Overview

Utility-scale energy arbitrage is crucial for optimizing electricity trading. It enables the purchase of power at low prices, allowing for sales during peak demand. This practice not only enhances grid reliability but also maximizes profit potential for stakeholders.

The article highlights the significance of:

- Strategic land acquisition

- Comprehensive market analysis

- Adherence to regulatory requirements

- The role of technological advancements

These factors collectively shape the success and financial viability of energy arbitrage projects.

Introduction

Utility-scale energy arbitrage represents a transformative approach in the power market, enabling stakeholders to optimize profits by strategically buying and selling electricity based on price fluctuations. This article delves into critical insights surrounding land acquisition for energy storage projects, highlighting how strategic site selection can significantly enhance operational efficiency and reduce costs.

However, as the landscape of energy trading evolves, what challenges and regulatory considerations must developers navigate to successfully capitalize on this opportunity? Understanding these complexities is essential for maximizing the potential of energy arbitrage.

Define Energy Arbitrage and Its Importance in Utility-Scale Storage

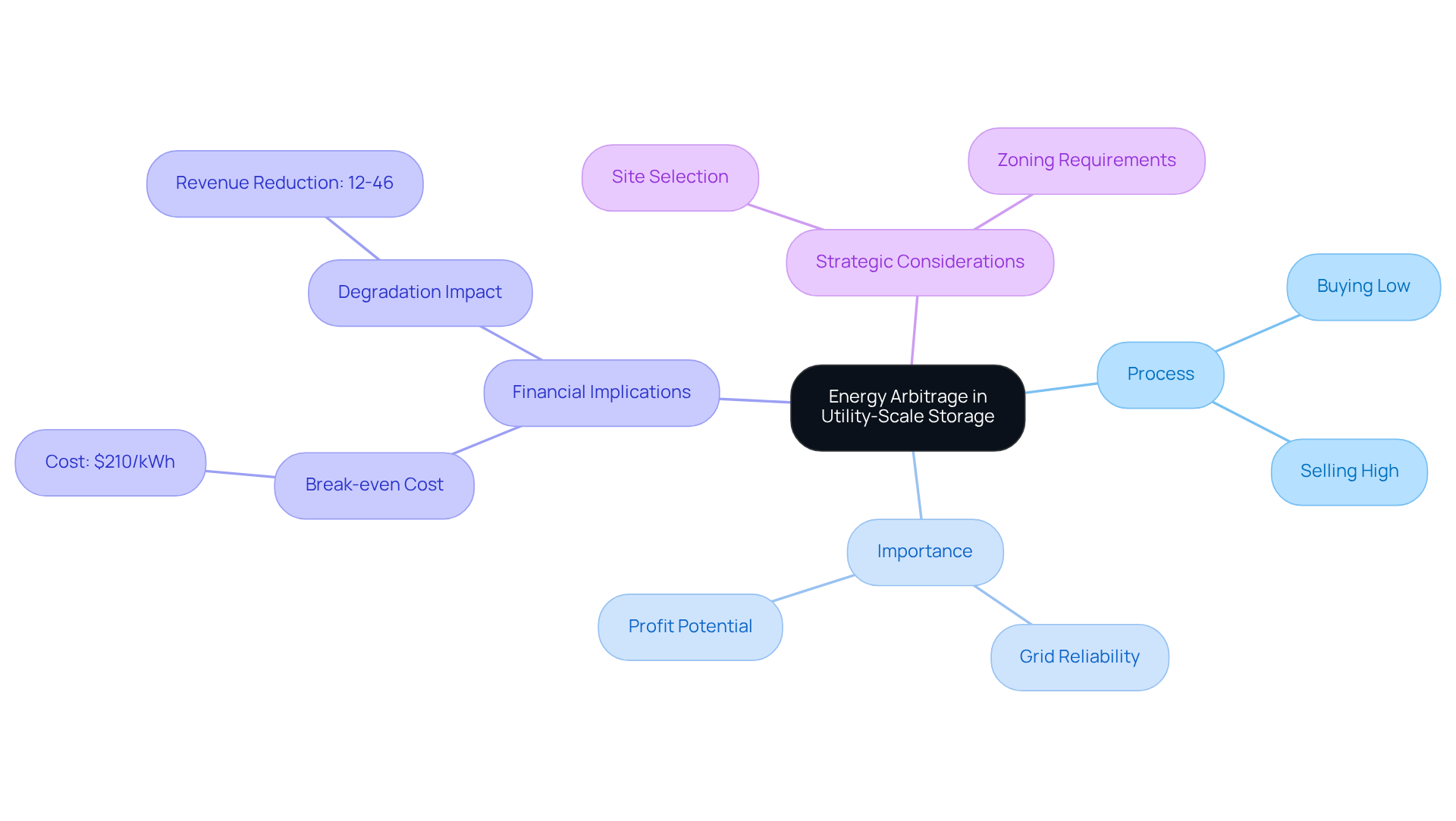

