Overview

This article presents a comprehensive cost analysis of energy storage technologies, highlighting critical components, emerging trends, and their implications for stakeholders within the dynamic energy landscape.

Understanding capital and operating expenditures is paramount; metrics such as the Levelized Cost of Reserve (LCOR) are essential for evaluating the economic viability of energy storage solutions.

As technological advancements and regulatory changes continue to reshape the market, it becomes increasingly vital for stakeholders to grasp these financial metrics. This understanding not only informs investment decisions but also positions stakeholders to navigate the evolving landscape effectively.

Introduction

The evolving landscape of energy storage technology is fundamentally reshaping how societies harness and utilize power. As our reliance on renewable energy sources like solar and wind continues to grow, the importance of effective energy storage systems becomes paramount. These systems not only balance supply and demand but also enhance grid reliability, mitigate intermittent energy generation, and support the transition to a more sustainable future. With significant advancements on the horizon—including innovative battery technologies and integration with smart grids—the energy storage sector is poised for transformative change.

Understanding the various applications, costs, and emerging trends is crucial for stakeholders seeking to navigate this dynamic field and capitalize on the opportunities it presents. As we look to the future, the role of energy storage will be central in addressing the challenges of energy management and sustainability.

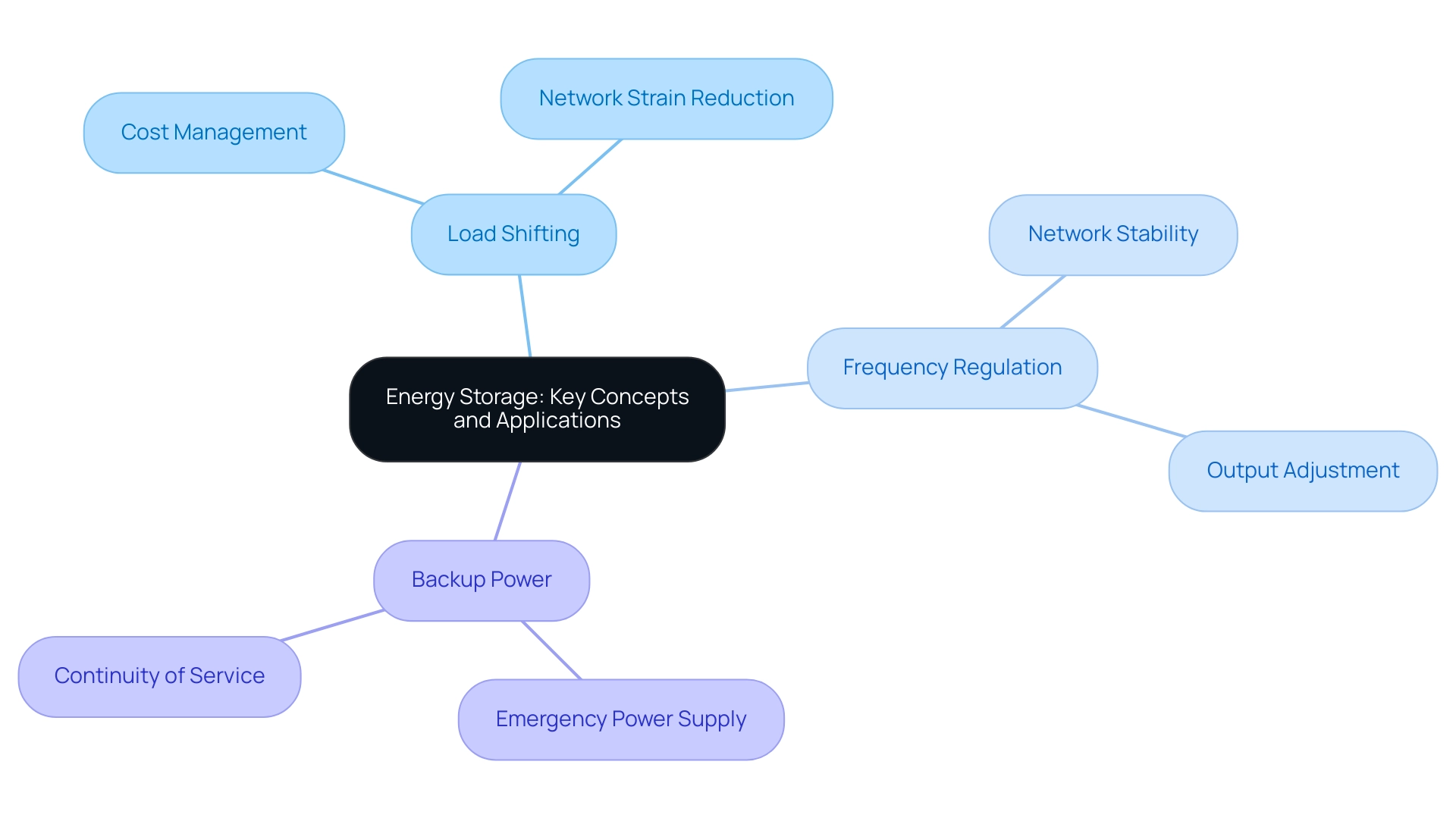

Understanding Energy Storage: Key Concepts and Applications

Power retention technology effectively captures power produced at one time for later use, playing a crucial role in balancing supply and demand, particularly as dependence on variable renewable sources such as solar and wind increases. As we approach 2025, the landscape of power retention applications is evolving, with several key areas of focus:

- Load Shifting: This involves capturing power during periods of low demand and releasing it during peak times, effectively managing costs and reducing strain on the network.

