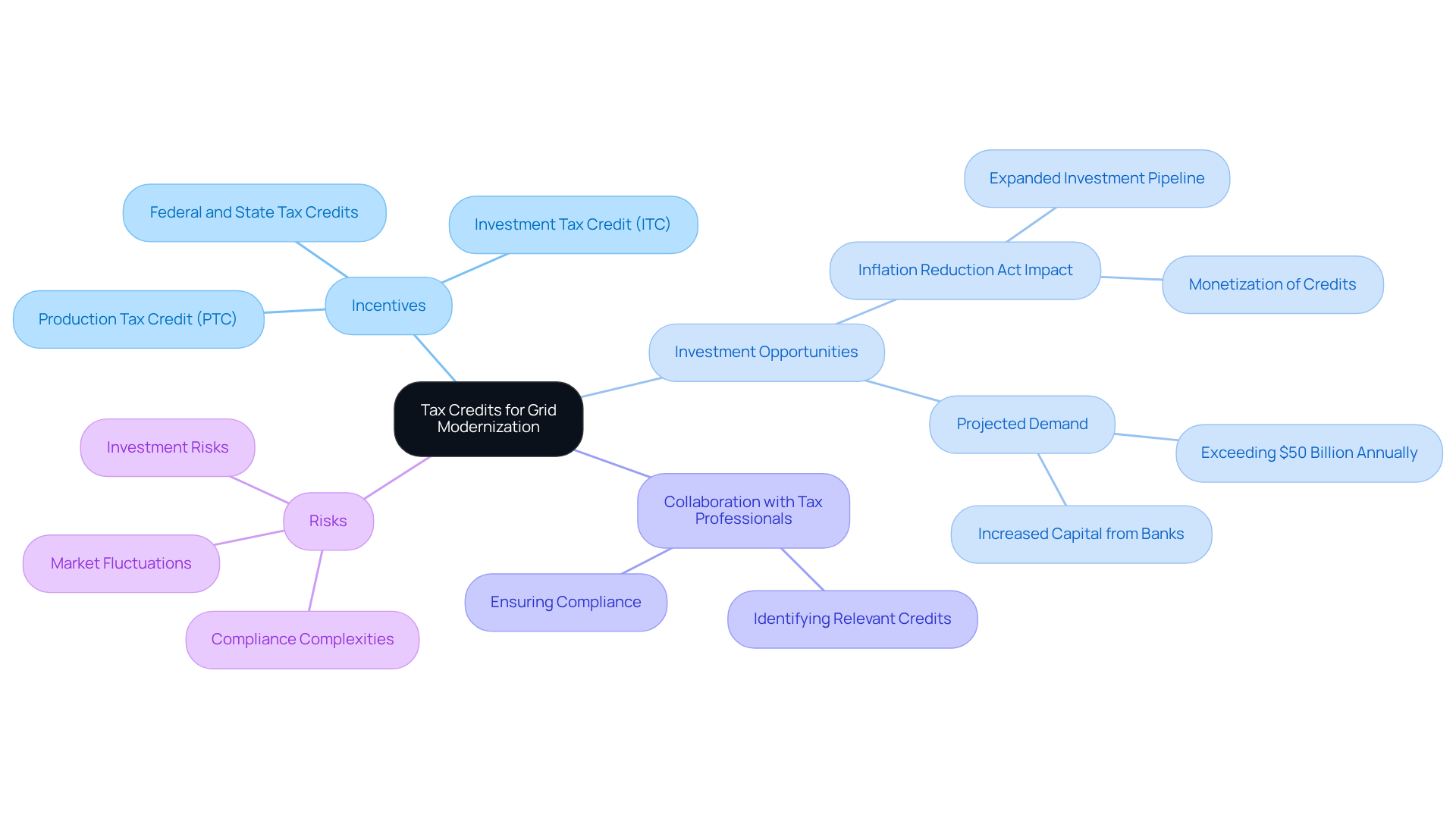

Tax credits serve as a vital instrument for bolstering the financial sustainability of grid modernization funding strategies. A diverse array of federal and state tax incentives is available for investments in renewable resources, efficiency, and infrastructure improvements. By effectively leveraging these credits, organizations can significantly reduce their tax liabilities, thus freeing up capital for further project financing. Notably, the Inflation Reduction Act has substantially expanded the investment pipeline flowing into renewables, presenting a more pragmatic approach to monetizing these credits.

