Overview

The article presents a compelling overview of large-scale energy arbitrage strategies designed to optimize investment opportunities within the energy sector. It underscores a range of approaches, including:

- The utilization of battery energy storage systems

- Adherence to regulatory compliance

- The application of AI-driven analytics

- The formation of strategic partnerships

These elements collectively enhance profitability and operational efficiency, empowering firms to adeptly navigate market dynamics and seize price discrepancies.

Introduction

The energy landscape is experiencing a seismic shift, with large-scale energy arbitrage strategies emerging as a pivotal approach for optimizing investments in this dynamic sector. Companies are striving to harness fluctuating energy prices to enhance profitability; thus, understanding the intricacies of these strategies is essential.

However, the challenge lies in navigating the complexities of regulatory compliance, technological advancements, and market volatility.

How can firms effectively implement these strategies to capitalize on current opportunities while ensuring long-term success in an ever-evolving energy market? This question underscores the need for a thorough examination of the landscape, as firms must not only adapt to immediate changes but also anticipate future developments.

Harbinger Land | Comprehensive Solutions for Land Services in Energy Arbitrage

Harbinger Land stands at the forefront of comprehensive land services, expertly tailored for power trading projects. With a robust suite of offerings that includes site and right-of-way acquisition, advanced title research, and GIS mapping, they address the critical need for optimizing land use in development initiatives. By leveraging highly integrated GIS modeling services, Harbinger Land facilitates efficient easements, saving clients both time and money. This significant enhancement in efficiency and accuracy streamlines the land acquisition process, allowing firms in the power sector to concentrate on maximizing their trading opportunities through large-scale energy arbitrage strategies while alleviating the challenges associated with land-related issues.

Moreover, Harbinger Land digitizes property data through effective document imaging solutions, empowering title agents to conduct title research and leasing in a cost-effective manner. As the demand for sustainable power escalates, the importance of effective land acquisition strategies becomes increasingly pronounced. These strategies ensure alignment with regulatory requirements and community needs, which are vital in today’s landscape. Successful case studies illustrate that integrating consulting expertise and stakeholder engagement not only mitigates risks but also fosters community support, ultimately leading to smoother project execution and enhanced investment outcomes.

Furthermore, with solar power projected to comprise nearly 60% of new utility-scale electricity-generating capacity in 2024 and a staggering $12 trillion investment forecasted in clean power and grid development by 2050, the significance of strategic land acquisition cannot be overstated. The time to act is now; partner with Harbinger Land to navigate the complexities of land acquisition and secure your project's success.

Battery Energy Storage Systems: Optimize Energy Use and Profit from Price Fluctuations

Battery Energy Storage Systems (BESS) play a crucial role in optimizing power utilization for large-scale energy arbitrage strategies. By strategically storing energy during low-cost periods and discharging it during peak demand, when prices surge, BESS enables utility companies to implement large-scale energy arbitrage strategies to effectively leverage market fluctuations. This strategy not only enhances profitability but also strengthens grid stability by enabling large-scale energy arbitrage strategies that balance supply and demand dynamics.

Recent advancements in BESS technology, such as improved efficiency and reduced costs, are significantly enhancing the financial viability of these systems. Notably, the projected decrease in BESS investment expenses to below $185 per kWh by 2030 will markedly increase their attractiveness for power trading.

Successful implementations of BESS have already demonstrated substantial financial benefits, with large-scale energy arbitrage strategies leading to 59% of U.S. utility-scale battery capacity utilized for price trading in 2021—a remarkable increase from previous years. However, it is crucial to assess the impact of battery degradation on profitability, as this factor can significantly influence overall returns from power trading.

As technology continues to evolve, the integration of advanced BESS solutions will be essential for maximizing profits in power trading.

Regulatory Compliance: Navigate Legal Frameworks for Effective Energy Arbitrage

Regulatory compliance is paramount for effective resource arbitrage, demanding a thorough understanding of the intricate legal frameworks that govern market operations. Energy firms must navigate a landscape shaped by federal and state regulations, encompassing environmental laws, zoning requirements, and energy trading rules. Compliance not only aids in avoiding legal complications but also enhances an organization's credibility, fostering trust among stakeholders. This strategic focus can lead to more effective large-scale energy arbitrage strategies, as organizations that prioritize compliance are better equipped to adapt to regulatory changes and seize market opportunities.

By integrating compliance into their operational framework, utility companies can streamline processes, mitigate risks, and ultimately optimize investment strategies. Harbinger Land plays a pivotal role in this process by utilizing advanced GIS modeling services for site and right-of-way acquisitions. This not only facilitates efficient easements but also helps mitigate compliance risks and enhances operational efficiency. Such expertise in land rights acquisition is essential for firms aiming to refine their operations and navigate the complexities of regulatory compliance.

AI-Driven Analytics: Enhance Decision-Making in Energy Arbitrage Strategies

AI-powered analytics are revolutionizing resource trading by delivering instantaneous information and predictive insights that empower companies to navigate complex economic dynamics. These advanced technologies analyze extensive historical and current data, facilitating the identification of trends and forecasting price fluctuations with remarkable accuracy. By leveraging AI, utility companies can enhance their trading strategies through large-scale energy arbitrage strategies, improving their arbitrage capabilities while effectively mitigating risks. This strategic application of AI not only optimizes decision-making but also significantly boosts profitability.

Consider this: AI workloads are projected to account for 27% of the global data center market by 2027. Consequently, the demand for power in data centers is expected to rise from 55 gigawatts to 84 gigawatts, underscoring AI's critical role in managing resource utilization efficiently. Moreover, Goldman Sachs predicts a staggering 165% increase in data center power demand by 2030, making the integration of AI in trading essential for maintaining competitive advantage and ensuring sustainable growth in an increasingly data-driven economy.

