Introduction

The acquisition of oil and gas easements is a multifaceted process that intertwines legal, financial, and regulatory considerations, making it essential for both landowners and companies to navigate this terrain with diligence and expertise. At its core, easements serve as critical agreements that allow companies to access and utilize portions of land for activities such as drilling and pipeline installation. However, the implications of these agreements extend far beyond mere access; they encompass a range of classifications, each carrying its own set of rights and responsibilities.

This article delves into the following topics:

- Definitions and classifications of easements

- Systematic steps involved in their acquisition

- Financial considerations that underpin valuation and payment structures

- Legal frameworks that govern these transactions

- Challenges and disputes that may arise, offering insights into effective strategies for resolution

By understanding these elements, stakeholders can better position themselves to achieve favorable outcomes in the increasingly complex landscape of oil and gas easements.

Understanding Oil and Gas Easements: Definitions and Classifications

Oil and gas rights signify legal contracts that permit companies to use part of a property owner's land for specified activities, like drilling or pipeline installation. These easements can be categorized into several distinct types, each with specific implications for land use:

- Temporary Easements: These agreements allow the use of land for a specified duration, usually for construction or maintenance activities, ensuring minimal disruption to the property owner's overall use of the property.

- Permanent Rights of Way: These agreements confer indefinite access to the land for ongoing operations, allowing companies to maintain their infrastructure without the need for further negotiation.

- Exclusive Rights: This type of agreement grants the holder unique privileges to use the property for the defined purpose, restricting the property owner and other parties from accessing the specified area for similar activities.

- Non-Exclusive Rights: In contrast, non-exclusive rights allow several parties to utilize the property for similar purposes, encouraging shared access while preserving entitlements for the property owner.

Comprehending these classifications is essential for both property owners and companies as it helps in identifying their respective rights and responsibilities throughout the acquisition process. Notably, the Trend Factor of 3.080 from 1993 and earlier provides a quantitative context that can affect the valuation of these rights over time.

Additionally, a citation from the Failure Investigation Report - TC Oil Pipeline Operations, Inc. highlights the significance of comprehending rights of way:

'Proper management of rights of way is vital to ensure operational integrity and reduce disturbances to property holders.'

This insight underscores the critical nature of these agreements in maintaining good relationships with landowners.

Furthermore, referencing the case study on the Economic Life and Depreciation of Gathering and Trunk/Transmission Systems illustrates the financial implications of land rights, particularly noting that gathering systems do not reach their fully depreciated 15% good residual floor until year 17, while trunk/transmission systems achieve this by year 30. This information is essential for land procurement strategies, as it emphasizes the long-term financial factors related to various types of rights-of-way.

Lastly, staying informed about recent legal updates and industry trends in property agreements can further inform strategic decisions in land acquisition.

Step-by-Step Process for Acquiring Oil and Gas Easements

The process of oil and gas easement acquisition involves a systematic approach that ensures both parties understand their rights and responsibilities. The steps typically include:

- Initial Assessment: Evaluate the need for the right of way and determine the suitable property owner to contact.

- Contact the Landowner: Open lines of communication with the landowner to articulate the purpose of the agreement and highlight its potential benefits, fostering a collaborative atmosphere.

- Conduct Title Research: Engage in thorough title research to confirm property ownership, identifying any pre-existing rights or encumbrances that may affect negotiations.

- Negotiate Terms: Enter into discussions about compensation, the duration of the agreement, and the specific rights that will be granted. This stage is crucial for aligning the interests of both parties. It is important to consider various valuation approaches, including the income approach, even if it may not be used directly in the negotiations.

- Draft the Easement Document: Create a comprehensive legal document that encapsulates the terms discussed, ensuring clarity for both parties.

- Obtain Necessary Permits: Verify compliance with local regulations and secure any required permits. Strict adherence to ecological regulations is not just a legal mandate but a cornerstone of corporate responsibility.

- Finalization and Signing: Facilitate a review period for both parties before the official endorsement of the access arrangement, solidifying mutual understanding and commitment.