- Frequency Regulation: Power retention systems enhance network stability by adjusting their output to maintain the desired frequency, which is essential for reliable power delivery.

- Backup Power: These systems provide critical emergency power during outages, ensuring continuity of service for essential operations.

Recent advancements in power retention technology have further enhanced these applications. For instance, the deployment of lithium-ion batteries continues to drive innovation in the sector, despite a 7% price increase in 2022—the first rise since 2010. This increase underscores the persistent challenges in the market and the importance of cost analysis for energy storage in the renewable resource transition, as it aids in incorporating renewable sources into the network, thus bolstering decarbonization initiatives.

Real-world instances demonstrate the efficiency of power retention in load shifting and frequency regulation. Notably, the Intermountain Power Project in Utah and the Magnolia Power Plant in Louisiana are set to become significant contributors to the power landscape, showcasing how power retention can replace conventional coal-fired capacity with cleaner alternatives. These initiatives exemplify the essential role of power retention in the cost analysis for energy storage, enhancing network reliability and facilitating the transition to renewable power sources.

Looking ahead, the impact of power retention on network reliability is becoming increasingly evident. In 2025, power retention solutions are expected to play a vital role in enhancing the resilience of the power grid, particularly in light of potential challenges such as the removal of IRA funds and tariffs on imports from China, which could affect pricing and availability. Furthermore, power retention solutions are anticipated to support decarbonization initiatives in emerging nations by addressing electricity generation and distribution challenges.

Understanding these applications and their implications is crucial for navigating the evolving power landscape.

