Overview

This article addresses the critical need for effective profitability modeling in small wind farms to secure successful project outcomes. It underscores the significance of various factors, including:

- Site selection

- Turbine efficiency

- Government incentives

- Operational costs

A thorough understanding of these elements is essential for maximizing revenue and ensuring financial viability in small renewable energy initiatives.

The complexities of land acquisition present notable challenges, particularly legal and regulatory hurdles that can impede progress. By navigating these intricacies, stakeholders can better position themselves for success.

Ultimately, this article aims to equip readers with the knowledge necessary to optimize their projects, highlighting the benefits of informed decision-making in the renewable energy sector. By addressing these critical components, stakeholders can enhance their operational strategies and achieve their financial goals.

Introduction

Small wind farms are emerging as a vital source of renewable energy, particularly for agricultural properties and rural areas, where they can generate electricity for various applications. However, understanding the profitability modeling of these projects is crucial for stakeholders aiming to navigate the complexities of site selection, turbine efficiency, and financial incentives.

With fluctuating energy prices and regulatory challenges, investors must ask: how can they ensure that their small wind farm initiatives remain financially viable and successful? This inquiry highlights the pressing need for effective strategies in the face of these challenges.

Explore the Basics of Small Wind Farms and Profitability

Small-scale turbine projects represent systems that generate electricity for minor applications, typically ranging from 20 watts to 100 kilowatts. These systems are often installed on agricultural properties, rural residences, or small businesses, serving as a vital renewable energy source. The small wind farm profitability modeling depends on several critical factors, including site selection, resource availability, and turbine efficiency. For instance, the highest average air speed analyzed occurred in April at 3.51 m/s, while the most efficient turbines boasted nominal power ratings of approximately 2 MW. Grasping these fundamentals is crucial for small wind farm profitability modeling, as they directly influence energy production and, consequently, the revenue from electricity sales.

Government incentives and tax credits significantly enhance the economic feasibility of small renewable energy installations. Such financial aids can substantially lower initial investment costs, making these projects more attractive to potential investors. By 2025, the typical profitability of small renewable installations is projected to improve, driven by increased financing and a growing market for decentralized power, which secured around $12.4 million in support specifically for distributed initiatives in 2023.

Successful small-scale turbine projects, such as Rivian's installation of a 2.8 MW unit in Illinois, illustrate the potential for on-site power generation in manufacturing, marking a pivotal shift in the utilization of distributed renewable resources. Similarly, a lime production facility in Ohio has implemented three 1.5 MW turbines, further exemplifying the trend of commercial clients harnessing distributed renewable resources to meet their power needs.

Several factors influence the profitability of small wind farms, including:

- Site selection and wind resource assessment

- Turbine efficiency and technology

- Government incentives and tax credits

- Local energy demand and electricity prices

- Environmental considerations, particularly noise emissions, which can pose challenges for wind farms.

By familiarizing themselves with these components, stakeholders can lay the groundwork for deeper financial analysis and strategic planning, ultimately leading to successful small renewable energy initiatives.

Analyze Key Financial Factors Affecting Small Wind Farm Profitability

Several key financial factors significantly influence small wind farm profitability modeling.

-

Initial Capital Investment: The costs associated with purchasing and installing turbines typically range from $3,000 to $6,000 per installed kilowatt. This initial outlay is crucial for determining the feasibility of a project.

-

Operational costs, including ongoing expenses like regular maintenance, insurance, and potential repairs, are essential components of small wind farm profitability modeling. These costs must be carefully monitored to ensure long-term viability. Notably, noise production from turbines can also add to operational expenses, as it may necessitate additional measures to mitigate environmental impacts.

-

Energy Production: The electricity produced by small turbines is directly related to airspeed and turbine efficiency. For instance, the most likely air velocity is 3 m/s, while the velocity at maximum power is 5 m/s. Accurate evaluations of wind resources are vital for predicting potential output and enhancing power production.

-

Revenue Streams: Income can be generated from various sources, including electricity sales, renewable power credits, and government incentives. A thorough understanding of these revenue streams is essential for effective financial forecasting and maximizing outcomes in small wind farm profitability modeling.