- Document the Access Right: Submit the access right agreement to the relevant local government office to preserve a public record, thus protecting the rights granted by the access right.

Grasping these steps can greatly improve negotiation results and reduce risks linked to oil and gas easement acquisition agreements, especially in light of rising mineral demand and regulatory oversight. For instance, the procurement of mineral rights in Texas highlights the complexities involved, underscoring the necessity for diligent research and compliance to navigate ownership structures and potential liabilities.

Financial Considerations: Valuation and Payment for Easements

When addressing the financial aspects of easement acquisition, it is crucial to consider several key factors:

-

Valuation Methods: The valuation of easements can be approached through various methodologies:

- Market Approach: This method involves comparing similar easements within the region to ascertain a fair market value, accounting for local market conditions and trends.

- Income Approach: This approach estimates the potential income that the agreement could generate, factoring in expected cash flows from resource extraction or other activities permitted under the agreement. As NAV models calculate the present value of future cash flows from existing reserves and resources, this method is particularly relevant in the current market.

- Cost Approach: In this case, the valuation relies on the expenses borne by the property owner for granting the right of way, including any related legal and administrative fees.

-

Payment Structures: The financial arrangements regarding easements can differ significantly and may include:

- Lump-Sum Payments: A single, upfront payment for the rights granted by the easement, often preferred for its simplicity and immediacy.

- Recurring Payments: These involve ongoing payments throughout the duration of the agreement, providing a steady income stream to the landowner.

- Royalties: A percentage of profits derived from activities conducted on the property, aligning the interests of both parties as it ties compensation to the success of the operations.

Understanding these financial considerations is vital for effective negotiation in oil and gas easement acquisition, ensuring that both parties achieve a mutually beneficial agreement. Additionally, as highlighted by The Economist's Oil Adequacy Index, which measures the net change in real oil supplies and forecasts global oil consumption, current fluctuations in oil and gas prices must be factored into these discussions. Furthermore, the global shift towards renewable energy, as illustrated in the case study titled 'Changing Energy Markets,' emphasizes the need to adapt valuation models to incorporate sustainability factors, which will be essential for future negotiations.

Legal and Regulatory Framework for Easement Acquisition

Navigating the legal and regulatory framework for acquiring oil and gas rights requires a thorough understanding of several key considerations:

-

State Regulations: Each state has unique laws regulating property rights, which set forth specific requirements for notifications and agreements. Recent legislative changes, such as Colorado's Senate Bill 19-181, which modifies the management of oil and gas development by enhancing regulatory oversight and public engagement, highlight the evolving nature of these laws. These changes influence how rights of way must be structured and negotiated in the context of oil and gas easement acquisition for oil and gas development.

Local Ordinances: Municipal regulations can significantly influence the property right procurement process, often necessitating additional permits or approvals that must be factored into project timelines and budgets.

-

Environmental Regulations: Compliance with environmental laws is paramount, particularly for projects that may affect land or water resources. The burden of regulatory compliance is evidenced by the new estimated total burdens for OMB Control Number 1004-0185, which show 16,340 annual responses and an annual burden cost of $3,766,184. These statistics highlight the significant impact of environmental regulations on the oil and gas easement acquisition process, as developers must allocate resources to meet these compliance demands.

Negotiation of Rights: It is essential that the agreement clearly delineates the rights and responsibilities of both parties, including any limitations on land use. Effective negotiation can prevent misunderstandings and protect the interests of both landowners and developers during the oil and gas easement acquisition.

Public Utility Regulations: For rights of way intended for public utility purposes, additional regulatory requirements may apply, necessitating coordination with relevant authorities to ensure compliance.

