Overview

The article presents a comparative analysis of battery storage incentive programs in California, New York, and Minnesota, emphasizing their distinct structures and objectives.

- California's SGIP stands out as the most comprehensive initiative, offering substantial funding and support for a variety of technologies.

- In contrast, New York prioritizes market acceleration through performance-based rewards, demonstrating a dynamic approach to fostering innovation.

- Meanwhile, Minnesota's focus on solar-integrated systems illustrates a targeted strategy aimed at enhancing battery storage solutions.

This examination highlights the diverse methodologies employed across these states to promote effective battery storage solutions.

Introduction

As the world increasingly shifts towards sustainable energy solutions, the role of battery storage has emerged as a pivotal component in this transition. States like California, New York, and Minnesota are leading the charge with innovative incentive programs designed to promote the adoption of energy storage technologies. Each program reflects unique strategies tailored to local energy goals. California's substantial funding and comprehensive support stand out, while New York's performance-driven approach and Minnesota's focus on solar integration further illustrate the diverse methods being employed.

However, while these initiatives promise significant benefits, they also present challenges that could affect their overall impact. Understanding the nuances of these programs is essential for stakeholders aiming to navigate the evolving landscape of energy storage incentives. What complexities lie within these incentives, and how can stakeholders effectively address them? As we delve deeper into this topic, we will explore the intricate balance of opportunity and challenge that defines the current state of energy storage initiatives.

Overview of Battery Storage Incentive Programs in California, New York, and Minnesota

California's battery storage incentive programs are primarily supported by the Self-Generation Incentive Initiative (SGIP), which has allocated over $450 million to assist power retention projects, particularly benefiting disadvantaged communities. This program, which is part of the battery storage incentive programs, offers substantial refunds for both residential and commercial installations, underscoring California's commitment to advancing power conservation technologies.

In New York, the Power Retention Initiative, through battery storage incentive programs and the Market Acceleration Bridge Incentive Program, provides upfront rebates based on system capacity, aiming to enhance the deployment of power retention systems. The state has set an ambitious target of achieving 1,500 MW of power reserves by 2025, with funding initiatives expected to significantly accelerate project implementation.

As noted in the 2024 Energy Storage Order Overview, modifying trade and tax policies may elevate the importance of supportive state laws and policies for power reserves, rendering these initiatives even more critical for stakeholders.

Concurrently, Minnesota's battery storage incentive programs focus on systems integrated with solar power, providing rebates for installations up to 50 kWh. Each state's battery storage incentive programs are tailored to its specific power objectives and regulatory landscape, reflecting varying levels of support for battery technologies.

The New York State Energy and Research Development Authority's plan to allocate $350 million for battery storage incentive programs is anticipated to substantially expedite the adoption of power retention solutions, supporting the state's long-term goal of 3,000 MW by the end of the next decade.

By 2025, these battery storage incentive programs will play a pivotal role in shaping the future of power storage across these states, with New York's funding statistics demonstrating a strong commitment to meeting its objectives.

As Alicia Legland, an associate at Hodgson Russ, states, "This client alert is a type of attorney promotion," emphasizing the legal implications of these incentive programs for stakeholders in the energy sector.