-

Payback Period: This metric indicates the time required to recoup the initial investment through generated income. A shorter payback period is generally more appealing to investors, making it a critical factor in project planning.

-

Market Conditions: Fluctuations in energy prices can profoundly impact profitability. Staying informed about market trends is essential for strategic planning and ensuring the financial success of small energy projects.

By examining these elements, stakeholders can more effectively manage the intricacies of small renewable energy investments and utilize small wind farm profitability modeling to improve their prospects for successful outcomes. Insights from case studies, such as the evaluation of turbine selection based on environmental conditions, can further illustrate the practical implications of these financial factors.

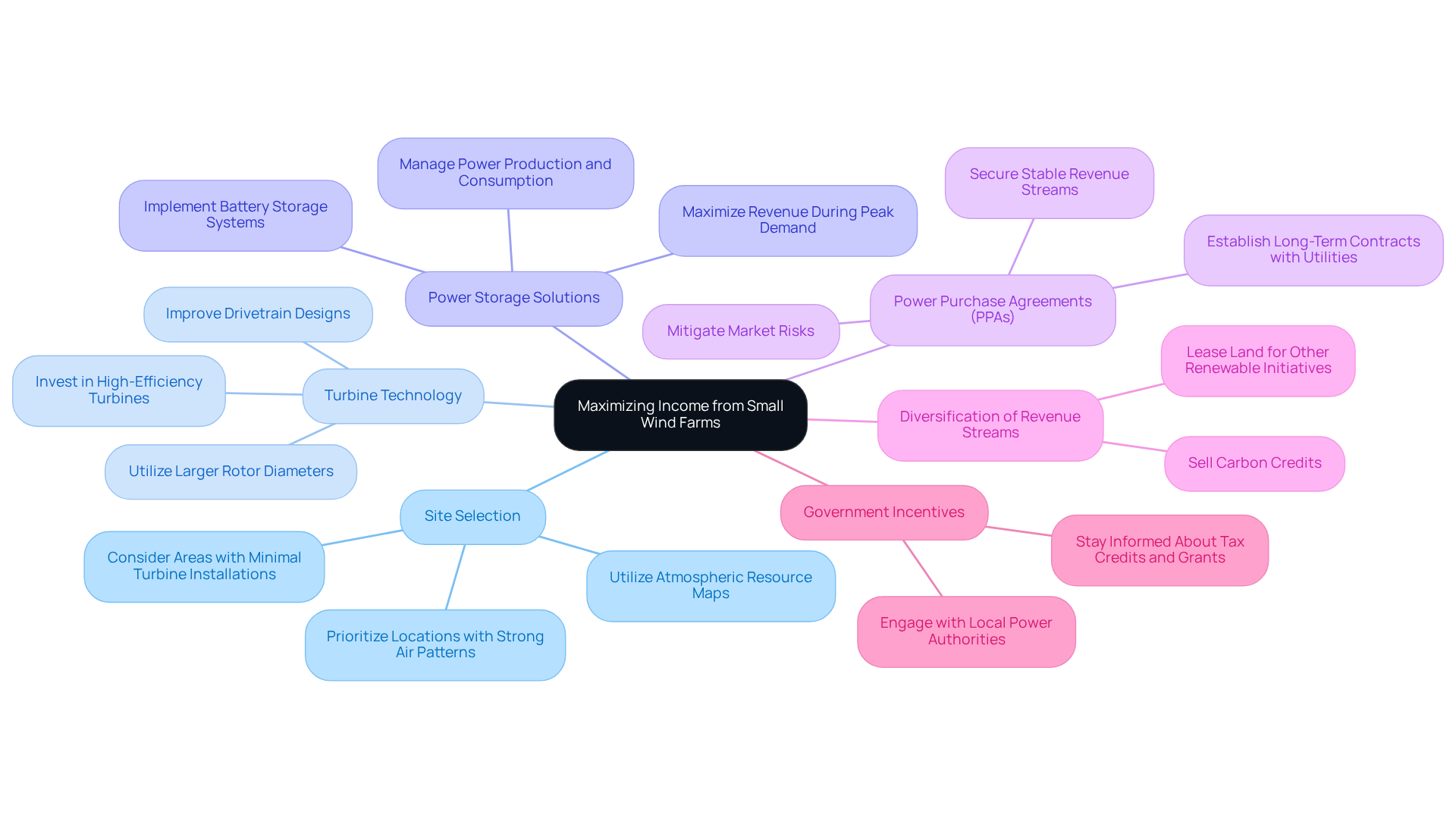

Implement Strategies to Maximize Income from Small Wind Farms

To maximize income from small wind farms, consider the following strategies:

-

Site Selection: Prioritize locations with steady and strong air patterns. Utilizing atmospheric resource maps can efficiently determine ideal locations, ensuring that the selected site can maintain power generation over time. Additionally, consider areas with minimal current turbine installations, such as the Southeast and Gulf Coast, which present substantial potential for development in this field.

-

Turbine Technology: Invest in high-efficiency turbines designed to generate more electricity at lower wind speeds. Recent advancements in turbine technology, including larger rotor diameters—growing from 30 meters to 125 meters—and improved drivetrain designs, can significantly enhance power output. This innovation makes even less windy sites viable for power generation.

-

Power Storage Solutions: Implement battery storage systems to effectively manage power production and consumption. This strategy permits the sale of electricity during peak demand times, maximizing revenue potential and enhancing overall renewable resource efficiency.

-

Power Purchase Agreements (PPAs) play a crucial role in small wind farm profitability modeling by establishing long-term contracts with utility companies to secure stable revenue streams. These agreements provide financial predictability and mitigate market risks, ensuring a consistent income flow. Notably, the typical expense of power purchase agreements has dropped to under 2 cents per kilowatt-hour, rendering them an appealing choice for ensuring income.

-

Diversification of Revenue Streams: Explore additional income opportunities, such as small wind farm profitability modeling by leasing land for other renewable initiatives or selling carbon credits. This diversification can enhance overall profitability and reduce reliance on a single revenue source.

-

Government Incentives: Stay informed about available tax credits and grants, such as the Production Tax Credit and Investment Tax Credit, which can offset initial costs and improve profitability. Engaging with local power authorities can provide valuable insights into programs that support renewable initiatives, further enhancing financial viability.