As Jensen Huang, CEO of Nvidia, aptly puts it, 'AI will be the most transformative technology of the 21st century,' emphasizing its importance across various industries. However, while AI presents significant opportunities, it is crucial to remain vigilant regarding potential risks, such as concerns about 'artificial idiocy,' to ensure responsible application in the power sector.

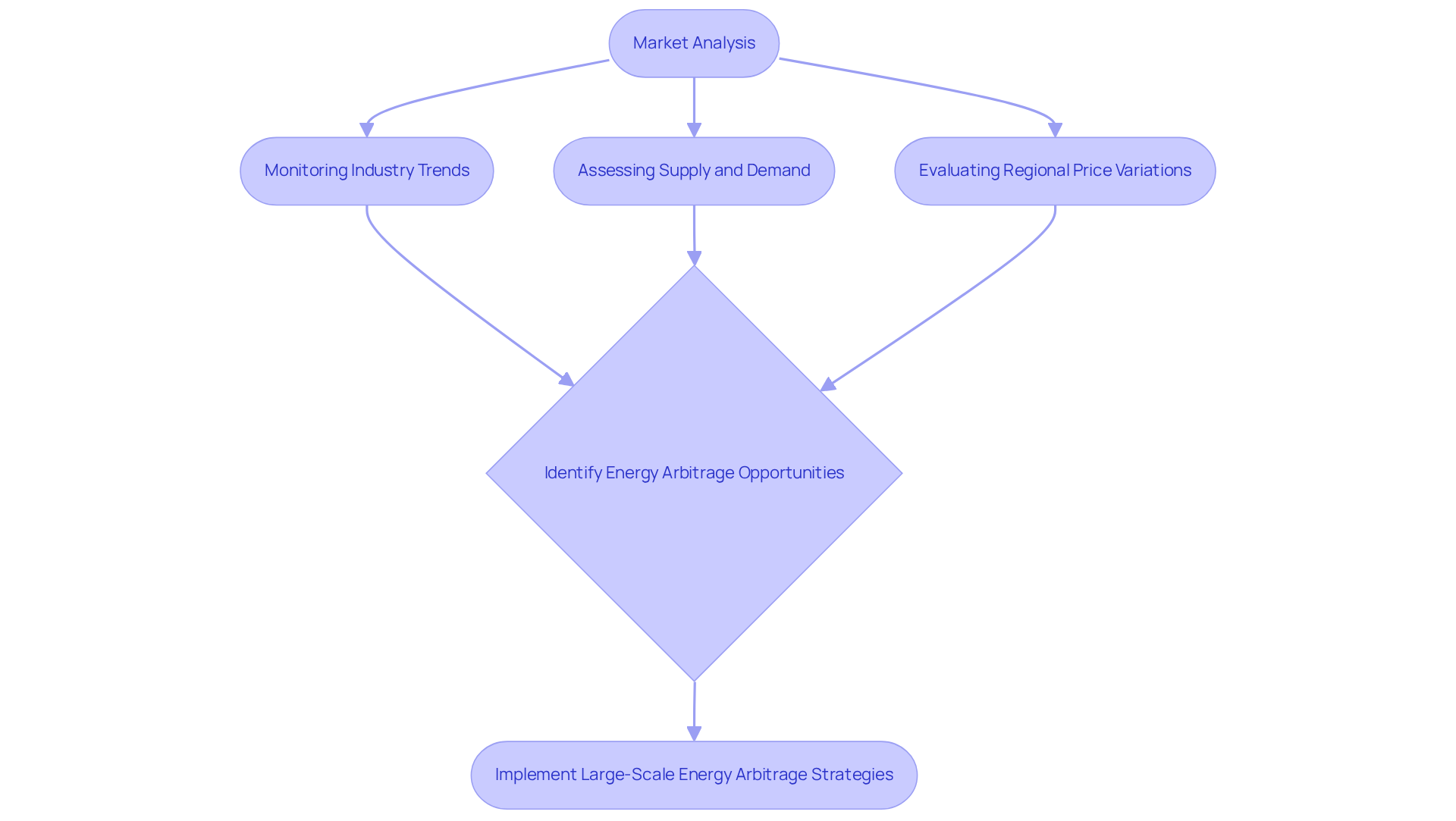

Market Analysis: Identify and Capitalize on Energy Price Discrepancies

Conducting a comprehensive industry analysis is vital for identifying and capitalizing on large-scale energy arbitrage strategies that exploit price discrepancies in resources. By closely monitoring industry trends, shifts in supply and demand, and regional price variations, utility providers can utilize large-scale energy arbitrage strategies to identify optimal moments for purchasing and selling power. This strategic approach incorporates large-scale energy arbitrage strategies, which not only maximizes profits but also bolsters competitiveness within the power sector, enabling companies to swiftly adapt to evolving conditions.

