Introduction

The realm of oil and gas mineral rights is a complex and multifaceted domain, crucial for property owners and investors alike. At the heart of this issue lies the distinction between mineral rights and surface rights, which fundamentally affects how resources beneath the earth's surface are accessed and managed. As the energy sector evolves, understanding these rights becomes increasingly vital, not only for strategic decision-making but also for navigating the intricate legal and financial landscapes associated with mineral extraction.

This article delves into the nuances of mineral rights, addressing key considerations for effective management, financial implications, and the potential for disputes. It also explores the future of mineral rights services in light of technological advancements and regulatory changes, providing essential insights for stakeholders aiming to optimize their interests in this dynamic field.

An Overview of Oil and Gas Mineral Rights

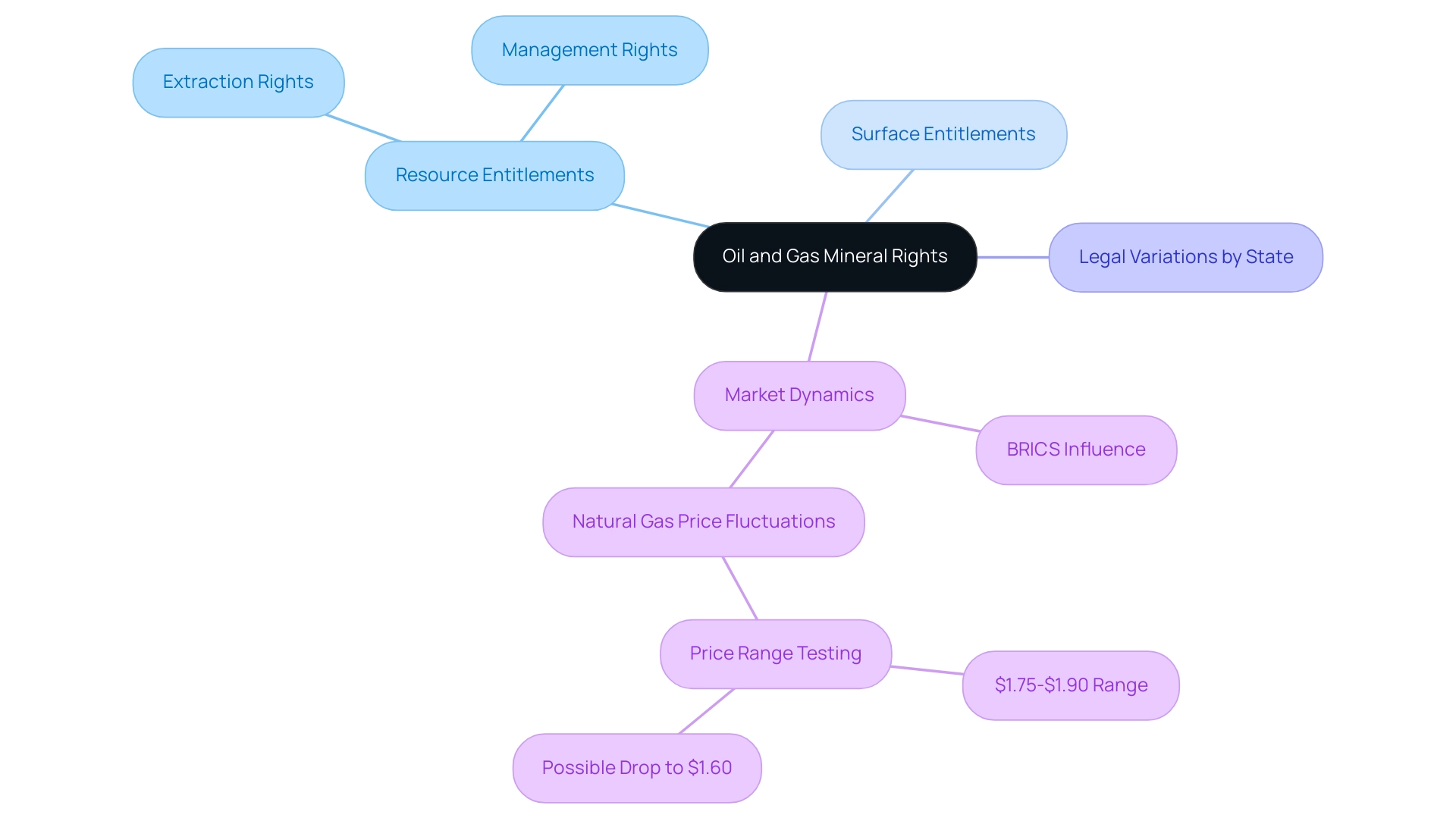

Ownership of resources provides the holder authority over the extraction and management of substances found beneath a land's surface, which is especially relevant in the context of oil and gas mineral rights services. These entitlements allow the holder to investigate, remove, and sell the resources found on their property, differentiating them from surface privileges, which relate only to the land above. This division is essential; a landowner may find themselves unable to access resources beneath their land if they have sold or leased these privileges to another entity.