Understanding these elements not only streamlines the process of oil and gas easement acquisition but also mitigates the risk of costly legal challenges. As Steven H. Feldgus, Principal Deputy Assistant Secretary for Land and Minerals Management, highlights, ensuring that public interest requirements are satisfied is crucial for the validity of agreements related to land use agreements. Case studies, such as the provision allowing for the extension of leases with ongoing drilling operations—where leases can be extended for up to two years if rental payments are timely—further illustrate how legal frameworks can facilitate the oil and gas easement acquisition, which enhances the practical implications for land procurement.

Navigating Challenges and Disputes in Easement Acquisition

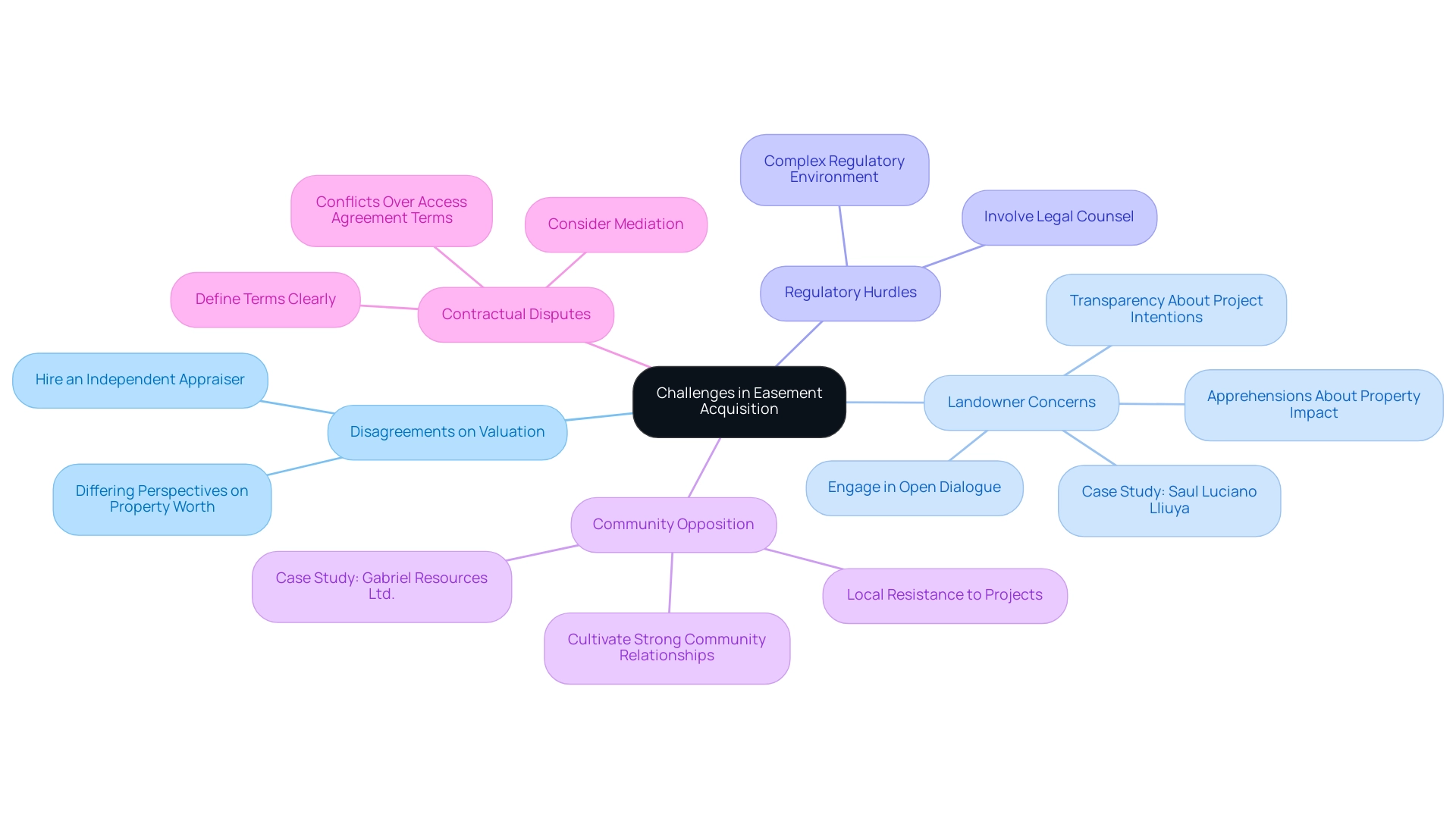

Navigating the complexities of oil and gas easement acquisition often involves a range of challenges and disputes, which can significantly impact project timelines and costs. Key issues include:

-

Disagreements on Valuation: Differing perspectives on the worth of the property right can lead to negotiation stalemates.