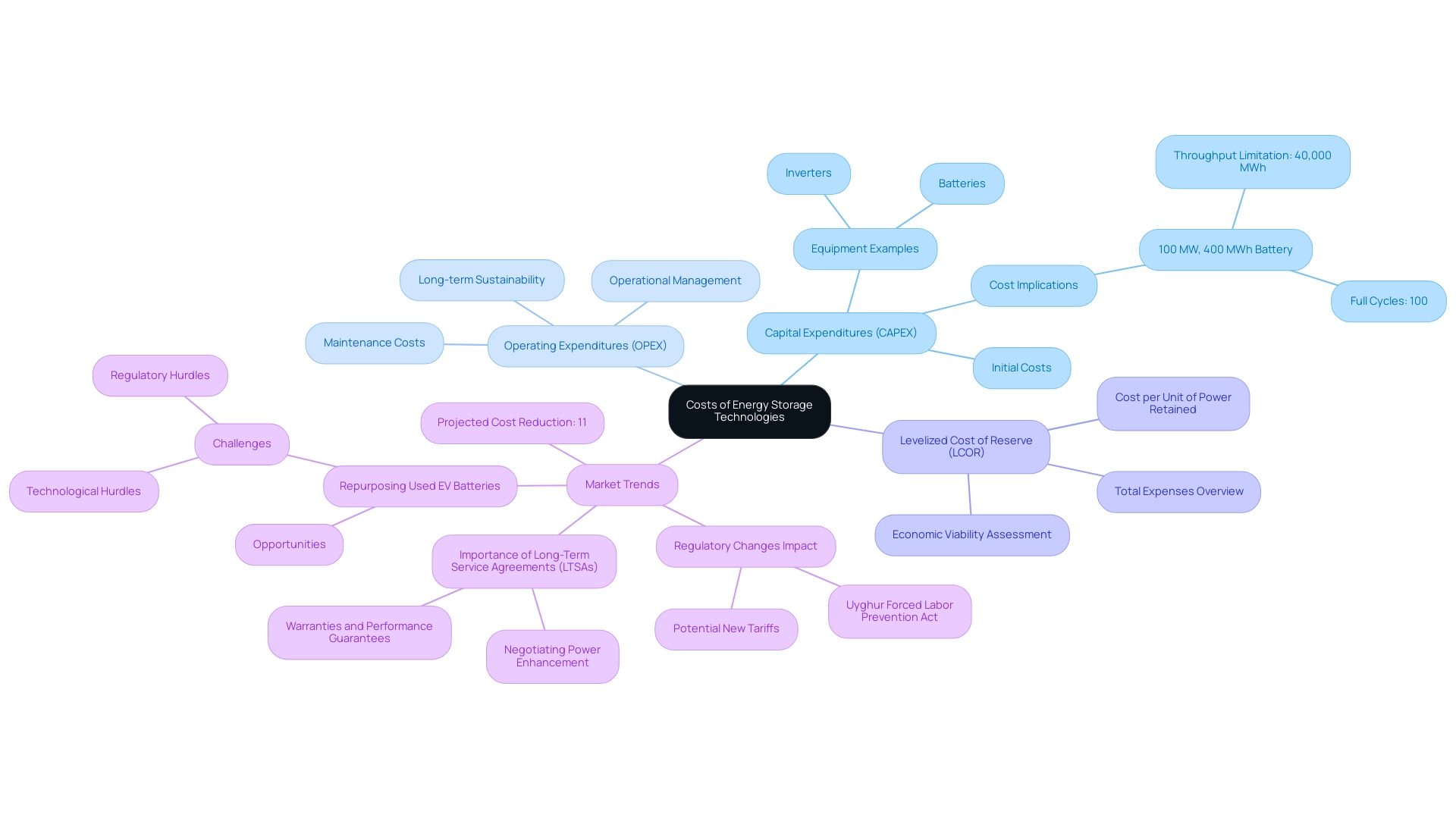

Analyzing the Costs of Energy Storage Technologies

The expenses associated with power retention technologies can be categorized into several essential components crucial for effective financial planning and project execution:

- Capital Expenditures (CAPEX): These represent the initial costs incurred for acquiring and installing power retention solutions. This includes expenses for batteries, inverters, and other critical equipment necessary for operation. For instance, a 100 MW, 400 MWh battery has a throughput limitation of 40,000 MWh, equating to 100 full cycles, illustrating both capacity and its implications for cost analysis.

- Operating Expenditures (OPEX): These ongoing costs encompass maintenance, operation, and management of power reserves. Understanding OPEX is vital for conducting a cost analysis of energy storage, which is essential for assessing the long-term sustainability and profitability of power reserve initiatives.

- Levelized Cost of Reserve (LCOR): This metric provides a comprehensive view of the total expenses associated with constructing and managing a reserve facility throughout its operational life, expressed as a cost per unit of power retained. LCOS serves as a critical tool for cost analysis in energy storage, aiding in the evaluation of the economic viability of various power retention solutions.

In 2025, the power retention landscape is witnessing a notable trend: battery power retention units (BESS) are projected to experience an 11% reduction in costs. This decrease not only improves the accessibility of these technologies across diverse applications but also reflects ongoing advancements in manufacturing and technology.

Furthermore, capital expenditures for power retention systems are transforming, with case studies indicating that long-term service agreements (LTSAs) are instrumental in securing warranties and performance guarantees. By implementing LTSAs alongside supply agreements, buyers can bolster their negotiating power, ensuring that performance standards are met while providing a safety net for long-term operational success. Evidence supports that the execution of LTSAs in tandem with supply agreements significantly enhances the operational success of battery systems.

As the market for power reserves continues to evolve due to regulatory changes—including potential new tariffs and the Uyghur Forced Labor Prevention Act—conducting a cost analysis for energy storage and comprehending these cost elements and trends will be essential for stakeholders aiming to optimize their investments in power reserve solutions. Additionally, the prospect of repurposing used EV batteries presents both opportunities and challenges, as technological and regulatory hurdles must be navigated to fully realize their benefits in the grid-scale power sector.