As Tracey Baird, Managing Director for Corporate Tax Services, articulates, "The IRA is anticipated to greatly enhance the flow of investment into renewables and power, and it pledges to offer a more feasible method for monetizing the credits."

Stakeholders are urged to collaborate with tax professionals to identify relevant credits and ensure compliance with all regulatory requirements, thereby maximizing their financial benefits. Industry insights reveal that the demand for tax equity in the U.S. renewable resources sector is projected to exceed $50 billion annually by mid-decade, underscoring the pivotal role of tax incentives in supporting initiatives.

Understanding the intricacies of tax credit frameworks can markedly enhance financial prospects for sustainability initiatives, making it imperative for organizations to stay informed about the latest advancements in grid modernization funding strategies. Nevertheless, it is crucial to acknowledge the potential risks associated with tax equity investments, which may encompass compliance complexities and market fluctuations.

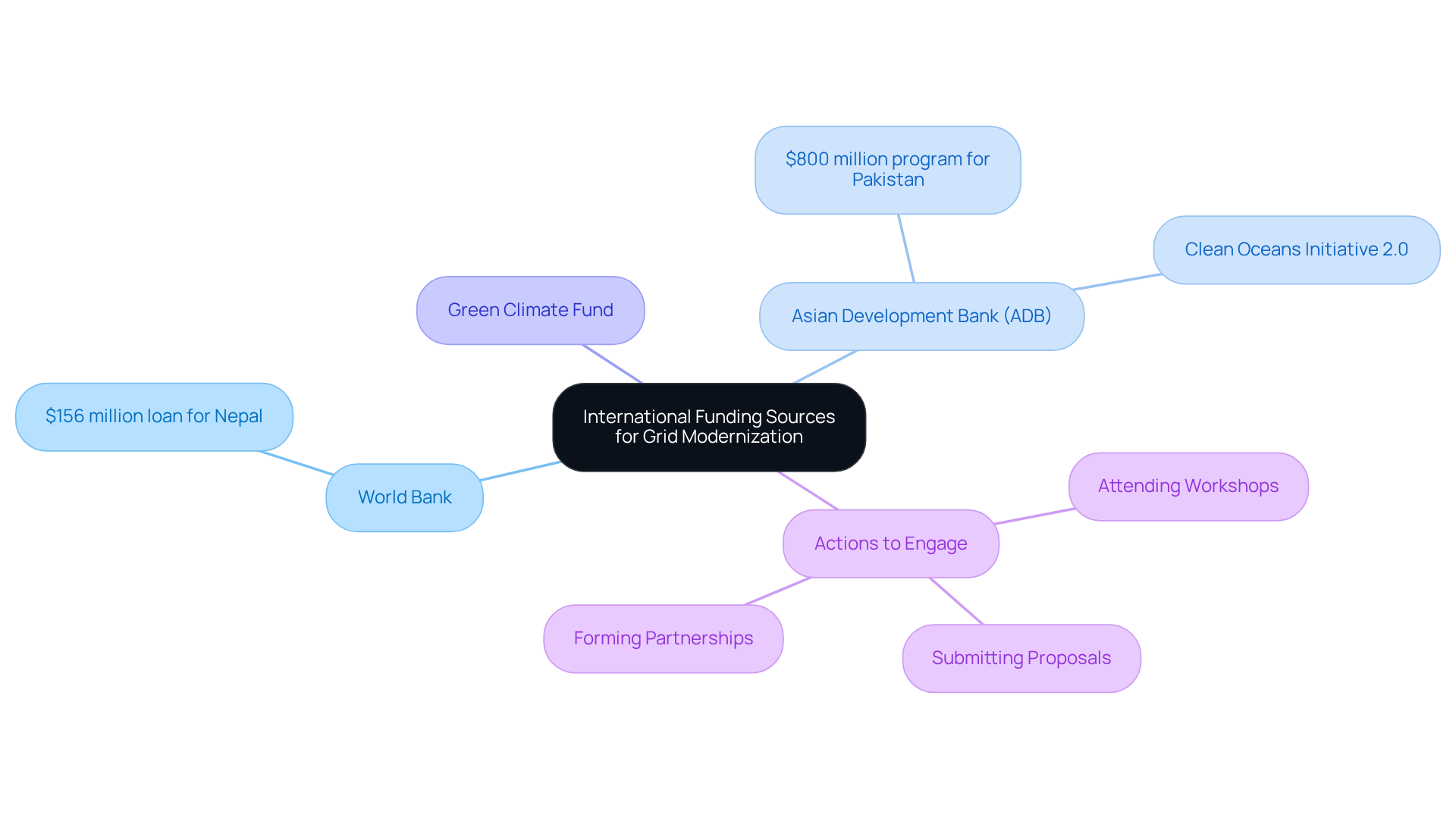

International Funding Sources: Expanding Financial Horizons for Grid Modernization