Understanding the distinction between resource entitlements and surface entitlements is crucial for property owners, particularly when engaging with oil and gas mineral rights services, as it greatly affects their negotiating strength and land-use management approaches. Moreover, the legal structure regulating resource entitlements differs by state, which can impact ownership arrangements and extraction methods. Engaging with a Land Management Advisor can offer essential assistance in addressing these intricacies and making educated choices regarding resource ownership.

As Ryan C. Moore, Founder and CEO of Pheasant Energy, asserts,

Grasping resource entitlements is not just about ownership; it’s about control and strategic decision-making in a rapidly evolving market.

Remaining knowledgeable about state regulations and recent changes in resource ownership is essential, particularly as the oil and gas mineral rights services sector continues to evolve. The emerging dynamics within the BRICS organization may influence pricing strategies, while fluctuating natural gas prices, which could test the $1.75-$1.90 range or drop as low as $1.60, directly affect land administration strategies and negotiations.

Managing Your Mineral Rights: Key Considerations and Responsibilities

Successfully overseeing resource entitlements necessitates a thorough comprehension of the privileges and responsibilities outlined in lease contracts. These agreements often stipulate common minimum thresholds for gas royalty payments, typically set at $50 or $100, with royalties accumulating until these amounts are reached. Regularly reviewing these agreements is essential for landowners to ensure they are receiving appropriate compensation for extraction activities.

Moreover, adherence to state-specific regulations regarding resource management is essential, as these can differ significantly and influence financial results. As mentioned by the US Mineral Exchange, the average cost per acre for resource entitlements that are not leased ranges from $0 to $250/acre, illustrating the variability in resource valuation. It is important to acknowledge that there is no typical price for resource ownership due to the distinctiveness of each parcel, as illustrated in case studies demonstrating significant value variations, which can range from $1,000 to $10,000 per acre depending on factors like lease conditions and production status.

Furthermore, assertions of a 'Zillow' for resource ownership are deceptive, as precisely determining their worth is not practical. Maintaining open communication with stakeholders—including those involved in oil and gas mineral rights services, oil and gas firms, and legal advisors—is essential for successful negotiations and to uphold interests effectively. Property owners are encouraged to maintain precise documentation of earnings obtained from resources, which will be significant for tax reporting.

Building a connection with a knowledgeable advisor can greatly improve the management of oil and gas mineral rights services, ensuring that all legal and financial interests are adequately addressed.

Understanding the Financial Aspects of Mineral Rights

The financial environment related to resource ownership is defined by possible revenue generated from leasing agreements and royalties associated with oil and gas mineral rights services linked to extraction. Notably, Canadian raw bitumen production grew by more than 12% per year from 2006 to 2014, highlighting the increasing opportunities in this sector. As of 2024, average royalties from oil and gas extraction have been projected to offer significant returns, prompting landowners to thoroughly understand the various oil and gas mineral rights services and payment structures involved.

These typically include:

- Bonuses, which are upfront payments

- Ongoing royalties based on production levels

- Rental payments for the permission to explore or extract resources

Furthermore, strategies for maximizing the value of oil and gas mineral rights services can involve negotiating higher percentages of royalties or securing favorable lease terms. Tax consequences of resource earnings are essential; such income is typically liable to taxation, requiring precise reporting by landowners.

A recent analysis indicates that landowners may face varying tax rates depending on state regulations, making it essential to stay informed on the latest developments in tax legislation. To enhance their financial results, landowners are encouraged to collaborate with financial advisors who provide oil and gas mineral rights services. The case study titled 'Cost of Listing Assets' illustrates that there are no costs for mineral owners to list their assets with US Mineral Exchange; they only pay a commission if a buyer is found.

This model eliminates out-of-pocket expenses for sellers, making it financially accessible. As stated by the US Mineral Exchange,

There are absolutely no costs to list your asset,

which encourages landowners to explore their options without incurring expenses, thereby allowing them to negotiate more favorable terms with energy companies. By understanding the nuances of valuation and payment structures, property owners can enhance their negotiating power and ultimately maximize their income while effectively managing their tax liabilities.