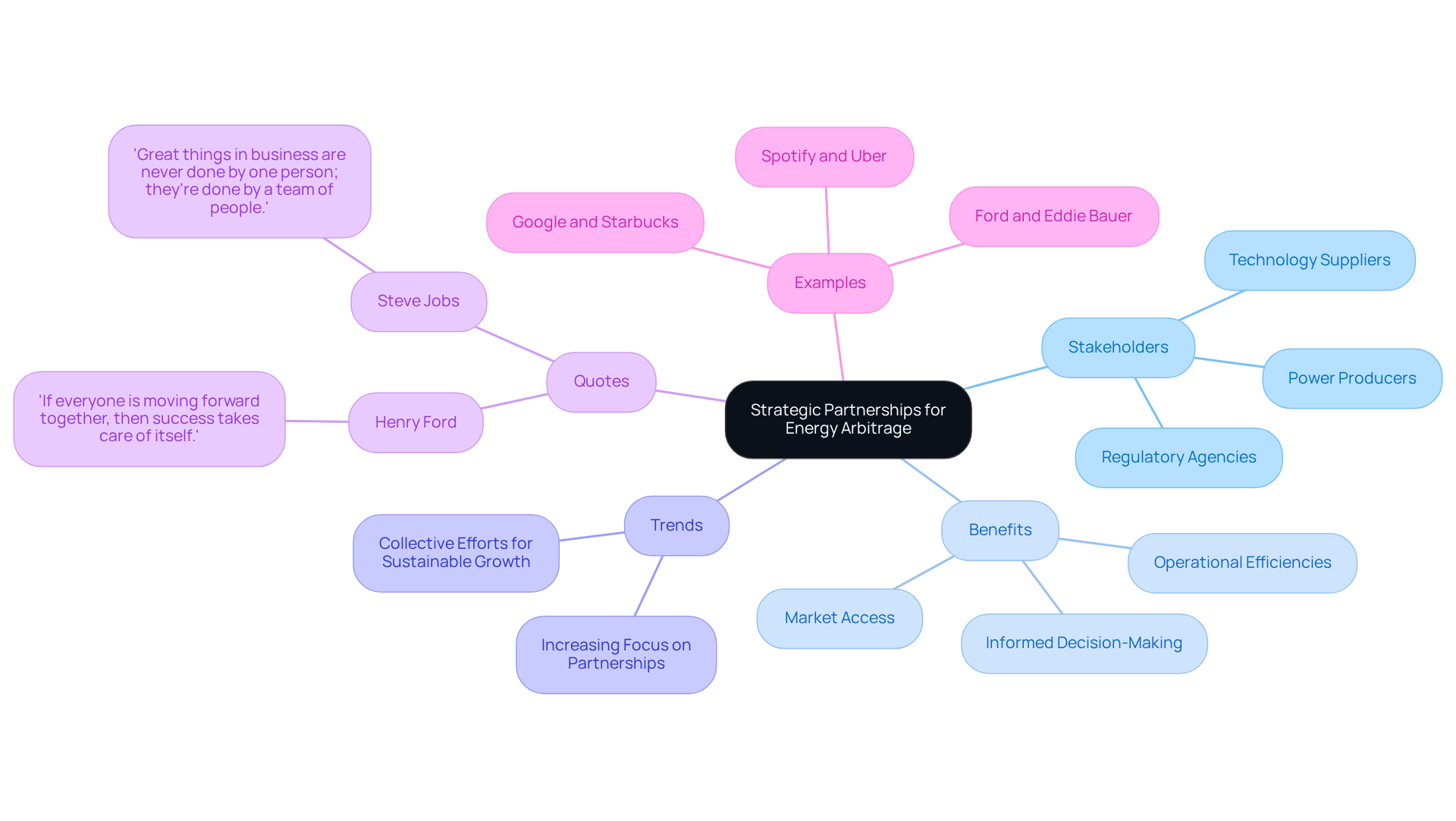

Strategic Partnerships: Collaborate for Enhanced Energy Arbitrage Opportunities

Strategic partnerships are essential for maximizing large-scale energy arbitrage strategies. Collaborating with diverse stakeholders—including power producers, technology suppliers, and regulatory agencies—enables companies to leverage shared resources and expertise. This joint strategy fosters innovative solutions and enhances operational efficiencies, empowering companies to navigate complex resource sectors more effectively.

Recent trends highlight an increasing focus on partnerships within the power industry, as stakeholders acknowledge the value of collective efforts in broadening market access and promoting sustainable growth. Such collaborations not only strengthen competitive positioning but also facilitate the exchange of insights, leading to more informed decision-making in trading.

As Henry Ford aptly stated, 'If everyone is moving forward together, then success takes care of itself.' This perspective underscores the importance of collaboration in achieving success through large-scale energy arbitrage strategies.

Furthermore, the partnership between Google and Starbucks exemplifies how strategic alliances can enhance access and stimulate growth. To capitalize on these insights, power firms must actively pursue partnerships that align with their strategic objectives, cultivating a culture of collaboration that can drive innovative market entries and improve operational outcomes.