To facilitate a fair resolution, hiring an independent appraiser can provide an objective assessment, helping to bridge the valuation gap between parties.

-

Landowner Concerns: Landowners frequently express apprehensions about how agreements will affect their property and quality of life.

Engaging in open dialogue and ensuring transparency about project intentions and impacts can foster trust and alleviate these concerns.

As noted by Saul Luciano Lliuya, a Peruvian farmer suing an energy company for its alleged contribution to climate change, addressing local concerns is crucial for sustaining community support.

-

Regulatory Hurdles: The regulatory environment regarding property rights acquisition can be intricate, with potential legal challenges emerging unexpectedly.

Involving legal counsel with expertise in local regulations is crucial for navigating these complexities and ensuring compliance.

-

Community Opposition: Local community resistance to access projects can pose significant public relations challenges.

The ongoing case of Gabriel Resources Ltd. illustrates the social license risk associated with community opposition, highlighting the importance of addressing local sentiments.

Cultivating strong relationships with community members and proactively addressing their concerns can help mitigate opposition and foster support for projects.

-

Contractual Disputes: Conflicts regarding the terms of access agreements are common and can lead to protracted disputes.

To minimize misunderstandings, it is essential to define all terms clearly within the contract.

Additionally, considering mediation as a preliminary step can facilitate amicable resolutions before disputes escalate.

Awareness and anticipation of these challenges are vital.

For example, 3% of participants noted that supply chain problems pose a substantial risk in Africa, illustrating the wider effects of such difficulties on land purchases.

Adopting effective strategies not only aids landowners but also enables companies to navigate the oil and gas easement acquisition process more efficiently, ultimately fostering smoother project execution.

Conclusion

The intricate process of acquiring oil and gas easements encompasses a variety of legal, financial, and regulatory considerations that demand careful navigation by both landowners and companies. Understanding the classifications of easements—such as temporary, permanent, exclusive, and non-exclusive—provides a foundation for recognizing the rights and responsibilities inherent in these agreements. This clarity is essential not only for negotiation but also for maintaining positive relationships between stakeholders.

The systematic steps for acquiring easements are critical in ensuring that both parties reach a mutually beneficial agreement. From the initial assessment and negotiation to the finalization of the easement agreement, each phase must be approached with diligence. Financial considerations, including valuation methods and payment structures, further underscore the importance of strategic planning in this domain. Recognizing the impact of fluctuating economic conditions and evolving energy markets is vital for effective negotiations.

Legal and regulatory frameworks also play a significant role in shaping the easement acquisition process. Compliance with state laws, local ordinances, and environmental regulations is paramount to avoid costly disputes and delays. Awareness of potential challenges and disputes—ranging from valuation disagreements to community opposition—allows stakeholders to proactively address issues and foster smoother project execution.

In conclusion, a comprehensive understanding of the complexities surrounding oil and gas easements is imperative for all parties involved. By equipping themselves with knowledge of definitions, classifications, negotiation strategies, and legal requirements, stakeholders can enhance their ability to navigate this challenging landscape effectively. Ultimately, informed engagement in the easement acquisition process not only facilitates successful transactions but also contributes to sustainable development practices in the oil and gas industry.

Frequently Asked Questions

What are oil and gas rights?

Oil and gas rights are legal contracts that allow companies to use a property owner's land for specific activities, such as drilling or pipeline installation.

What are the different types of easements related to oil and gas rights?