Navigating Legal Issues and Disputes in Mineral Rights

Navigating legal challenges in resource management, especially in relation to oil and gas mineral rights services, is intricate and frequently filled with conflicts regarding ownership, lease contracts, and compliance with both state and federal regulations. Landowners frequently encounter conflicts with energy companies, particularly regarding payment disputes, non-compliance with lease terms, and issues related to oil and gas mineral rights services, along with trespassing and environmental standards. Recent statistics from the article 'Balancing Rights in a New Energy Era: Will the Mineral Estate’s Dominance Continue?' indicate a surge in legal disputes surrounding resource rights, highlighting the necessity for proactive measures.

For instance, the case of Getty Oil Co. v. Jones illustrates the importance of the accommodation doctrine, which mandates that resource owners consider existing surface uses when extracting resources. This case underscores the need for a balance between competing interests, as emphasized in North Dakota's mandate regarding oil and gas mineral rights services to safeguard the public welfare.

To protect their interests, property owners must diligently document all agreements and communications related to oil and gas mineral rights services, as this can provide crucial evidence during conflicts involving competing interests between surface owners and resource developers.

Seeking advice from a legal professional who specializes in oil and gas mineral rights services can greatly assist in managing these conflicts and guaranteeing adherence to legal obligations. A thorough comprehension of legal entitlements and duties is crucial for effectively overseeing resource rights.

The Future of Oil and Gas Mineral Rights Services

The terrain of oil and gas mineral rights services is set for change, driven by technological advancements and an evolving regulatory structure. New technologies, such as AI-driven title investigation and GIS mapping, are greatly enhancing efficiency in resource administration, allowing for more accurate and timely evaluations of ownership and usage. For instance, these advancements facilitate a more streamlined approach to data analysis, which is essential for optimizing resource allocation and compliance tracking.

Notably, PT Vale Indonesia has reduced costs by US$2.5 billion by using slag nickel as a substitute for natural stone, showcasing the financial benefits of technological innovations in resource management. As environmental regulations keep changing, landowners must manage new compliance obligations that may modify their resource agreements. Staying abreast of these developments is crucial for landowners aiming to adapt their strategies effectively and capitalize on emerging opportunities.

Interacting with industry specialists and taking part in workshops centered on these trends can provide invaluable insights, equipping stakeholders for the dynamic future of resource services. Furthermore, examining successful case studies, such as the joint venture between CODELCO and SQM in lithium extraction, illustrates how technological integration can enhance resource extraction while adhering to local regulations, thereby emphasizing the potential benefits of a forward-thinking approach in this sector. As global supply and demand factors continue to dictate production, investment, and pricing patterns, understanding these dynamics will be essential for effective management of oil and gas mineral rights services.

Conclusion

The exploration of oil and gas mineral rights reveals a landscape marked by complexity and opportunity. Understanding the distinction between mineral rights and surface rights is fundamental for property owners and investors, as it directly impacts their control over the resources beneath their land. The management of these rights requires diligence in navigating lease agreements, adhering to state regulations, and maintaining open communication with stakeholders.

Financially, mineral rights can provide significant income through royalties and leasing arrangements, necessitating a thorough comprehension of the various payment structures and tax implications involved. Landowners are encouraged to engage with financial advisors to optimize their financial outcomes and ensure compliance with relevant tax legislation.

Legal challenges are an ever-present concern in mineral rights management, with disputes over ownership and lease agreements being common. Proactive measures, including meticulous documentation and consultation with legal experts, are essential for safeguarding one's interests.

Looking ahead, the future of mineral rights services is set to evolve through technological advancements and changing regulatory environments. Engaging with emerging technologies and staying informed about industry trends will empower stakeholders to adapt their strategies and optimize their resource management. Ultimately, a comprehensive understanding of mineral rights, coupled with strategic decision-making, will be vital for navigating the complexities of this dynamic sector.

Frequently Asked Questions

What do resource entitlements include in the context of land ownership?

Resource entitlements provide the holder authority over the extraction and management of substances found beneath a land's surface, particularly relevant for oil and gas mineral rights services. This allows the holder to investigate, remove, and sell resources on their property.

How do resource entitlements differ from surface privileges?

Resource entitlements relate to the substances found beneath the land's surface, while surface privileges pertain only to the land above. A landowner may lose access to subsurface resources if they have sold or leased these entitlements to another entity.

Why is it important for property owners to understand the distinction between resource and surface entitlements?