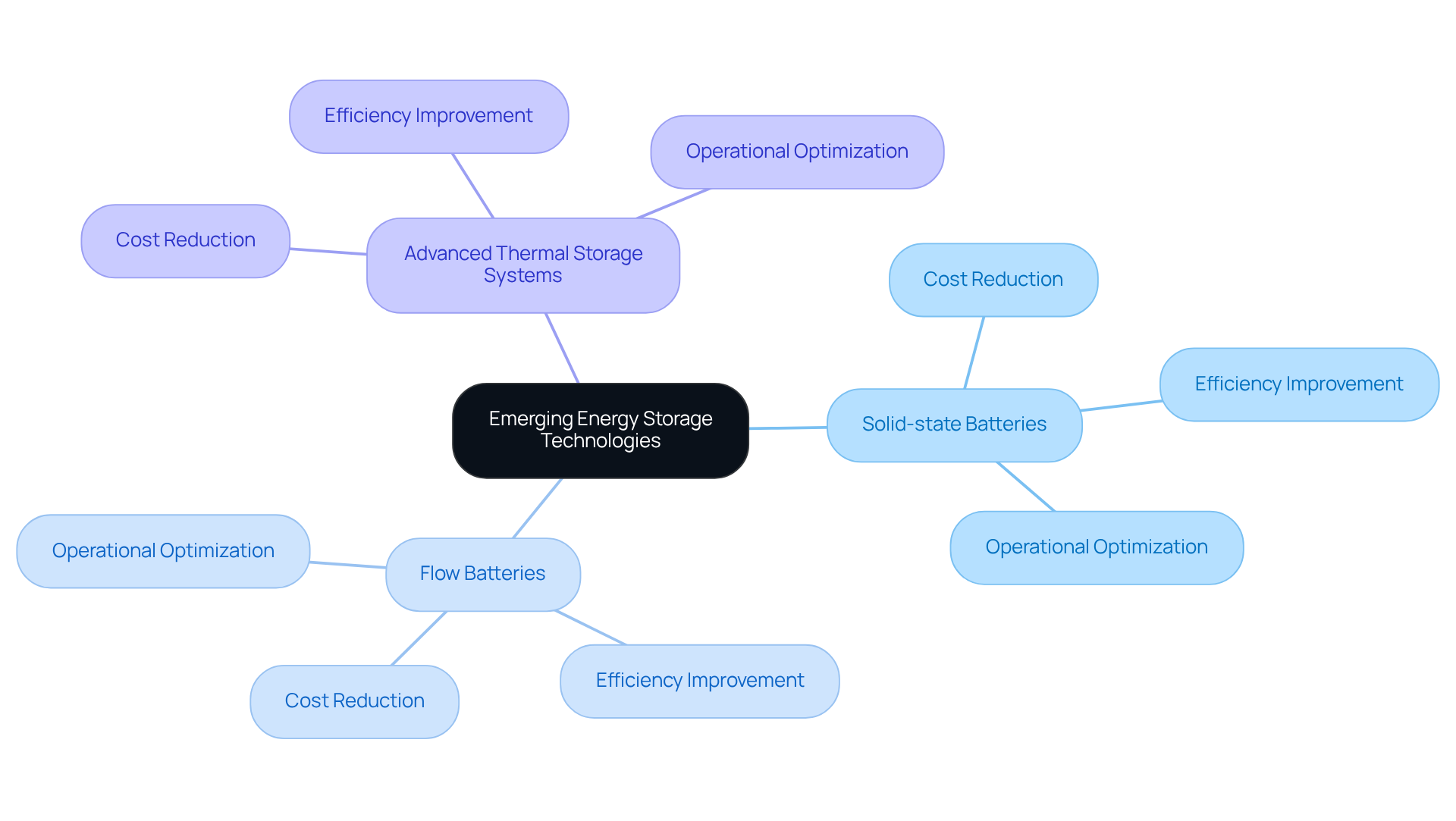

Emerging Energy Storage Technologies: Stay Ahead in Arbitrage Strategies

Staying abreast of new power storage innovations is essential for gaining a competitive edge in resource trading. Innovations such as:

- Solid-state batteries

- Flow batteries

- Advanced thermal storage systems

are revolutionizing the power landscape. These technologies not only enhance storage capabilities but also significantly reduce costs and improve the efficiency of large-scale energy arbitrage strategies. For instance, solid-state batteries, noted for their superior power density and safety, are being effectively integrated into various power projects, enabling companies to optimize their operations. As the sector evolves, embracing these advancements will be vital for boosting profitability and securing sustainable power solutions.