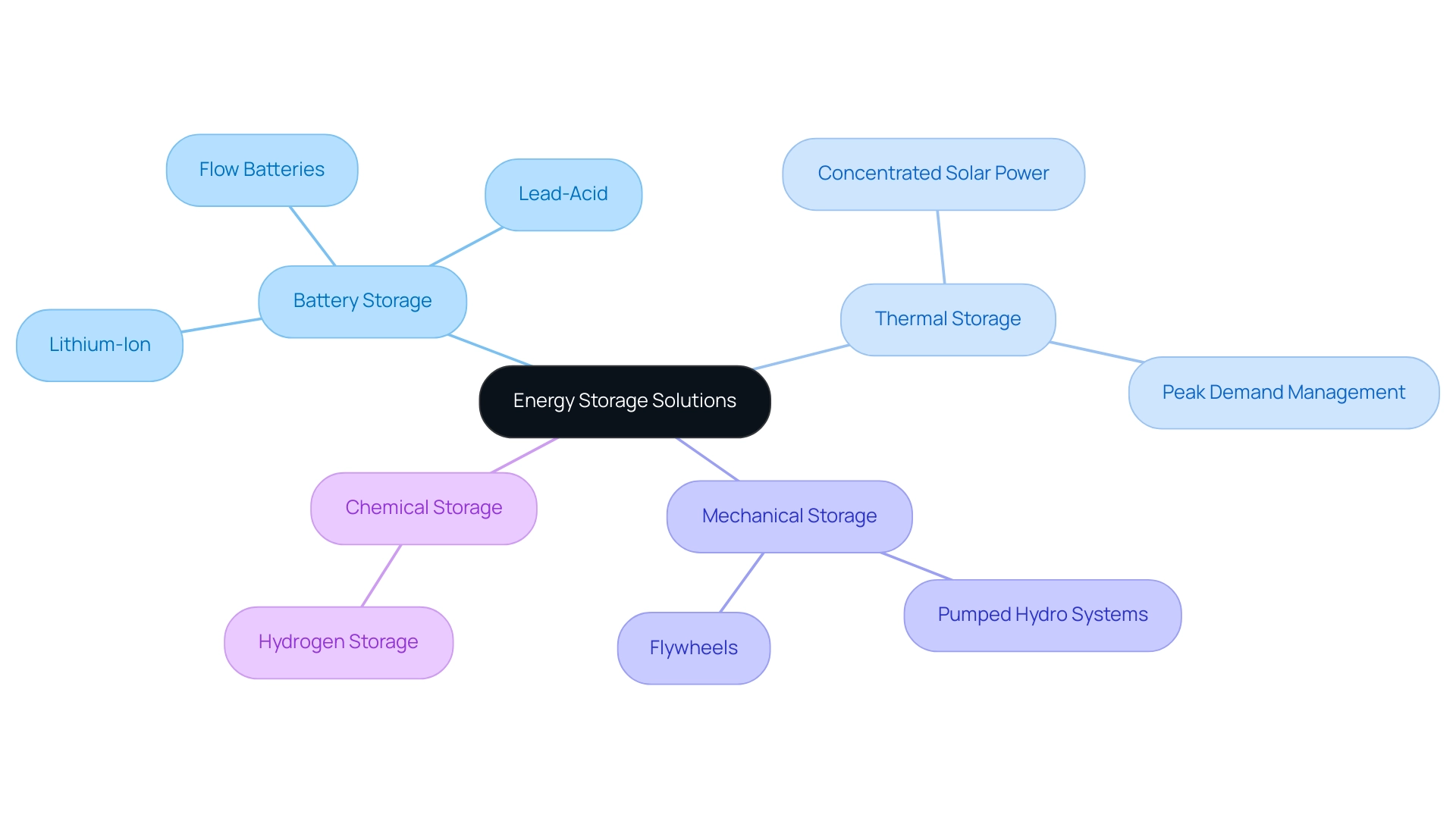

Exploring Different Types of Energy Storage Solutions

Energy storage solutions encompass a diverse array of technologies, each offering distinct characteristics and applications tailored to meet various project needs.

- Battery Storage: This category includes lithium-ion, lead-acid, and flow batteries, recognized for their high efficiency and rapid response capabilities. Starting in 2025, lithium-ion batteries are set to lead the market due to their excellent power density and declining costs, making them a favored option for both grid applications and electric vehicles. The energy storage market remains fragmented, with key players such as GS Yuasa Corporation, Contemporary Amperex Technology Co. Limited, and BYD Co. Ltd.

- Thermal Storage: This method involves storing energy in the form of heat, commonly utilized in concentrated solar power systems. Thermal storage systems offer significant advantages in power management, enabling the delivery of retained heat during peak demand times, thereby enhancing grid reliability. The transition in power sources is underscored by the replacement of 1,800 MW of coal-fired capacity with natural gas capacity at the Intermountain Power Project, highlighting the need for efficient power retention solutions.

- Mechanical Storage: Mechanical methods of energy retention, such as pumped hydro systems and flywheels, conserve energy through physical means. Pumped hydro systems remain the most widely utilized method of energy retention globally, accounting for a substantial portion of the market due to their capacity for large-scale storage and grid stability.

- Chemical Storage: This approach entails storing energy in chemical forms, such as hydrogen, which can be converted back into electricity when required. The growing interest in hydrogen as a clean energy carrier is driving innovations in chemical storage technologies, positioning them as a vital component of future energy systems.

The energy storage sector faces challenges such as limited capacity and high upfront costs, as highlighted in the cost analysis for energy storage. However, it is also buoyed by opportunities in the electric vehicle market and technological advancements. Moreover, findings from the AI in Energy Global Market Report 2025 indicate that AI technologies are playing a crucial role in optimizing energy storage solutions, enhancing efficiency in resources and infrastructure projects.

Each of these technologies presents unique applications, costs, and performance characteristics. For instance, while battery systems are preferred for their rapid response times, thermal solutions excel in managing power supply during peak periods. Evaluating these solutions through cost analysis for energy storage, tailored to specific project needs, is essential for optimizing resource retention strategies and enhancing overall efficiency in power and infrastructure initiatives.