Understanding this distinction is crucial for property owners as it affects their negotiating strength and land-use management approaches, especially when dealing with oil and gas mineral rights services.

How does state regulation impact resource entitlements?

The legal structure regulating resource entitlements varies by state, which can influence ownership arrangements and extraction methods. This makes it essential for landowners to be aware of state-specific regulations.

What role does a Land Management Advisor play in resource ownership?

A Land Management Advisor can assist property owners in navigating the complexities of resource ownership, helping them make informed decisions regarding their entitlements and management strategies.

What are common minimum thresholds for gas royalty payments in lease contracts?

Common minimum thresholds for gas royalty payments are typically set at $50 or $100, with royalties accumulating until these amounts are reached.

How should landowners manage their lease agreements?

Landowners should regularly review their lease agreements to ensure they receive appropriate compensation for extraction activities and adhere to state-specific regulations regarding resource management.

What is the average cost per acre for resource entitlements that are not leased?

The average cost per acre for resource entitlements that are not leased ranges from $0 to $250/acre, illustrating variability in resource valuation.

Is there a typical price for resource ownership?

No, there is no typical price for resource ownership as values can vary significantly, ranging from $1,000 to $10,000 per acre based on factors like lease conditions and production status.

Why is communication with stakeholders important for property owners?

Maintaining open communication with stakeholders—including oil and gas mineral rights services, oil and gas firms, and legal advisors—is essential for successful negotiations and to protect the property owner's interests effectively.

What should property owners document regarding their resource earnings?

Property owners are encouraged to maintain precise documentation of earnings obtained from resources, which is important for tax reporting purposes.

How can a knowledgeable advisor assist property owners in managing their mineral rights?

A knowledgeable advisor can improve the management of oil and gas mineral rights services, ensuring that all legal and financial interests are adequately addressed.

List of Sources

- An Overview of Oil and Gas Mineral Rights

- Mineral and Royalty Outlook: 2024 and Beyond | Enverus (https://enverus.com/blog/mineral-and-royalty-outlook-2024-and-beyond)

- Which States Has Mineral Rights: Most Prevalent Ones - Pheasant Energy (https://pheasantenergy.com/mineral-rights-by-state)

- Oil And Gas Outlook & Impact On US Mineral And Royalty Owners (https://venergymomentum.com/posts/oil-gas-impact-mineral-and-royalty-owners)

- Managing Your Mineral Rights: Key Considerations and Responsibilities

- Fracking: What Every Agent Needs to Know (https://bulletins.ncrec.gov/fracking-what-every-agent-needs-to-know)

- Calculate Oil and Gas Royalties Value 2024 - Free Guide (https://usmineralexchange.com/blog/mineral-rights-value/oil-and-gas-royalties-value)

- How To Calculate Value Of Mineral Rights 2024 | US Mineral Exchange (https://usmineralexchange.com/blog/mineral-rights-value/calculate-mineral-rights-value)

- Understanding the Financial Aspects of Mineral Rights

- (PDF) US private oil and natural gas royalties: estimates and policy relevance (https://researchgate.net/publication/299334649_US_private_oil_and_natural_gas_royalties_estimates_and_policy_relevance)

- Calculate Oil and Gas Royalties Value 2024 - Free Guide (https://usmineralexchange.com/blog/mineral-rights-value/oil-and-gas-royalties-value)

- Navigating Legal Issues and Disputes in Mineral Rights

- Balancing Rights in a New Energy Era: Will the Mineral Estate's Dominance Continue? | Published in Houston Law Review (https://houstonlawreview.org/article/12945-balancing-rights-in-a-new-energy-era-will-the-mineral-estate-s-dominance-continue)

- Planning For Mineral Rights: Essential Strategies | JD Supra (https://jdsupra.com/legalnews/planning-for-mineral-rights-essential-5084508)

- Conflict Minerals: 2022 Company Reports on Mineral Sources Were Similar to Those Filed in Prior Years (https://gao.gov/products/gao-23-106295)

- The Future of Oil and Gas Mineral Rights Services

- Mine 2024: Preparing for impact (https://pwc.com/gx/en/industries/energy-utilities-resources/publications/mine.html)

- Mineral and Royalty Outlook: 2024 and Beyond | Enverus (https://enverus.com/blog/mineral-and-royalty-outlook-2024-and-beyond)

- Mining & metals 2024: Geopolitics in the driver’s seat | White & Case LLP (https://whitecase.com/insight-our-thinking/mining-metals-2024-geopolitics-drivers-seat)