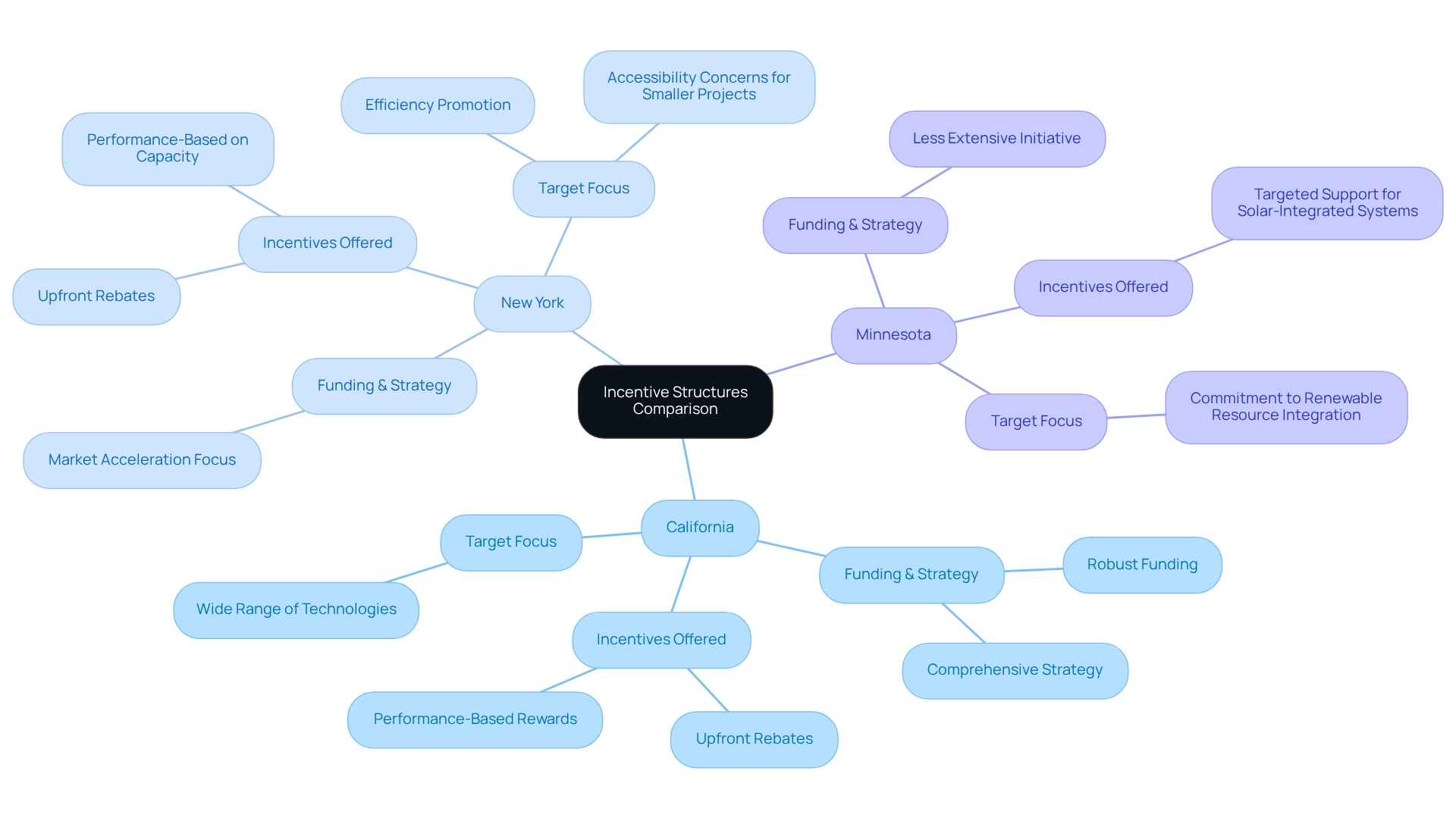

Comparative Analysis of Incentive Structures: California vs. New York vs. Minnesota

California's SGIP stands out due to its robust funding and comprehensive strategy, including battery storage incentive programs that offer both upfront rebates and performance-based rewards. This system is designed to support a wide range of technologies, making it highly adaptable. In contrast, New York's battery storage incentive programs are primarily aimed at market acceleration, offering upfront rebates that depend on system performance and capacity. While this method promotes efficiency, it may restrict accessibility for smaller projects. Minnesota's initiative, though less extensive, offers battery storage incentive programs that provide targeted support for solar-integrated battery systems, showcasing its commitment to renewable resource integration.

In summary:

- California's program is the most comprehensive.

- New York's is strategically focused.

- Minnesota's approach, while niche, proves effective for specific applications.