The main types of easements include: 1. Temporary Easements: Allow land use for a specified duration, typically for construction or maintenance. 2. Permanent Rights of Way: Grant indefinite access for ongoing operations. 3. Exclusive Rights: Provide unique privileges to one party, restricting others from similar use. 4. Non-Exclusive Rights: Allow multiple parties to use the property for similar purposes.

Why is it important to understand the classifications of easements?

Understanding these classifications helps both property owners and companies identify their respective rights and responsibilities during the acquisition process.

What is the Trend Factor of 3.080, and why is it significant?

The Trend Factor of 3.080 from 1993 and earlier provides a quantitative context that can impact the valuation of oil and gas rights over time.

What does the Failure Investigation Report highlight regarding rights of way?

The report emphasizes that proper management of rights of way is crucial for operational integrity and minimizing disturbances to property holders.

What are the financial implications of land rights in oil and gas systems?

Gathering systems do not reach their fully depreciated value until year 17, while trunk/transmission systems achieve this by year 30, affecting land procurement strategies.

What are the steps involved in the oil and gas easement acquisition process?

The steps include: 1. Initial Assessment 2. Contact the Landowner 3. Conduct Title Research 4. Negotiate Terms 5. Draft the Easement Document 6. Obtain Necessary Permits 7. Finalization and Signing 8. Document the Access Right.

How can understanding the easement acquisition process improve negotiations?

Grasping these steps can enhance negotiation outcomes and reduce risks associated with oil and gas easement agreements, especially given rising mineral demand and regulatory oversight.

List of Sources

- Understanding Oil and Gas Easements: Definitions and Classifications

- National Pipeline Performance Measures (https://phmsa.dot.gov/data-and-statistics/pipeline/national-pipeline-performance-measures)

- Chapter 8 - Oil and Gas Pipeline | Assessors' Library (https://arl.colorado.gov/chapter-8-oil-and-gas-pipeline)

- Step-by-Step Process for Acquiring Oil and Gas Easements

- sciencedirect.com (https://sciencedirect.com/science/article/pii/S2405656118301421)

- Chapter 8 - Oil and Gas Pipeline | Assessors' Library (https://arl.colorado.gov/chapter-8-oil-and-gas-pipeline)

- Key Strategies in Oil and Gas Land Acquisition: An In-depth Analysis (https://blog.harbingerland.com/key-strategies-in-oil-and-gas-land-acquisition-an-in-depth-analysis)

- Financial Considerations: Valuation and Payment for Easements

- Asset Valuation For Oil Rig Companies: Key Metrics And Market Trends - Hadco International - Appraisals & Consulting Services (https://hadcointernational.com/asset-valuation-for-oil-rig-companies-key-metrics-and-market-trends)

- Research Guides: Oil and Gas Industry: A Research Guide: Statistical Data (https://guides.loc.gov/oil-and-gas-industry/statistical-data)

- Valuation Methodologies in the Oil & Gas Industry (https://stout.com/en/insights/article/valuation-methodologies-oil-gas-industry)

- Legal and Regulatory Framework for Easement Acquisition

- The New Oil and Gas Governance (https://yalelawjournal.org/forum/the-new-oil-and-gas-governance)

- Fluid Mineral Leases and Leasing Process (https://federalregister.gov/documents/2024/04/23/2024-08138/fluid-mineral-leases-and-leasing-process)

- Navigating Challenges and Disputes in Easement Acquisition

- Key findings (https://cms.law/en/gbr/publication/oil-and-gas-disputes-survey-2021-22/key-findings)

- Quantum in extractive sector disputes: oil and gas and mining (https://globalarbitrationreview.com/guide/the-guide-damages-in-international-arbitration/6th-edition/article/quantum-in-extractive-sector-disputes-oil-and-gas-and-mining)

- Global overview of dispute trends in the energy sector (https://nortonrosefulbright.com/en/knowledge/publications/45e07228/global-overview-of-dispute-trends-in-the-energy-sector)