International funding sources, including development banks and global climate funds, are pivotal in implementing grid modernization funding strategies. Organizations must actively pursue opportunities from entities such as the World Bank, Asian Development Bank (ADB), and Green Climate Fund, which prioritize initiatives aimed at enhancing access to power and promoting sustainability. For instance, the ADB has allocated substantial resources to projects that improve electricity transmission and distribution systems, exemplified by a recent $156 million loan for the Electricity Grid Modernization initiative in Nepal, designed to bolster power reliability and efficiency. Notably, adaptation finance reached USD 63 billion, underscoring the urgent need for climate funding in power initiatives.

Moreover, global climate funds have increasingly focused on improving access to power, with recent initiatives aimed at supporting vulnerable communities and fostering sustainable practices. The Clean Oceans Initiative 2.0, launched by six public development banks, serves as a prime example of collaborative efforts to tackle environmental challenges while enhancing infrastructure resilience. Such initiatives can indirectly bolster energy infrastructure by promoting sustainable practices that align with grid modernization objectives. As Takehiko Nakao, President of ADB, remarked, "Climate finance is critical to mitigate and adapt to climate change impacts. However, finance alone is not enough. It is imperative that we combine increased finance with smarter technology, stronger partnerships, and deeper knowledge."

By leveraging these global resources, stakeholders can broaden their financial opportunities. Engaging with these funding sources can involve:

- Attending workshops

- Submitting proposals

- Forming partnerships with organizations that have successfully navigated the funding landscape

This proactive approach ensures that grid modernization funding strategies not only address current demands but also contribute to long-term sustainability and climate resilience.

Conclusion

The exploration of grid modernization funding strategies highlights the critical importance of innovative financing solutions in creating a resilient and sustainable energy infrastructure. By leveraging a diverse array of funding sources—such as federal grants, public-private partnerships, and green bonds—stakeholders can effectively navigate the complexities of project financing, thereby enhancing the viability of their initiatives.

Key insights underscore the role of technology in streamlining land acquisition processes, the necessity of collaboration between public and private sectors, and the potential of crowdfunding to engage communities in energy projects. As the demand for cleaner energy solutions escalates, understanding and utilizing these funding strategies becomes essential for organizations aiming to modernize their infrastructure and meet future energy needs.

As the energy infrastructure landscape evolves, it is imperative for stakeholders to proactively seek out funding opportunities and engage with innovative financing models. By doing so, they not only contribute to the advancement of grid modernization but also foster sustainable practices that benefit both communities and the environment. Embracing these strategies will be vital in shaping a resilient and efficient energy future.

Frequently Asked Questions

What services does Harbinger Land provide for land acquisition in grid modernization?

Harbinger Land offers comprehensive land acquisition solutions, including site and right-of-way acquisition, title research, GIS mapping, and data processing.

How does Harbinger Land utilize technology in their operations?

Harbinger Land leverages cutting-edge technology, such as AI-driven title research software and real-time data analytics, to enhance efficiency and improve decision-making processes in land acquisition.

Why are public-private partnerships (PPPs) important for grid modernization?

PPPs integrate public resources with private sector innovation, reducing costs and expediting timelines, which enhances the resilience and reliability of energy infrastructure.

What role do federal grants play in grid modernization?

Federal grants, such as those from the Grid Resilience and Innovation Partnerships (GRIP), provide substantial funding to support grid modernization initiatives, with a total of $10.5 billion allocated across multiple funding rounds.

What are the funding requirements for the GRIP program?

The GRIP program has two topic areas: Topic Area 1 requires a 100% cost share from applicants, while Topic Area 2 requires a 50% cost share.

What is the expected funding opportunity available for modernization initiatives this summer?

A $24 million funding opportunity is expected to be available this summer for modernization initiatives.

How can stakeholders improve their chances of securing federal funding for grid modernization?