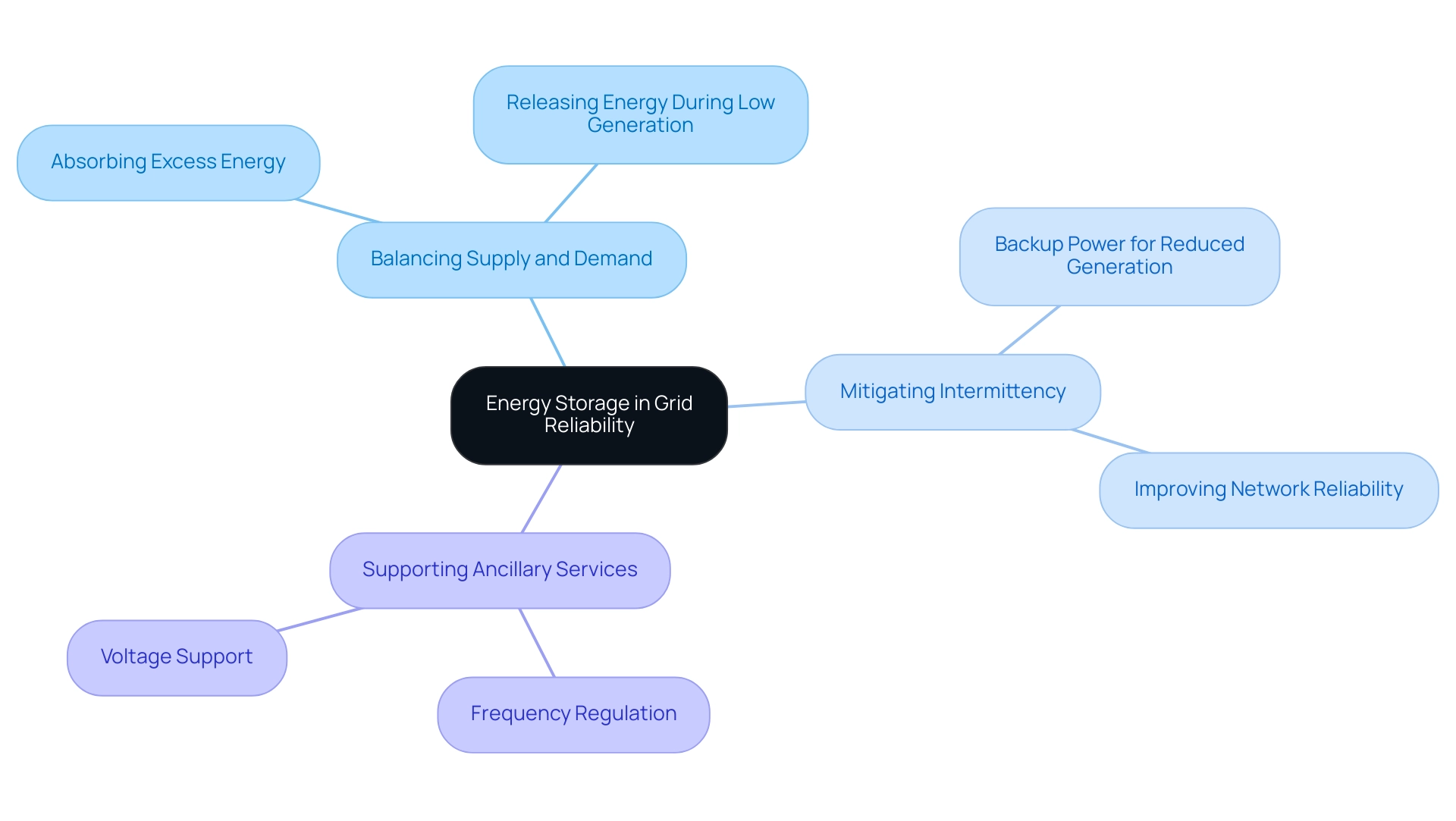

The Role of Energy Storage in Grid Reliability and Renewable Integration

Power retention is essential for enhancing grid reliability and facilitating the integration of renewable power sources. Its key contributions include:

- Balancing Supply and Demand: Energy storage systems adeptly manage fluctuations in energy generation by absorbing excess energy during peak production periods and releasing it when generation is low. This capability ensures a stable and dependable power supply, increasingly vital as renewable sources like solar and wind become more prevalent.

- Mitigating Intermittency: Power reserves act as a buffer against the inherent variability of renewable generation. By providing backup power during times of reduced generation, such as overcast days for solar or still days for wind, power reserves help sustain a steady supply, thereby improving overall network reliability.

- Supporting Ancillary Services: Beyond power supply, holding systems contribute to network stability by offering ancillary services like frequency regulation and voltage support. These services are crucial for maintaining the balance between supply and demand, particularly in the context of cost analysis for energy storage, as the share of renewables in the power mix continues to grow.

In 2025, as the shift to electrification accelerates, the significance of power reserves in ensuring a dependable and robust power grid cannot be overstated. For instance, the National Electric Vehicle Infrastructure program aims to establish thousands of EV chargers nationwide, underscoring the broader context of power management and electrification. Recent statistics indicate that power retention systems can reduce the need for peaker plants, which are often less efficient and more polluting.

Furthermore, case studies demonstrate how the cost analysis for energy storage has effectively balanced supply and demand in various projects, showcasing its efficiency in mitigating renewable variability.

However, uncertainties surrounding funding and policy changes may impact the development of power retention. As Sachu Constantine, executive director of Vote Solar, remarked, "We don't know how much money got out the door, we don't know how much money the administration can seek to claw back." Additionally, federal incentives for electrification in buildings and transportation play a supportive role in the development of power retention, yet potential changes in laws and regulations, including tariffs and the Uyghur Forced Labor Prevention Act, could influence the procurement of equipment for power retention projects.

As the power landscape evolves, expert insights emphasize that resource retention will be pivotal in achieving a sustainable and reliable future, particularly through mechanisms like Build-Transfer Agreements (BTAs), which combine features of PPAs and EPC contracts, enabling developers to manage project risks while providing utilities with long-term ownership without development risks.