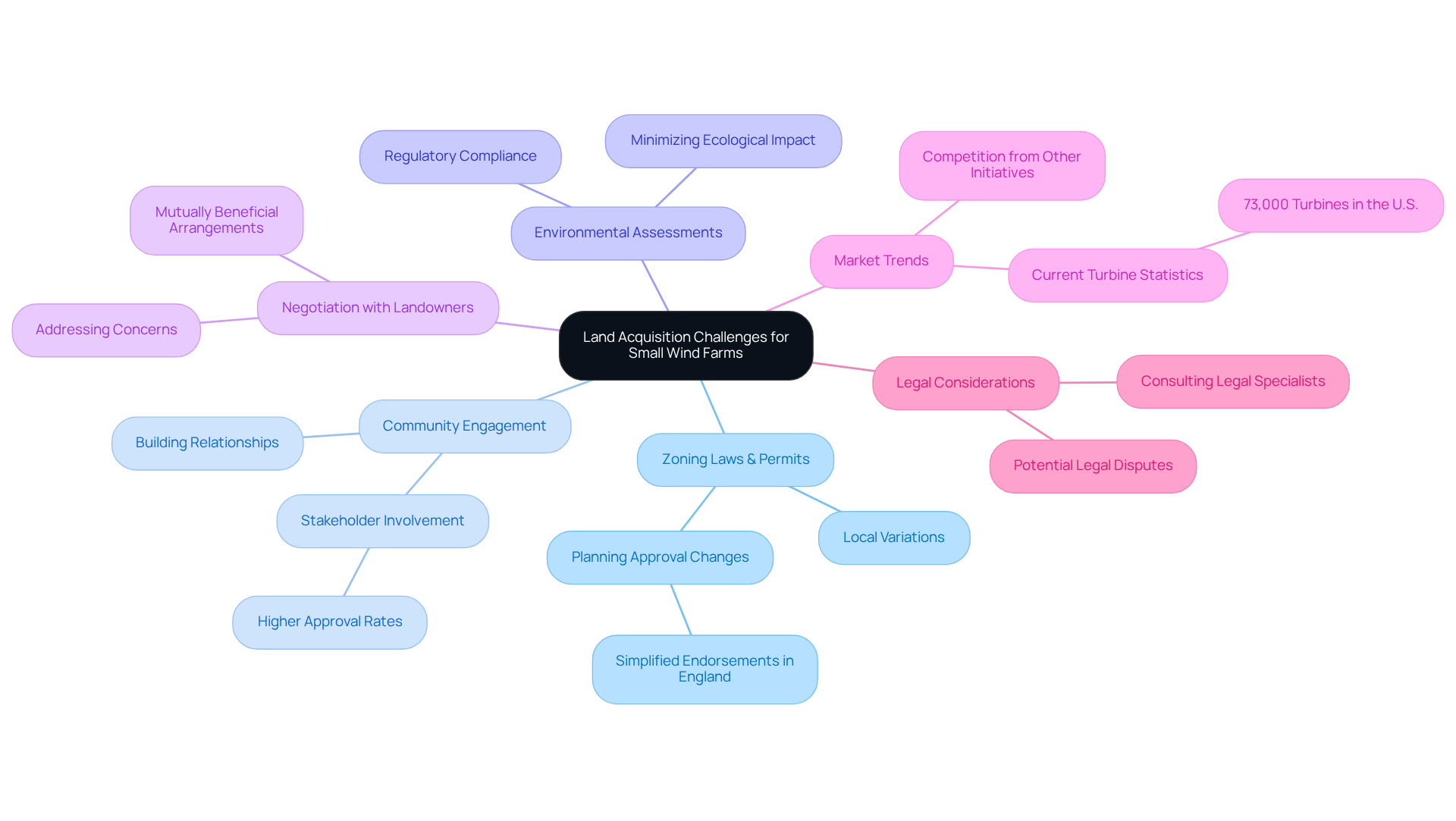

Navigate Land Acquisition Challenges for Small Wind Farm Development

Navigating land acquisition for small wind farms presents several challenges that require careful consideration. Understanding local zoning laws and obtaining necessary permits is essential, as regulations can vary significantly by state. Recent alterations in planning approvals in England, for example, have simplified the endorsement of onshore turbine initiatives, which is vital for the successful advancement of energy endeavors.

Establishing strong relationships with local communities can facilitate smoother negotiations and mitigate opposition. Involving stakeholders early in the process has demonstrated to improve acceptance and success rates, with statistics indicating that early involvement can result in higher approval rates in similar initiatives.

Conducting thorough environmental assessments is often mandated to ensure compliance with regulations and to minimize ecological impacts. This step is vital for maintaining community support and meeting legal requirements.

Effective negotiation with landowners is key to securing favorable lease agreements. Addressing landowner concerns and demonstrating the advantages of renewable energy initiatives can lead to mutually beneficial arrangements, fostering long-term partnerships.

The availability of land and competition from other renewable initiatives can influence acquisition strategies. With more than 73,000 turbines producing clean energy throughout the U.S., staying updated on market trends and local advancements is crucial for making strategic choices that align with objectives.

Be prepared to navigate potential legal disputes related to land rights and usage. Consulting with legal specialists in renewable resources is essential, as they can offer valuable insights and assist in reducing risks related to land acquisition.

In 2024, renewable energy initiatives provided over $2 billion in state and local tax contributions, highlighting the economic advantages of effective land acquisition strategies. Furthermore, the U.S. renewable energy sector employs veterans at a higher rate than the national average, reflecting its commitment to community and workforce development. By prioritizing regulatory compliance and community engagement, developers can enhance the viability through small wind farm profitability modeling of projects.

Conclusion

Mastering the intricacies of small wind farm profitability modeling is crucial for stakeholders seeking to harness renewable energy effectively. By comprehending key components—from site selection to turbine efficiency and government incentives—stakeholders establish a solid foundation for successful project implementation. This focus enables investors to navigate the complexities of the renewable energy landscape, unlocking the potential for sustainable income generation.