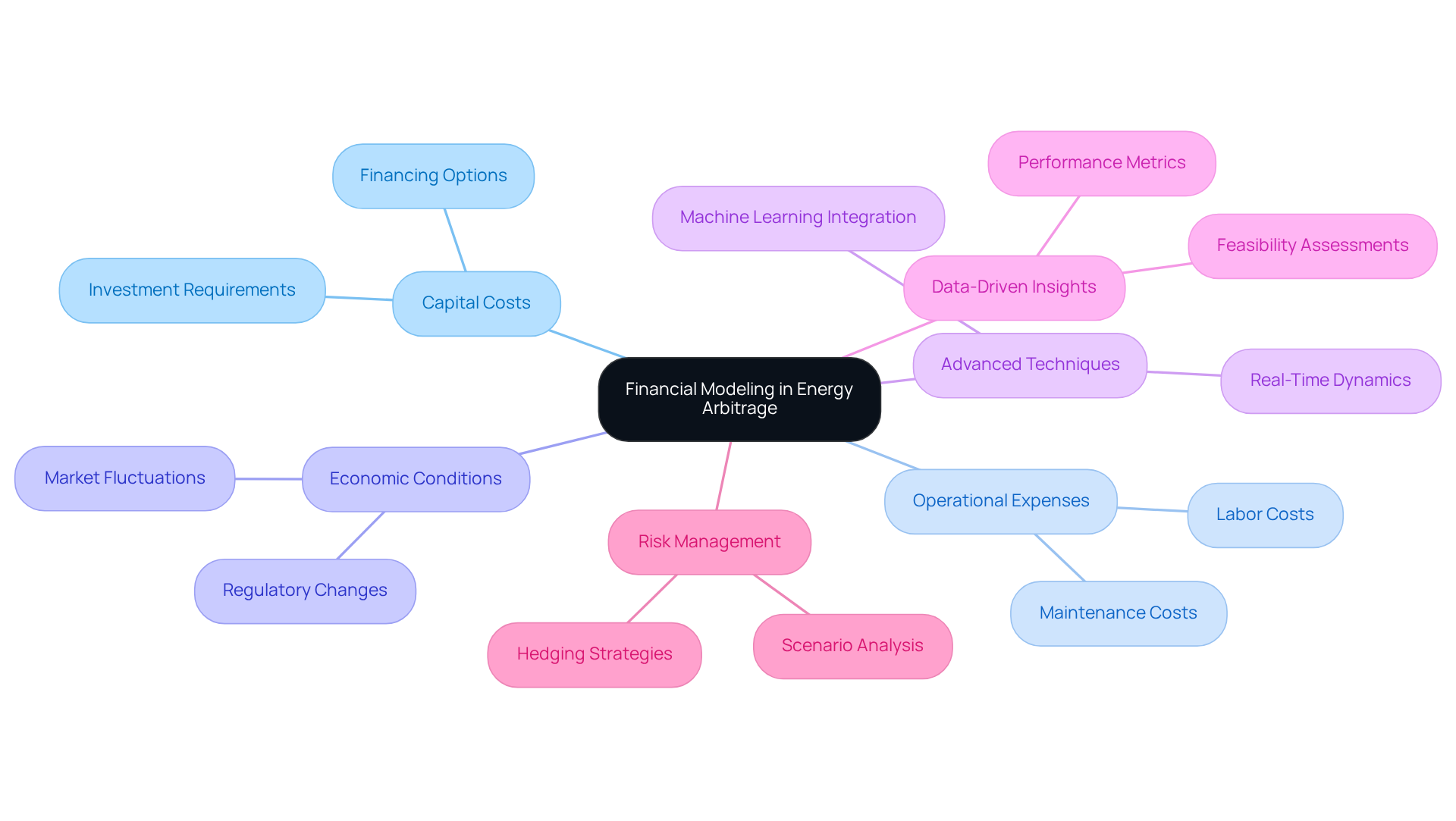

Financial Modeling: Assess Potential Returns in Energy Arbitrage Investments

Financial modeling serves as a vital tool for evaluating potential returns on power trading investments. By developing comprehensive financial models that encompass capital costs, operational expenses, and fluctuating economic conditions, companies can effectively assess the viability and profitability of their large-scale energy arbitrage strategies. This analytical framework not only promotes informed decision-making but also provides stakeholders with a clearer understanding of the associated risks and rewards.

As we look to 2025, the evolution of power sectors will necessitate the integration of advanced financial modeling techniques to enhance investment strategies. Notably, 85% of renewable power initiatives rely on sophisticated financial models for feasibility assessments, underscoring the growing reliance on data-driven insights within the industry.

Furthermore, Warren Buffett aptly stated, "Activity is the enemy of investment returns," highlighting the critical role of strategic modeling in navigating financial complexities. Experts emphasize that successful financial evaluations in the trading sector hinge on the ability to adapt models to reflect real-time dynamics, empowering investors to navigate the intricacies of trading with confidence.

A relevant case study reveals that 61% of airlines employ financial models that link fuel hedging strategies to macroeconomic indicators, illustrating how financial modeling can effectively manage risks in volatile environments.

Risk Management: Mitigate Losses in Energy Arbitrage Investments

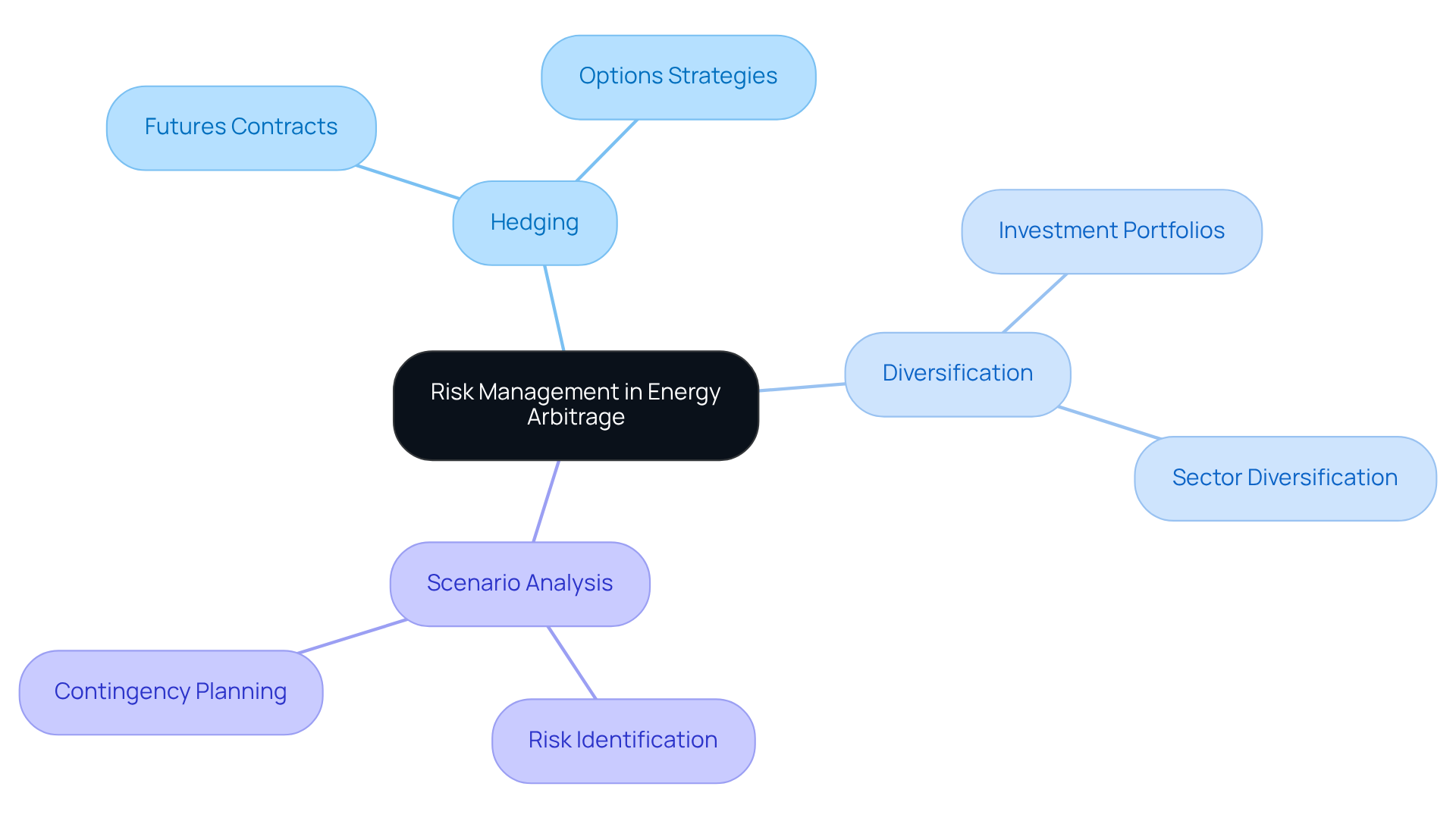

Efficient risk management is paramount in arbitrage, particularly given the inherent price volatility that can lead to substantial financial losses. Companies must implement comprehensive risk management strategies that encompass:

- Hedging

- Diversification

- Detailed scenario analysis

By proactively identifying potential risks and formulating contingency plans, firms can safeguard their investments and enhance their resilience against market fluctuations.