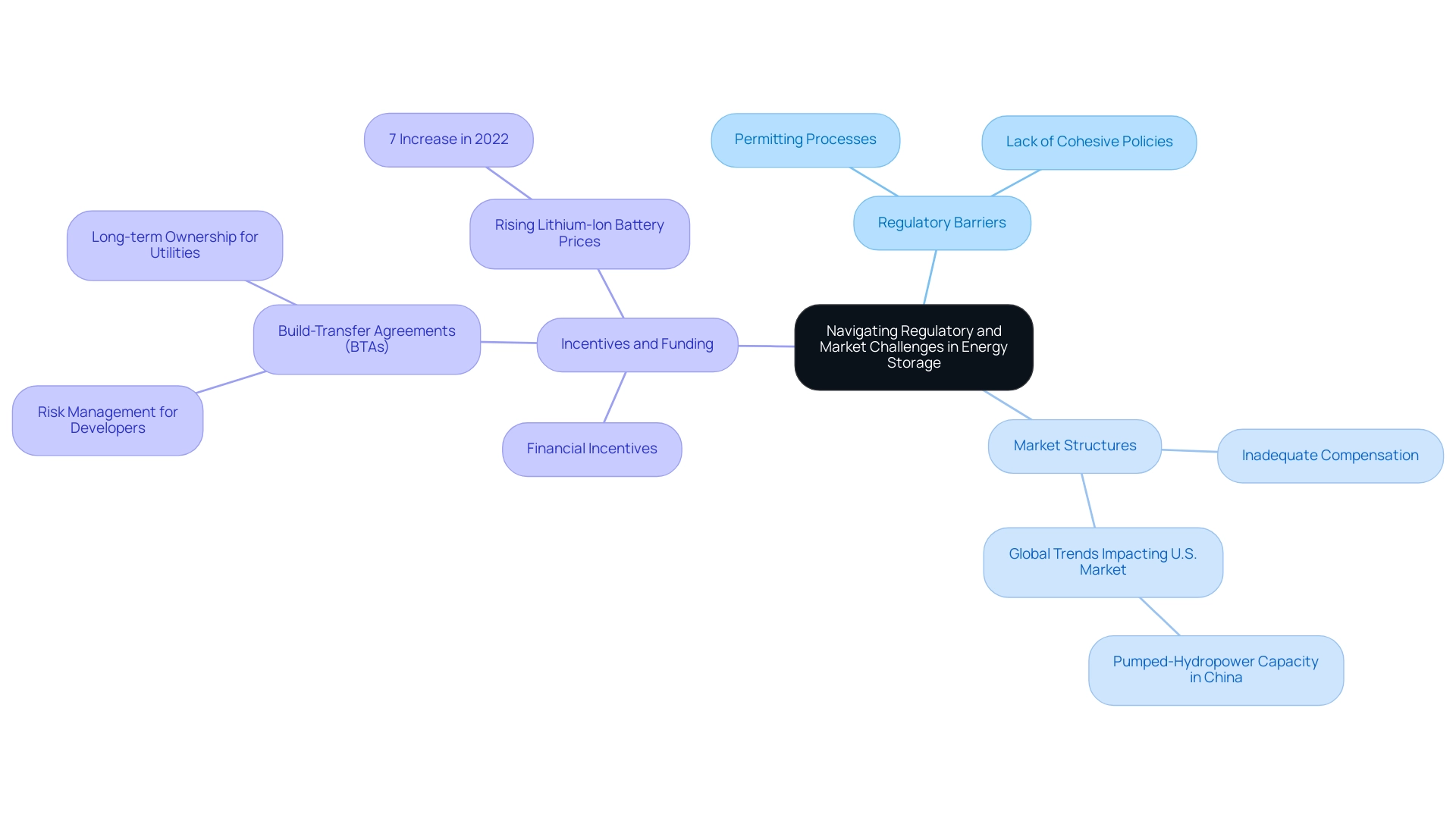

Navigating Regulatory and Market Challenges in Energy Storage

The implementation of power retention technologies in 2025 faces a myriad of regulatory and market obstacles that stakeholders must navigate effectively. These challenges can significantly hinder progress in power reserve projects, necessitating a strategic approach to overcome them.

Regulatory Barriers: The landscape is often marred by intricate permitting processes and a lack of cohesive policies. Carolyn Amon, a research leader at Deloitte, emphasizes that addressing these regulatory obstacles is essential for facilitating efficient project implementation and advancing decarbonization strategies. How can stakeholders tackle these barriers to ensure progress?

Market Structures: Existing market frameworks frequently fail to provide adequate compensation for the diverse services that power reserve systems offer. This shortfall restricts the economic feasibility of these technologies, making it imperative for stakeholders to advocate for reforms that recognize and reward the value of power preservation. Notably, a significant portion of recent pumped-hydropower capacity investments is currently taking place in China, highlighting global trends that could influence the U.S. market.