This article explores vital financial factors influencing profitability, including:

- Initial capital investment

- Operational costs

- Energy production rates

- Market conditions

To maximize income, strategies such as:

- Selecting optimal sites

- Investing in advanced turbine technology

- Leveraging power purchase agreements

enhance the viability of small wind projects. Moreover, addressing land acquisition challenges through community engagement and legal compliance is essential for ensuring project success.

As the demand for renewable energy grows, the significance of small wind farms in contributing to a sustainable energy future cannot be overstated. Stakeholders are urged to prioritize strategic planning and informed decision-making to capitalize on the opportunities presented by small wind energy projects. By embracing these best practices, stakeholders will not only improve profitability but also support the broader transition towards cleaner, renewable energy sources.

Frequently Asked Questions

What are small-scale turbine projects?

Small-scale turbine projects are systems that generate electricity for minor applications, typically ranging from 20 watts to 100 kilowatts. They are often installed on agricultural properties, rural residences, or small businesses.

What factors influence the profitability of small wind farms?

The profitability of small wind farms depends on several factors, including site selection, wind resource assessment, turbine efficiency and technology, government incentives and tax credits, local energy demand and electricity prices, and environmental considerations such as noise emissions.

How do government incentives and tax credits affect small wind farm projects?

Government incentives and tax credits significantly enhance the economic feasibility of small renewable energy installations by substantially lowering initial investment costs, making these projects more attractive to potential investors.

What is the projected profitability of small renewable installations by 2025?

By 2025, the typical profitability of small renewable installations is projected to improve due to increased financing and a growing market for decentralized power, which received around $12.4 million in support specifically for distributed initiatives in 2023.

Can you provide examples of successful small-scale turbine projects?

Yes, successful projects include Rivian's installation of a 2.8 MW turbine in Illinois for on-site power generation in manufacturing, and a lime production facility in Ohio that has implemented three 1.5 MW turbines to harness distributed renewable resources.

Why is understanding the fundamentals of small wind farm profitability important?

Understanding the fundamentals is crucial for small wind farm profitability modeling, as factors like site selection, resource availability, and turbine efficiency directly influence energy production and revenue from electricity sales.

List of Sources

- Explore the Basics of Small Wind Farms and Profitability

- (PDF) Energy Efficiency of Small Wind Turbines in an Urbanized Area—Case Studies (https://researchgate.net/publication/362184063_Energy_Efficiency_of_Small_Wind_Turbines_in_an_Urbanized_Area-Case_Studies)

- Small Wind Power Projects Expanding into New Markets (https://pnnl.gov/news-media/small-wind-power-projects-expanding-new-markets)

- Analyze Key Financial Factors Affecting Small Wind Farm Profitability

- Westwood Insight – Five things to watch in offshore wind in 2025 - Westwood (https://westwoodenergy.com/news/westwood-insight/westwood-insight-five-things-to-watch-in-offshore-wind-in-2025)

- (PDF) Energy Efficiency of Small Wind Turbines in an Urbanized Area—Case Studies (https://researchgate.net/publication/362184063_Energy_Efficiency_of_Small_Wind_Turbines_in_an_Urbanized_Area-Case_Studies)

- Implement Strategies to Maximize Income from Small Wind Farms

- Technology Advancements Could Unlock 80% More Wind Energy Potential During This Decade | NREL (https://nrel.gov/news/detail/program/2023/technology-advancements-could-unlock-80-more-wind-energy-potential-during-this-decade)

- 10 Essential Wind Energy ROI Studies for Informed Development (https://blog.harbingerland.com/10-essential-wind-energy-roi-studies-for-informed-development)

- Wind Power Facts and Statistics | ACP (https://cleanpower.org/facts/wind-power)

- Global Statistics (https://wwindea.org/GlobalStatistics)

- WWEA Annual Report 2023: Record Year for Windpower (https://wwindea.org/AnnualReport2023)

- Navigate Land Acquisition Challenges for Small Wind Farm Development

- Wind Power Facts and Statistics | ACP (https://cleanpower.org/facts/wind-power)

- Land Required for a Wind Farm - What Landowners Should Know (https://lumifyenergy.com/blog/land-required-for-a-wind-farm)