For example, utilizing hedging techniques such as futures contracts can effectively lock in prices and mitigate the effects of unfavorable price movements. Additionally, diversifying investment portfolios across various power sectors can significantly reduce exposure to specific financial risks.

Expert insights suggest that a well-structured risk management system not only protects against losses but also equips companies for sustained success in the dynamic landscape of resource trading. This approach not only addresses immediate challenges but also prepares organizations for future uncertainties, fostering long-term growth and stability.

Continuous Evaluation: Adapt Strategies for Long-Term Success in Energy Arbitrage

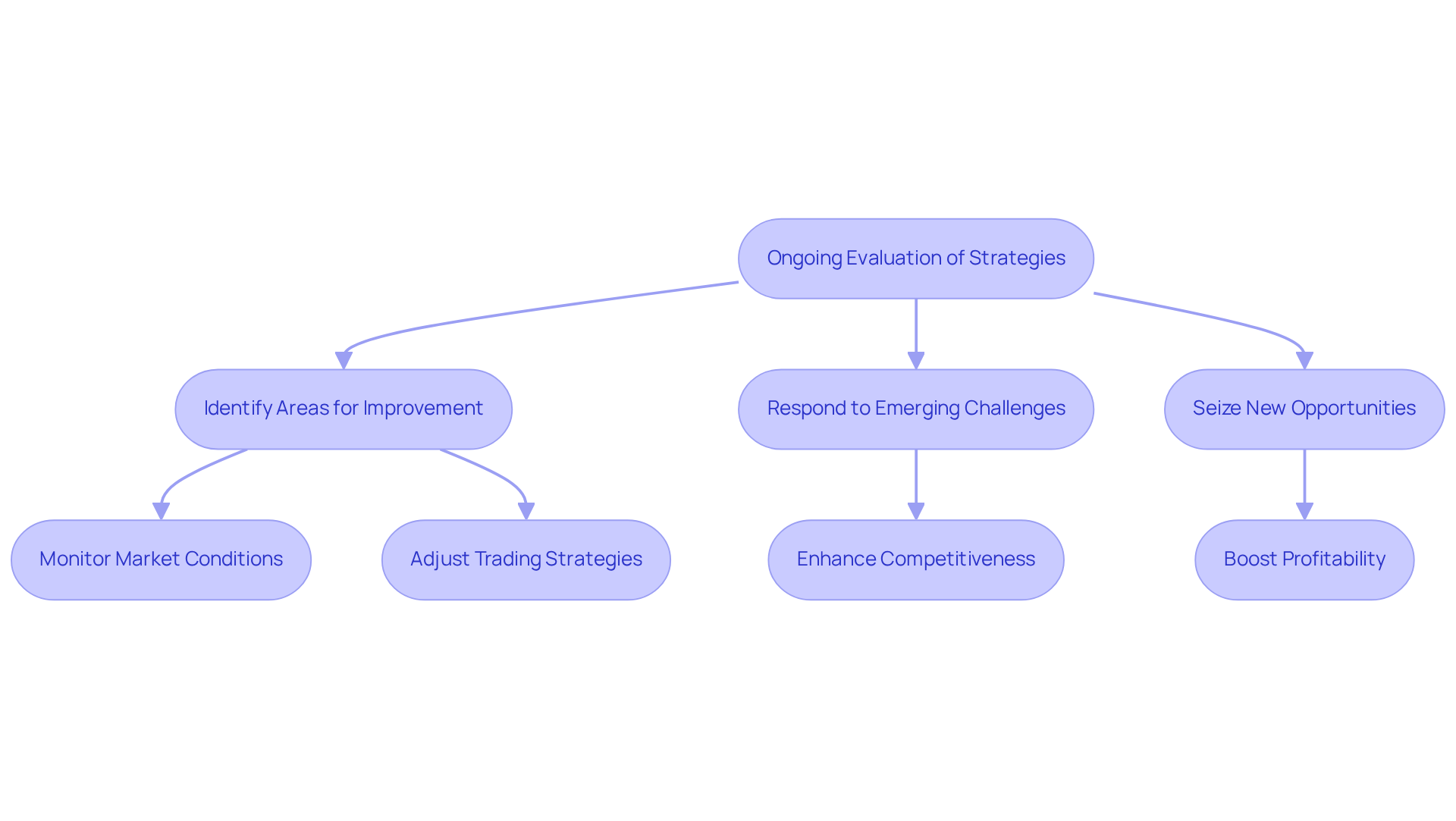

In the rapidly evolving energy sector, the continuous assessment of large-scale energy arbitrage strategies is crucial for achieving enduring success. Regulatory shifts, technological advancements, and dynamic market conditions demand a proactive approach. For example, the trading cost assumed for arbitrage trading stands at €0.116 per MWh, underscoring the financial ramifications of necessary strategy adaptations.

By regularly evaluating their strategies and performance, companies can identify areas for improvement, respond to emerging challenges, and seize new opportunities. Frances Beinecke noted that sustainable energy will facilitate the end of reliance on fossil fuels, emphasizing the importance of recalibrating approaches in this shifting landscape.