Stakeholders should submit detailed proposals that clearly articulate anticipated enhancements in network reliability and resilience, and they must remain vigilant about funding opportunities and application deadlines.

What are some examples of initiatives funded under the GRIP program?

Initiatives funded under the GRIP program have included advanced weather monitoring systems and sectionalization improvements, which enhance grid resilience.

List of Sources

- Harbinger Land | Comprehensive Solutions for Land Acquisition in Grid Modernization

- Grid Modernization Market Size, Growth and Forecast 2032 (https://credenceresearch.com/report/grid-modernization-market)

- The US Transmission Line Market (https://market.us/report/the-us-transmission-line-market)

- Grid infrastructure investments drive increase in utility spending over last two decades - U.S. Energy Information Administration (EIA) (https://eia.gov/todayinenergy/detail.php?id=63724)

- Expanding and modernizing the power grid for a clean energy transition (https://www2.deloitte.com/us/en/insights/industry/power-and-utilities/grid-modernization-and-expansion-critical-for-clean-energy-future.html)

- Public-Private Partnerships: Collaborative Funding for Grid Modernization

- Funding the growth in the US power sector (https://www2.deloitte.com/us/en/insights/industry/power-and-utilities/funding-growth-in-us-power-sector.html)

- Quotes About Solar Power: 50 Picks to Light Up Your Life - Lumify Energy (https://lumifyenergy.com/blog/quotes-about-solar-power)

- New analysis finds that public-private financing for transmission infrastructure could save Californians $3 billion per year (https://catf.us/2024/12/analysis-public-private-financing-transmission-infrastructure-save-californians-3-billion)

- Electric Grid Upgrades for Renewables: How Much Is Being Invested? (Latest Data) (https://patentpc.com/blog/electric-grid-upgrades-for-renewables-how-much-is-being-invested-latest-data)

- 60 Quotes About the Future of Renewable Energy (https://deliberatedirections.com/renewable-energy-quotes)

- Federal Grants: Unlocking Financial Resources for Grid Modernization

- Guide to Federal Funding for Grid-Enhancing Technologies - WATT Coalition (https://watt-transmission.org/guide-to-federal-funding-for-grid-enhancing-technologies)

- 8 transmission projects selected for $2.2 billion in federal grants (https://renewableenergyworld.com/power-grid/transmission/8-transmission-projects-selected-for-2-2-billion-in-federal-grants)

- 10 Inspirational Quotes for NGO Fundraisers - fundsforNGOs (https://www2.fundsforngos.org/articles/10-inspirational-quotes-for-ngo-fundraisers)

- A final chance to access billions in DOE’s GRIP funding | Baker Tilly (https://bakertilly.com/insights/doe-grip-funding)

- $3.5 Million Available To Develop Grid Modernization Projects - NYSERDA (https://nyserda.ny.gov/About/Newsroom/2024-Announcements/2024_04_05-Governor-Kathy-Hochul-Announces-3-Million-Available-Grid-Modernization)

- State Incentives: Boosting Funding Opportunities for Grid Modernization

- A Rush of Federal Funding for Energizing the Grid (https://powereng.com/library/energizing-the-grid-a-rush-of-federal-funding)

- Grid Resilience Utility and Industry Grants (https://energy.gov/gdo/grid-resilience-utility-and-industry-grants)

- How Can We Improve Grid Modernization Incentives? → Question (https://energy.sustainability-directory.com/question/how-can-we-improve-grid-modernization-incentives)

- Where Grid Resilience Funding Has Been Allocated | American Public Power Association (https://publicpower.org/periodical/article/where-grid-resilience-funding-has-been-allocated)

- Utility Company Investments: Driving Financial Support for Grid Modernization

- AMI and grid hardening drive $36.4B investment plans for US grid modernization (https://renewableenergyworld.com/power-grid/smart-grids/ami-and-weatherproofing-guide-36-4bn-investment-plans-for-us-grid-modernisation)

- Industry Data (https://eei.org/en/resources-and-media/industry-data)

- US$36.4B of grid modernization planned by investor-owned utilities | Wood Mackenzie (https://woodmac.com/press-releases/$36.4b-of-grid-modernization-planned-by-investor-owned-utilities)

- Grid infrastructure investments drive increase in utility spending over last two decades - U.S. Energy Information Administration (EIA) (https://eia.gov/todayinenergy/detail.php?id=63724)