Eligibility Criteria and Application Processes for Battery Storage Incentives

In California, the Self-Generation Incentive Program (SGIP) is part of the battery storage incentive programs that mandate applicants to install energy storage systems meeting stringent performance criteria. The application process initiates with a reservation request, followed by installation and confirmation steps. Notably, SGIP funding operates on a first-come, first-served basis, creating urgency among potential participants to apply early, as funding levels decrease over time. This urgency has proven effective, driving businesses to maximize their financial benefits by securing available funding promptly. Furthermore, customers qualifying for the Equity Resilience incentive category receive rebates of $1,000 per kWh through battery storage incentive programs, which further incentivize participation.

New York's Energy Storage Program mirrors this approach, requiring applicants to adhere to specific performance standards while offering a streamlined application process designed for efficiency. The program's application requirements are clearly outlined, and resources such as the Battery Energy Storage System Guidebook provided by NYSERDA assist applicants in navigating the planning and inspection phases. Governor Kathy Hochul emphasized the significance of safety in this context, mentioning that the Inter-Agency Fire Safety Working Group was assembled to tackle issues arising from incidents at battery storage systems.

In Minnesota, eligibility criteria specify that storage systems must be combined with solar installations and must be newly installed after a designated date. This requirement reflects the state's commitment to integrating renewable energy sources. While each state's process differs in complexity, California's detailed requirements stand out due to its larger scale and funding availability. Thus, it is crucial for applicants to thoroughly understand the nuances of each initiative, particularly battery storage incentive programs, to ensure compliance and maximize incentives. The urgency created by the first-come, first-served funding model in California has been highlighted in case studies, demonstrating the importance of timely applications to secure funding before it diminishes. Overall, understanding the support available through resources like the NYSERDA guidebook is essential for applicants navigating these processes.

Benefits and Challenges of Battery Storage Incentive Programs

California's Self-Generation Incentive Program (SGIP) stands out due to its substantial financial support and diverse range of eligible technologies, creating a robust environment for battery implementation. Looking ahead to 2025, this initiative is expected to continue driving growth, particularly as homeowners increasingly seek power independence in light of rising electricity costs and grid reliability concerns. The SGIP's focus on resilience is particularly noteworthy, as it addresses critical threats such as wildfires and public safety power shutoffs—issues that are all too familiar in California. However, the program is not without challenges; the application process can be intricate, and delays in funding distribution may hinder timely project execution.

In contrast, New York's power reserve initiative seeks to stimulate market expansion through a defined reward framework. While this approach has its merits, reliance on performance-based rewards may pose challenges for smaller projects that require upfront capital. As the state pushes for ambitious power reserve objectives, these financial hurdles could limit participation from a broader range of stakeholders, ultimately affecting the program's overall efficiency.

Minnesota adopts a more targeted strategy, effectively supporting solar integration via its power reserve initiatives. Nonetheless, the specific eligibility criteria of battery storage incentive programs may restrict wider acceptance, potentially leaving some initiatives without the necessary support. Overall, while each state's initiative presents unique advantages—California's financial incentives and emphasis on resilience, New York's market development strategies with performance-based rewards, and Minnesota's focused support—they also encounter significant challenges that could impact their effectiveness in promoting battery solutions. As discussions evolve around power security, reliability, and independence, understanding these dynamics is crucial for stakeholders navigating the shifting landscape of storage incentives. The increasing demand for energy independence among homeowners highlights the significance of these programs; the conversation has transcended mere energy savings to encompass security, reliability, and autonomy.

Conclusion

The diverse battery storage incentive programs in California, New York, and Minnesota underscore the significant strides being made towards a sustainable energy future. California's Self-Generation Incentive Program (SGIP) stands out due to its extensive funding and comprehensive support for a wide array of technologies, particularly benefiting vulnerable communities. In contrast, New York's Energy Storage Program accelerates the market through performance-based incentives, while Minnesota's initiatives emphasize solar integration, showcasing a tailored approach to meet state-specific energy goals.