This ongoing evaluation process not only enhances competitiveness but also boosts profitability in the ever-changing realm of large-scale energy arbitrage strategies. A case study examining a trading agent's performance on the Dutch DAM demonstrates how precise forecasting can yield a profit of €678.07, further validating the significance of continuous assessment.

As industry leaders assert, adapting to market fluctuations is not merely advantageous; it is imperative for thriving in an environment where change is the only constant.

Conclusion

The exploration of large-scale energy arbitrage strategies reveals a multifaceted approach essential for optimizing investments in the energy sector. By integrating various techniques—from advanced battery energy storage systems to regulatory compliance and AI-driven analytics—companies can significantly enhance their trading capabilities and maximize profitability. This emphasis on strategic partnerships and continuous evaluation underscores the importance of collaboration and adaptability in navigating the complexities of the energy market.

Key insights from the article highlight the vital role of:

- Efficient land acquisition

- Innovative storage technologies

- Robust financial modeling

in developing successful energy arbitrage strategies. Moreover, the necessity of effective risk management and proactive compliance with legal frameworks cannot be overstated, as these elements are crucial for safeguarding investments and ensuring sustainable growth. As the energy landscape evolves, staying informed about emerging technologies and market trends will be paramount for maintaining a competitive edge.

Ultimately, the call to action is clear: stakeholders in the energy sector must embrace these strategies and innovations to thrive in a rapidly changing environment. By prioritizing collaboration, leveraging technology, and continuously assessing their approaches, companies can not only secure their investments but also contribute to a more sustainable and prosperous energy future. The time to act is now; the future of energy arbitrage awaits those ready to seize the opportunities ahead.

Frequently Asked Questions

What services does Harbinger Land provide for energy arbitrage projects?

Harbinger Land offers comprehensive land services, including site and right-of-way acquisition, advanced title research, and GIS mapping, specifically tailored for power trading projects.

How does Harbinger Land enhance the land acquisition process?

By leveraging highly integrated GIS modeling services, Harbinger Land facilitates efficient easements, streamlining the land acquisition process and saving clients time and money.

Why is effective land acquisition important in the context of sustainable power?

Effective land acquisition strategies ensure alignment with regulatory requirements and community needs, which are crucial for successful project execution, especially as the demand for sustainable power increases.

What role do Battery Energy Storage Systems (BESS) play in energy arbitrage?

BESS optimizes power utilization by storing energy during low-cost periods and discharging it during peak demand, enabling utility companies to leverage market fluctuations for profitability.

What advancements in BESS technology are influencing its financial viability?

Recent advancements include improved efficiency and reduced costs, with projections indicating that BESS investment expenses will fall below $185 per kWh by 2030, making them more attractive for power trading.

How has the utilization of BESS for price trading changed recently?

In 2021, 59% of U.S. utility-scale battery capacity was utilized for price trading, marking a significant increase compared to previous years.

What is the significance of regulatory compliance in energy arbitrage?

Regulatory compliance is essential for navigating legal frameworks, avoiding complications, and enhancing credibility, which helps organizations adapt to regulatory changes and seize market opportunities.

How can utility companies integrate compliance into their operations?

By incorporating compliance into their operational framework, utility companies can streamline processes, mitigate risks, and optimize investment strategies, aided by services like those provided by Harbinger Land.

List of Sources

- Harbinger Land | Comprehensive Solutions for Land Services in Energy Arbitrage

- Optimizing Energy Projects: Land Acquisition and Consulting for Sustainable Development (https://blog.harbingerland.com/optimizing-energy-projects-land-acquisition-and-consulting-for-sustainable-development)

- 60 Quotes About the Future of Renewable Energy (https://deliberatedirections.com/renewable-energy-quotes)

- 100+ inspirational and powerful quotes on Sustainability (clustered by topic) - Twenty Now (https://twentynow.com/sustainability-initiatives/sustainability/100-inspirational-and-powerful-quotes-on-sustainability-clustered-by-topic)

- (PDF) The expected revenue of energy storage from energy arbitrage service based on the statistics of realistic market data (https://researchgate.net/publication/323715132_The_expected_revenue_of_energy_storage_from_energy_arbitrage_service_based_on_the_statistics_of_realistic_market_data)

- Battery Energy Storage Systems: Optimize Energy Use and Profit from Price Fluctuations

- Battery Energy Storage System (BESS) | ENGIE Global Energy Management & Sales (https://gems.engie.com/energy-encyclopedia/battery-energy-storage-system-bess)

- Arbitrage is the top use case for batteries by U.S. utilities, report finds - Energy Storage (https://ess-news.com/2024/06/28/arbitrage-is-the-top-use-case-for-batteries-by-u-s-utilities-report-finds)

- Battery Energy Storage - Key Points (https://linkedin.com/pulse/battery-energy-storage-key-points-irfan-akhtar-pe-be-me)

- Profitability of energy arbitrage net profit for grid-scale battery energy storage considering dynamic efficiency and degradation using a linear, mixed-integer linear, and mixed-integer non-linear optimization approach (https://sciencedirect.com/science/article/pii/S2352152X24019662)

- Grid-Scale Battery Energy Storage for Arbitrage Purposes: A Colombian Case (https://mdpi.com/2313-0105/7/3/59)

- Regulatory Compliance: Navigate Legal Frameworks for Effective Energy Arbitrage

- (PDF) Regulatory and Legal Challenges in the Energy Sector: How Corporate Governance Affects Compliance and Risk Management (https://researchgate.net/publication/388659655_Regulatory_and_Legal_Challenges_in_the_Energy_Sector_How_Corporate_Governance_Affects_Compliance_and_Risk_Management)