Incentives and Funding: Financial incentives and funding mechanisms are pivotal in determining the viability of power preservation initiatives. In 2022, the rising prices of lithium-ion batteries—up by 7% compared to the previous year—underscore the necessity for robust financial backing to mitigate these costs and foster investment in power retention solutions. Furthermore, the U.S. has three operational direct air capture facilities, with more in development, illustrating the evolving power landscape and its critical role in power retention solutions.

Addressing these challenges requires a comprehensive strategy that includes cost analysis for energy storage projects, aligning them with shifting regulatory requirements and market conditions. For instance, Build-Transfer Agreements (BTAs) have emerged as a viable strategy, enabling developers to manage project risks while ensuring utilities can acquire resources without incurring development risks. Although BTAs can be complex to negotiate, they exemplify how innovative contractual frameworks can help surmount regulatory hurdles and enhance project viability by providing long-term ownership without development risks.

As the landscape continues to evolve, understanding these market structures and regulatory challenges will be essential for stakeholders aiming to implement effective power retention solutions that contribute to a sustainable future.

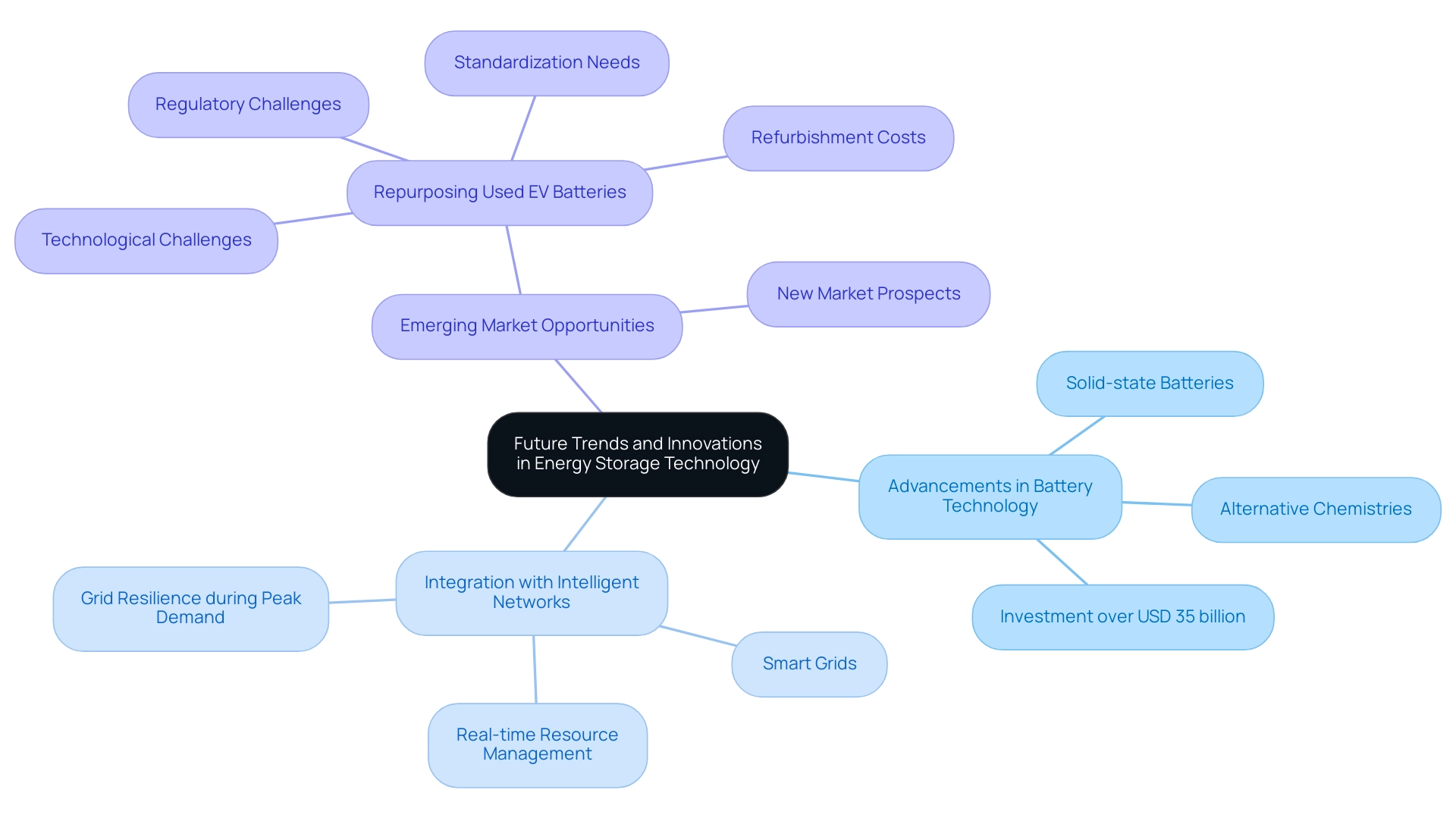

Future Trends and Innovations in Energy Storage Technology

The power retention landscape is undergoing significant transformation, driven by advancements in technology and market dynamics. Key trends shaping its future include:

- Advancements in Battery Technology: Innovations such as solid-state batteries and alternative chemistries are poised to revolutionize energy storage by improving energy density and safety. These advancements are crucial, as global investment in battery power systems is anticipated to exceed USD 35 billion in 2023, reflecting a robust commitment to enhancing battery technologies.