Utility-scale energy arbitrage is a critical practice in the power market, involving the purchase of electricity when costs are low and its sale when prices rise. This strategy allows stakeholders to capitalize on price fluctuations effectively. In utility-scale energy arbitrage systems, where significant volumes of power can be stored and dispatched as needed, this practice becomes even more essential. Managing power reserves not only enhances grid reliability but also boosts profit potential for suppliers.

Understanding power trading is particularly vital in land acquisition, as it influences site selection, zoning requirements, and the overall feasibility of power retention projects. Developers must prioritize well-located warehousing options to significantly reduce operational costs and improve competitive positioning. For example, California, which represents over 35% of the U.S. The Battery Power Accumulation System (BESS) sector illustrates how strategically positioned battery systems can enhance profitability through utility-scale energy arbitrage.

The financial implications of power trading in land acquisition strategies are underscored by the break-even investment cost for a grid-scale BESS, identified as $210/kWh. Moreover, as Florian Wankmüller notes, "degradation significantly affects battery storage system (BESS) profitability," highlighting the necessity for developers to focus on resource trading factors in their land acquisition strategies. This ensures that selected locations align with economic trends and operational efficiencies, ultimately driving successful outcomes.

Explain the Mechanisms of Energy Arbitrage in the Market

The mechanisms of utility-scale energy arbitrage encompass several critical processes that are vital for success in the energy market.