- Top 4 Compliance Challenges in the Energy and Utilities Sector in 2024 - RiskWatch (https://riskwatch.com/top-4-compliance-challenges-in-the-energy-and-utilities-sector-in-2024)

- Major Compliance Challenges in U.S. Energy & Utilities — Solutions for 2025 and Beyond (https://v-comply.com/blog/the-major-challenges-of-energy-and-utilities-compliance-in-the-u-s-and-how-to-solve-them)

- 110 Compliance Statistics to Know for 2025 (https://secureframe.com/blog/compliance-statistics)

- Ten policy management and compliance statistics you need to know for 2025 - Xoralia (https://xoralia.com/ten-policy-management-and-compliance-statistics-you-need-to-know-for-2023)

- AI-Driven Analytics: Enhance Decision-Making in Energy Arbitrage Strategies

- 35 AI Quotes to Inspire You (https://salesforce.com/artificial-intelligence/ai-quotes)

- 21 Quotes on the Promise and Peril of Artificial Intelligence (https://inc.com/peter-economy/21-quotes-on-the-promise-and-the-peril-of-artificial-intelligence/91191432)

- AI to drive 165% increase in data center power demand by 2030 (https://goldmansachs.com/insights/articles/ai-to-drive-165-increase-in-data-center-power-demand-by-2030)

- Market Analysis: Identify and Capitalize on Energy Price Discrepancies

- Infographic: The Rise of U.S. Energy Costs (https://statista.com/chart/26882/us-energy-costs-natural-gas-gasoline-electricity)

- 6 Must Read Quotes About Pricing Strategy | SBI Growth (https://sbigrowth.com/insights/pricing-strategy-quotes)

- Energy Markets In Focus Q1 2025 - IMA Financial Group (https://imacorp.com/insights/energy-markets-in-focus-q1-2025)

- 10 of the Best Market Research Quotes (https://driveresearch.com/market-research-company-blog/10-of-the-best-market-research-quotes)

- The Latest Market Data Show that the Potential Savings of New Electric Transmission was Higher Last Year than at Any Point in the Last Decade | Energy Markets & Policy (https://emp.lbl.gov/news/latest-market-data-show-potential)

- Strategic Partnerships: Collaborate for Enhanced Energy Arbitrage Opportunities

- Benefits of Strategic Partnerships (https://business.com/articles/connor-blakley-strategic-partnerships)

- 33 inspirational business partnership quotes (2025) (https://enterpriseleague.com/blog/business-partnership-quotes)

- The role of renewable energy alliances in enhancing corporate innovation: Evidence from China (https://sciencedirect.com/science/article/abs/pii/S0960148123013307)

- The Growing Trend of Strategic Partnerships as a Key Growth Strategy in the Global Real Estate Sector (https://linkedin.com/pulse/growing-trend-strategic-partnerships-key-growth-strategy-jena-n1kif)

- The value of strategic partnerships in driving sustainable success and transformation (https://kpmg.com/sg/en/home/insights/2024/07/the-value-of-strategic-partnerships-in-driving-sustainable-success-and-transformation.html)

- Emerging Energy Storage Technologies: Stay Ahead in Arbitrage Strategies

- Empowering the Future: The Most Inspirational Quotes About Battery Energy Storage (https://eszoneo.com/info-detail/empowering-the-future-the-most-inspirational-quotes-about-battery-energy-storage)

- Economics of electric energy storage for energy arbitrage and regulation in New York (https://sciencedirect.com/science/article/abs/pii/S0301421506003545)

- U.S. Battery Storage Hits a New Record Growth in 2024 (https://carboncredits.com/u-s-battery-storage-hits-a-new-record-growth-in-2024)

- Topic: Energy storage worldwide (https://statista.com/topics/4632/energy-storage)

- Clean Energy Storage Facts | ACP (https://cleanpower.org/facts/clean-energy-storage)

- Financial Modeling: Assess Potential Returns in Energy Arbitrage Investments

- 100 Famous Investing Quotes [2025] (https://digitaldefynd.com/IQ/investing-quotes)

- The Top 25 Investing Quotes of All Time (https://investopedia.com/financial-edge/0511/the-top-17-investing-quotes-of-all-time.aspx)

- 150 Quotes on Saving, Investing, and Financial Wellness (https://deliberatedirections.com/quotes-financial-wellness)

- 100 Surprising Financial Modeling Facts & Statistics [2025] (https://digitaldefynd.com/IQ/financial-modeling-statistics)

- Risk Management: Mitigate Losses in Energy Arbitrage Investments

- Statistical arbitrage trading across electricity markets using advantage actor–critic methods (https://sciencedirect.com/science/article/pii/S2352467723000310)

- Quotes on Risk Management • Novel Investor (https://novelinvestor.com/quote-category/risk-management)

- TOP 25 RISK MANAGEMENT QUOTES (of 128) | A-Z Quotes (https://azquotes.com/quotes/topics/risk-management.html)

- AES Corporation: A Golden Opportunity in Renewable Energy M&A Arbitrage (https://ainvest.com/news/aes-corporation-golden-opportunity-renewable-energy-arbitrage-2507)

- Continuous Evaluation: Adapt Strategies for Long-Term Success in Energy Arbitrage

- 60 Quotes About the Future of Renewable Energy (https://deliberatedirections.com/renewable-energy-quotes)

- 9 Quotes on Climate Change and Energy, and Why They Matter (https://aspeninstitute.org/blog-posts/nine-quotes-on-climate-change-and-energy-and-why-they-matter)

- 20 Quotes To Get You Inspired For a Renewable Future - Solstice (https://solstice.us/solstice-blog/20-quotes-for-a-renewable-future)

- Statistical arbitrage trading across electricity markets using advantage actor–critic methods (https://sciencedirect.com/science/article/pii/S2352467723000310)

- About the statistical review (https://energyinst.org/statistical-review/about)