- Green Bonds: Innovative Financing for Sustainable Grid Modernization

- Green Bonds: The Financial Accelerator Of The Global Renewable Energy Revolution (https://forbes.com/councils/forbesbusinesscouncil/2024/08/20/green-bonds-the-financial-accelerator-of-the-global-renewable-energy-revolution)

- Topic: Green bonds in the U.S. (https://statista.com/topics/9223/green-bonds-market-in-the-us)

- Sustainable Bond Analysis 2024 (https://ice.com/insights/sustainable-bond-report-2024)

- April GB media digest with a special section on green bonds &… (https://climatebonds.net/news-events/blog/april-gb-media-digest-special-section-green-bonds-covid-19-crisis-euromoney-ft-chinese-reuters-politico-libération)

- 10 Years of Green Bonds: Creating the Blueprint for Sustainability Across Capital Markets (https://worldbank.org/en/news/immersive-story/2019/03/18/10-years-of-green-bonds-creating-the-blueprint-for-sustainability-across-capital-markets)

- Crowdfunding: Engaging Communities in Grid Modernization Funding

- Crowdfunding Market Overview and Industry Insights Report 2025 (https://thebusinessresearchcompany.com/report/crowdfunding-global-market-report)

- Crowdfunding Statistics: Market Size and Growth (https://fundera.com/resources/crowdfunding-statistics)

- Top 20 Giving and Fundraising Quotes From Our Fundraising Experts | Heller Fundraising Group (https://hellerfundraisinggroup.com/blog/top-20-giving-and-fundraising-quotes-from-our-fundraising-experts)

- 40+ Crucial Crowdfunding Stats In 2025 | SmallBizGenius (https://smallbizgenius.net/by-the-numbers/crowdfunding-stats)

- Institutional quality and success in U.S. equity crowdfunding (https://sciencedirect.com/science/article/pii/S004873332400163X)

- Technology Grants: Funding Innovations in Grid Modernization

- $2.2B in Resiliency Grants Awarded to Upgrade the US Electric Grid – DOE (https://blogs.duanemorris.com/esg/2024/08/06/2-2b-in-resiliency-grants-awarded-to-upgrade-the-us-electric-grid-doe)

- DOE Makes up to $3.9 Billion Available for Grid Projects | American Public Power Association (https://publicpower.org/periodical/article/doe-makes-39-billion-available-grid-projects)

- White House Sets $13B of Funding to Modernize Power Grid (https://meritalk.com/articles/white-house-sets-13b-of-funding-to-modernize-power-grid)

- US Invests $2.2B Into Grid Upgrades for Climate Resilience (https://sustainablebrands.com/read/us-22b-grid-upgrades-climate-resilience)

- Tax Credits: Enhancing Financial Viability for Grid Modernization Projects

- SOI tax stats - Clean energy tax credit statistics | Internal Revenue Service (https://irs.gov/statistics/soi-tax-stats-clean-energy-tax-credit-statistics)

- Renewable energy a strategic driver, enabled by tax credits | Grant Thornton (https://grantthornton.com/insights/articles/energy/2023/renewable-energy-a-strategic-driver-enabled-by-tax-credits)

- ACORE Report: The Risk Profile of Renewable Energy Tax Equity Investments (https://acore.org/resources/the-risk-profile-of-renewable-energy-tax-equity-investments)

- Renewable Energy Tax Credit Finance: Insights Into 2024 Tax Equity Financing Trends (https://novoco.com/periodicals/articles/renewable-energy-tax-credit-finance-insights-into-2024-tax-equity-financing-trends)

- International Funding Sources: Expanding Financial Horizons for Grid Modernization

- Global Landscape of Climate Finance 2023 - CPI (https://climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2023)

- 54107-001: Electricity Grid Modernization Project (https://adb.org/projects/54107-001/main)

- Development Banks Vow to Mobilize Collective Resources to Confront Climate Change (https://adb.org/news/development-banks-vow-mobilize-collective-resources-confront-climate-change)

- Global Landscape of Climate Finance 2024 - CPI (https://climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2024)

- Remarks by World Bank Group President Ajay Banga at the 2023 Annual Meetings Plenary (https://worldbank.org/en/news/speech/2023/10/13/remarks-by-world-bank-group-president-ajay-banga-at-the-2023-annual-meetings-plenary)