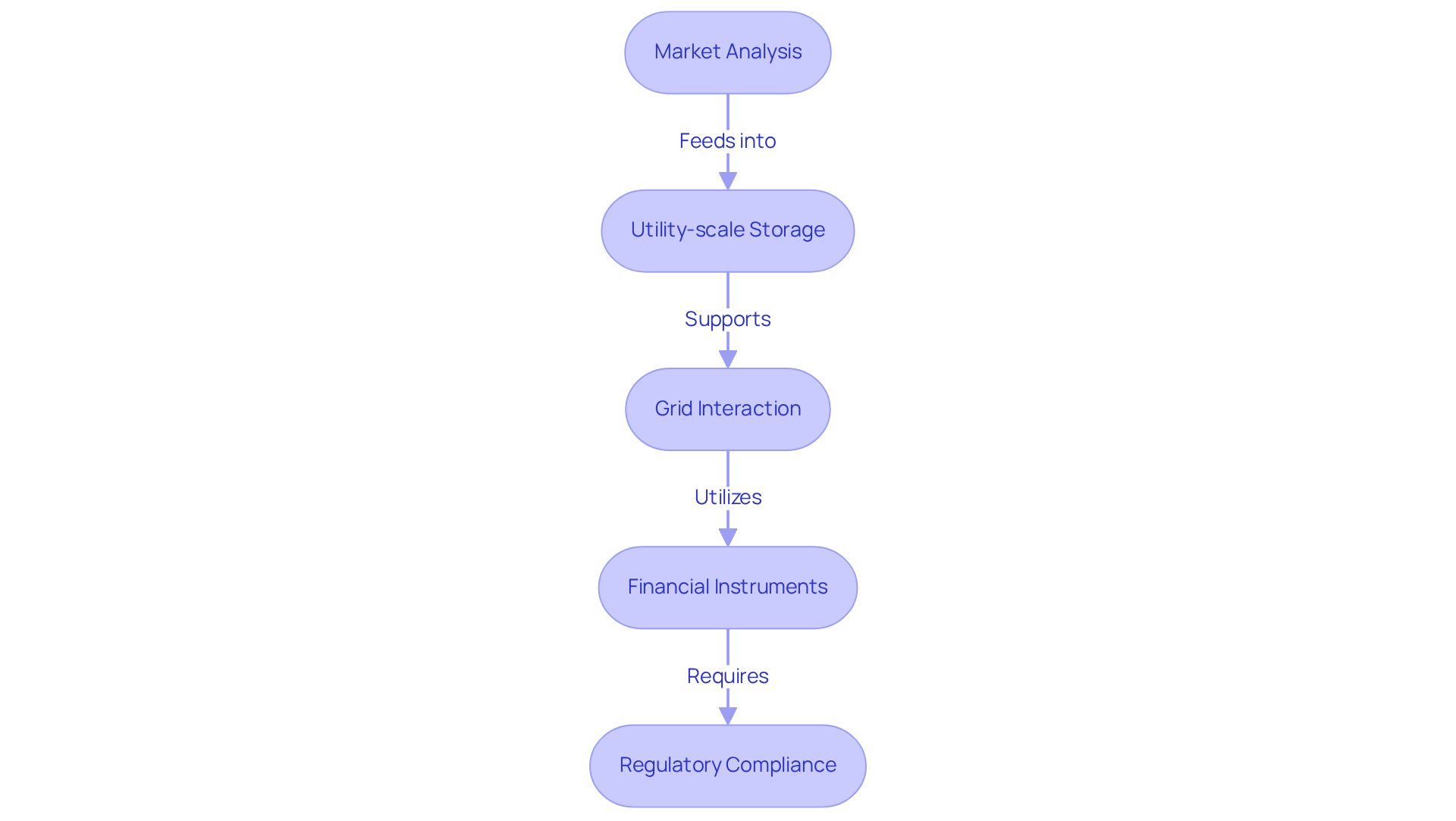

- Market Analysis: Energy traders must continuously monitor market prices to pinpoint opportunities for buying low and selling high. Access to real-time data and predictive analytics is essential in this endeavor.

- Utility-scale energy arbitrage is essential, as utility-scale storage systems, such as batteries, play a pivotal role in power trading. These systems store excess energy generated during off-peak hours and release it during peak demand when prices surge.

- Grid Interaction: The dynamics of energy trading are closely linked to grid operations. A thorough understanding of grid demand patterns and regulatory constraints is crucial for optimizing storage dispatch.

- Financial Instruments: Traders often employ financial instruments, including futures contracts, to safeguard against price fluctuations, thus ensuring profitability in their trading activities.

- Regulatory Compliance: Navigating the regulatory landscape is imperative, as varying rules across regions can significantly impact the viability of power trading strategies.

By comprehensively understanding these mechanisms, stakeholders can make informed decisions regarding land acquisition and project development.

Discuss Regulatory Frameworks and Market Dynamics Affecting Energy Arbitrage

The regulatory frameworks and market dynamics impacting energy arbitrage present a complex landscape:

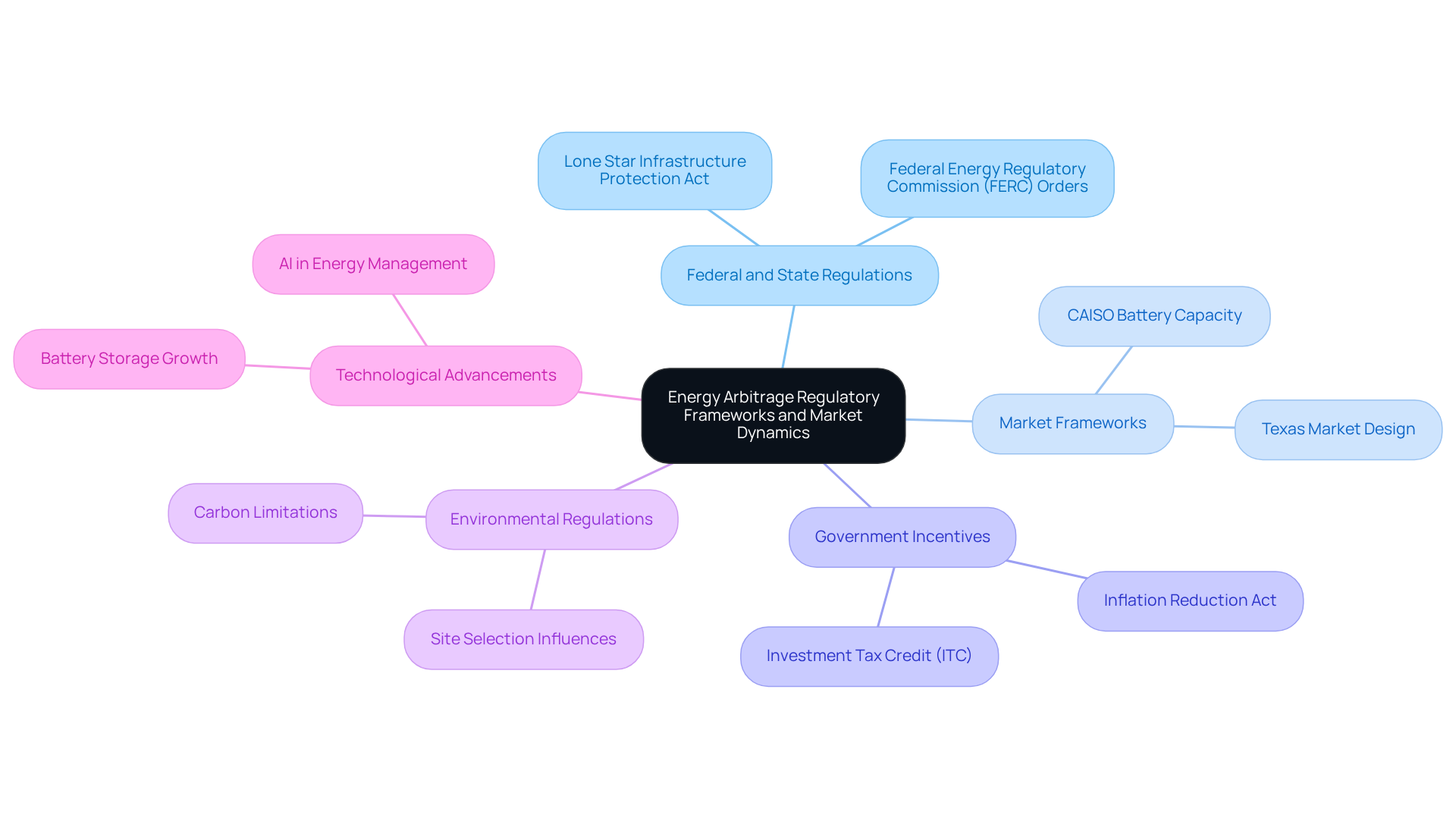

- Federal and State Regulations: Energy policies at both federal and state levels dictate the parameters for energy trading and storage. For example, the recent enactment of the Lone Star Infrastructure Protection Act in Texas restricts ownership of critical infrastructure by foreign entities, which can influence project eligibility and operational requirements. Understanding these regulations is essential for compliance and strategic planning.