However, these programs are not without their complexities. Challenges such as intricate application processes, financial barriers for smaller projects, and specific eligibility criteria can hinder participation and limit the overall effectiveness of these initiatives. As stakeholders navigate this evolving landscape, understanding these dynamics is essential. The balance of opportunity and challenge underscores the importance of these programs not just for energy savings but for achieving energy security and independence.

Ultimately, the success of these incentive programs will depend on their ability to adapt and respond to the diverse needs of stakeholders. As the demand for energy independence continues to rise, these initiatives play a critical role in shaping the future of energy storage, ensuring that communities are equipped to meet both current and future energy challenges. Embracing these opportunities will be key to unlocking the full potential of battery storage technologies in the transition towards sustainable energy solutions.

Frequently Asked Questions

What is the Self-Generation Incentive Initiative (SGIP) in California?

The SGIP is a program that supports battery storage incentive programs in California, having allocated over $450 million to assist power retention projects, particularly benefiting disadvantaged communities.

What types of installations does the SGIP provide refunds for?

The SGIP offers substantial refunds for both residential and commercial battery storage installations.

What is New York's Power Retention Initiative?

The Power Retention Initiative in New York provides upfront rebates based on system capacity through battery storage incentive programs and the Market Acceleration Bridge Incentive Program to enhance the deployment of power retention systems.

What is New York's target for power reserves by 2025?

New York has set an ambitious target of achieving 1,500 MW of power reserves by 2025.

How do battery storage incentive programs vary by state?

Each state's battery storage incentive programs are tailored to its specific power objectives and regulatory landscape, reflecting varying levels of support for battery technologies.

What is Minnesota's focus regarding battery storage incentive programs?

Minnesota's battery storage incentive programs focus on systems integrated with solar power, providing rebates for installations up to 50 kWh.

What funding is New York planning to allocate for battery storage incentive programs?

The New York State Energy and Research Development Authority plans to allocate $350 million for battery storage incentive programs.

What long-term goal does New York have for power reserves by the end of the next decade?

New York aims to achieve a long-term goal of 3,000 MW of power reserves by the end of the next decade.

What role will battery storage incentive programs play by 2025?

By 2025, battery storage incentive programs will play a pivotal role in shaping the future of power storage across various states.

What legal implications do these incentive programs have for stakeholders?

The incentive programs have legal implications for stakeholders in the energy sector, as noted by Alicia Legland, emphasizing the importance of supportive state laws and policies for power reserves.

List of Sources

- Overview of Battery Storage Incentive Programs in California, New York, and Minnesota

- morganlewis.com (https://morganlewis.com/pubs/2025/03/state-by-state-an-updated-roadmap-through-the-current-us-energy-storage-policy-landscape)

- nyserda.ny.gov (https://nyserda.ny.gov/All-Programs/Energy-Storage-Program)

- New York State Public Service Commission Approves the Retail and Residential Energy Storage Program Implementation Plan (https://hodgsonruss.com/newsroom/publications/new-york-state-public-service-commission-approves-the-retail-and-residential-energy-storage-program-implementation-plan)

- New York State funds energy storage projects | Smart Energy Decisions (https://smartenergydecisions.com/news/new-york-state-funds-energy-storage-projects)

- Eligibility Criteria and Application Processes for Battery Storage Incentives

- nyserda.ny.gov (https://nyserda.ny.gov/All-Programs/Energy-Storage-Program)

- Exploring the Self-Generation Incentive Program (SGIP) for Battery Storage (https://energytoolbase.com/blog/energy-storage/exploring-the-self-generation-incentive-program-sgip-for-battery-storage)

- DSIRE (https://programs.dsireusa.org/system/program/detail/22098/nyserda-retail-energy-storage-incentive-program)

- Benefits and Challenges of Battery Storage Incentive Programs

- Exploring the Self-Generation Incentive Program (SGIP) for Battery Storage (https://energytoolbase.com/blog/energy-storage/exploring-the-self-generation-incentive-program-sgip-for-battery-storage)

- Home Battery Storage Market: How Many Households Are Adopting Solar + Storage? (https://patentpc.com/blog/home-battery-storage-market-how-many-households-are-adopting-solar-storage)