- Integration with Intelligent Networks: The synergy between power retention systems and smart network technologies is increasingly apparent. This integration enables more efficient resource management, allowing for real-time adjustments to supply and demand. For instance, initiatives in California demonstrate how smart grids, in conjunction with power reserves, can optimize electricity distribution and bolster grid resilience, particularly during peak demand periods.

- Emerging Market Opportunities: The rising demand for power retention solutions is creating new market prospects, especially in regions rich in renewable resources. As stakeholders navigate this evolving landscape, they must evaluate the potential of repurposing used electric vehicle (EV) batteries for grid-scale power. However, this strategy faces hurdles, including competition from new systems, refurbishment costs, and the necessity for standardized metrics to assess battery health. Carolyn Amon, a research leader in power, utilities, and renewables, underscores that "a successful journey to net zero will depend on how five verticals are scaled in a phased manner, aided by various enablers and drivers."

Staying informed about these trends is essential for stakeholders seeking to effectively leverage energy storage technologies and conduct cost analysis for energy storage, thereby contributing to a sustainable energy future.

Conclusion

The advancements in energy storage technology are not merely reshaping the way power is generated and consumed; they are crucial in driving the transition towards a sustainable energy future. Energy storage systems play a pivotal role in:

- Balancing supply and demand

- Mitigating the intermittency of renewable energy sources

- Enhancing grid reliability

With applications that include load shifting, backup power, and frequency regulation, the versatility of these systems becomes increasingly vital as society leans more towards renewables.

Financial considerations are paramount, with a significant reduction in costs anticipated for battery energy storage systems, thereby improving accessibility and economic feasibility. For stakeholders aiming to optimize their investments in this sector, understanding the components of capital and operating expenditures, along with the levelized cost of storage, is essential. Innovative contractual frameworks, such as Build-Transfer Agreements, provide pathways to navigate regulatory and market challenges, ensuring that energy storage projects can flourish.

Looking ahead, the integration of advanced battery technologies and smart grid solutions will further enhance the capabilities of energy storage systems. As new market opportunities emerge, particularly in regions abundant with renewable resources, stakeholders must be prepared to adapt and innovate. The journey towards a reliable, sustainable energy future hinges on the effective implementation of energy storage solutions, making it imperative for all involved to remain informed and engaged in this dynamic landscape. The path forward is clear: embracing energy storage technology is essential for achieving a resilient and decarbonized energy system.

Frequently Asked Questions

What is power retention technology and why is it important?

Power retention technology captures power produced at one time for later use, playing a crucial role in balancing supply and demand, especially as reliance on variable renewable sources like solar and wind increases.

What are the key applications of power retention technology?

The key applications include: Load Shifting (capturing power during low demand and releasing it during peak times), Frequency Regulation (enhancing network stability by adjusting output to maintain the desired frequency), and Backup Power (providing emergency power during outages to ensure continuity of essential operations).

How has recent innovation impacted power retention technology?

Recent advancements, particularly in lithium-ion batteries, have driven innovation in power retention technology, despite a 7% price increase in 2022. This highlights ongoing market challenges and the need for cost analysis in energy storage for renewable resource transitions.

Can you provide examples of real-world applications of power retention?

The Intermountain Power Project in Utah and the Magnolia Power Plant in Louisiana are notable examples, showcasing how power retention can replace conventional coal-fired capacity with cleaner alternatives.

What challenges are anticipated for power retention solutions by 2025?

Challenges include potential removal of IRA funds and tariffs on imports from China, which could affect pricing and availability. However, power retention solutions are expected to enhance the resilience of the power grid and support decarbonization initiatives, especially in emerging nations.

What are the main cost components associated with power retention technologies?

The main cost components are: Capital Expenditures (CAPEX) for initial costs of acquiring and installing solutions, Operating Expenditures (OPEX) for ongoing maintenance and operation costs, and Levelized Cost of Reserve (LCOR) which expresses total expenses as a cost per unit of power retained.

What trends are expected in the power retention landscape by 2025?

By 2025, battery power retention units (BESS) are projected to see an 11% reduction in costs, improving accessibility and reflecting advancements in manufacturing and technology.

How can long-term service agreements (LTSAs) benefit power retention systems?

LTSAs can secure warranties and performance guarantees, enhancing negotiating power for buyers and ensuring performance standards are met, which contributes to the long-term operational success of battery systems.

What role does cost analysis play in the evolving power retention market?

Conducting a cost analysis for energy storage is essential for stakeholders to optimize investments in power reserve solutions, especially amidst regulatory changes and market trends.

What opportunities and challenges exist with repurposing used EV batteries for power retention?

Repurposing used EV batteries presents opportunities for grid-scale power applications, but it also involves navigating technological and regulatory hurdles to fully realize their benefits.