- Market Frameworks: Regions exhibit diverse commercial structures, such as wholesale and retail environments, which significantly influence pricing and trading strategies. California's market, for instance, has robust policies supporting reserves, while Texas operates without official requirements, leading to differing trading conditions. Notably, CAISO boasts approximately 0.76 GWh of battery capacity for each GW of solar potential, illustrating the integration of reserves into trading strategies.

- Government incentives for renewable resources and solutions can greatly enhance the financial viability of utility-scale energy arbitrage projects. The Inflation Reduction Act, which established a 30% Investment Tax Credit for battery retention systems, exemplifies how financial incentives can improve project feasibility. Developers must remain informed about available programs to optimize their investments. Additionally, the 25% tariff on power conversion systems can significantly escalate project costs, impacting overall financial viability.

- Environmental Regulations: Adherence to environmental laws is critical, as these regulations can influence site selection and operational practices. For instance, stringent carbon limitations may necessitate a shift from natural gas to increased variable generation and power retention, thereby affecting project planning and execution.

- Technological Advancements: The rapid evolution of technology in power retention and management can alter industry dynamics, creating new opportunities for arbitrage. With battery retention capacity surging by 64% to 7.4 GW in 2024, the integration of advanced retention solutions has become vital for maximizing power trading potential. Furthermore, 60% of the nationwide battery storage expansions in 2024 occurred in California and Texas, underscoring regional disparities in economic dynamics.

By comprehensively understanding these regulatory and market factors, stakeholders can effectively navigate the complexities surrounding land acquisition for utility-scale energy arbitrage projects, ensuring compliance and optimizing their energy trading strategies.

Conclusion

Utility-scale energy arbitrage stands as a cornerstone of modern power markets, empowering stakeholders to optimize financial outcomes through strategic buying and selling of electricity in response to price fluctuations. The critical role of land acquisition in this context is paramount; it directly impacts operational efficiency, regulatory compliance, and overall project success. By grasping the nuances of energy arbitrage, developers can make informed decisions that align with market dynamics, enhancing their competitive edge.

This article explores various essential facets of energy arbitrage, including:

- Market analysis mechanisms

- Grid interaction

- The significance of regulatory frameworks

It underscores how strategically positioned energy storage systems can leverage price variations, highlighting the need for developers to adeptly navigate the complexities of regulations and market conditions. The insights herein illuminate the financial ramifications of land acquisition strategies, particularly in regions characterized by distinct regulatory environments and market structures.

Ultimately, the landscape of utility-scale energy arbitrage is shaped by evolving regulations, technological advancements, and market dynamics. Stakeholders must remain vigilant and proactive in understanding these factors, as they are crucial for optimizing land acquisition and enhancing the viability of energy storage projects. By leveraging the insights shared, developers can position themselves to thrive in an increasingly competitive energy market, ensuring that their strategies align with both economic trends and operational efficiencies for sustainable growth.

Frequently Asked Questions

What is energy arbitrage in the context of utility-scale storage?

Energy arbitrage in utility-scale storage refers to the practice of purchasing electricity when costs are low and selling it when prices rise, allowing stakeholders to take advantage of price fluctuations in the power market.

Why is energy arbitrage important for utility-scale systems?

It is important because it enhances grid reliability and increases profit potential for suppliers by effectively managing power reserves and responding to price changes.

How does power trading influence land acquisition for energy projects?

Power trading influences land acquisition by affecting site selection, zoning requirements, and the overall feasibility of power retention projects, making it essential for developers to prioritize well-located warehousing options.

What is the significance of California in the energy arbitrage market?

California is significant because it represents over 35% of the U.S. Battery Energy Storage System (BESS) sector, demonstrating how strategically positioned battery systems can enhance profitability through utility-scale energy arbitrage.

What is the break-even investment cost for a grid-scale BESS?

The break-even investment cost for a grid-scale Battery Energy Storage System (BESS) is identified as $210/kWh.

How does battery degradation affect profitability in energy storage systems?

Battery degradation significantly affects the profitability of Battery Energy Storage Systems (BESS), making it crucial for developers to consider resource trading factors in their land acquisition strategies to ensure economic viability.