Introduction

The management of solar assets is becoming increasingly complex as the demand for renewable energy surges. Effective solar asset management requires a comprehensive and structured approach that encompasses various strategies to optimize performance, enhance financial viability, and ensure regulatory compliance.

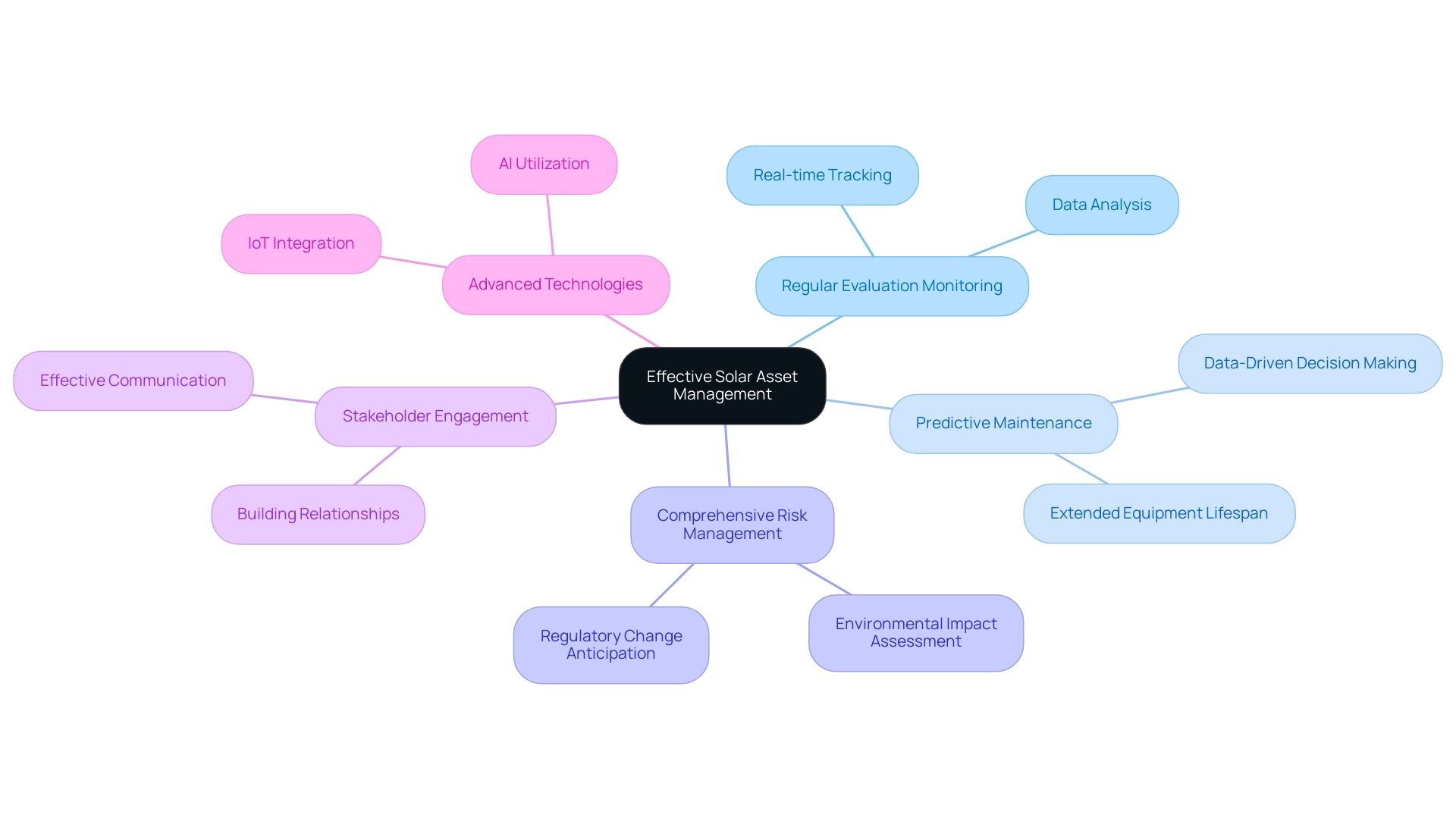

From implementing advanced technologies such as IoT and AI to adopting sustainable investing practices and engaging stakeholders, organizations must navigate a multifaceted landscape. This article delves into essential strategies for managing solar assets effectively, emphasizing the importance of:

- Performance monitoring

- Predictive maintenance

- Risk management

While also exploring the integration of sustainability and advanced technologies to drive long-term success in the solar energy sector.

Essential Strategies for Effective Solar Asset Management

To effectively manage solar resources, organizations must adopt a structured approach that incorporates several essential strategies:

- Regular Evaluation Monitoring: Implementing monitoring systems is crucial for tracking energy output, efficiency, and maintenance needs in real-time. This proactive monitoring allows for rapid identification of underachieving resources, facilitating prompt interventions that can greatly improve overall system efficiency. Recent advancements in sunlight monitoring technology have further streamlined this process, allowing for more precise data collection and analysis. Just as YouTube monitors user engagement through cookies, effective oversight in renewable sources is crucial for comprehending asset utilization and effectiveness.

- Predictive Maintenance: Utilizing data analytics to predict maintenance requirements based on historical performance and environmental factors is vital. Predictive maintenance not only reduces downtime but also extends the lifespan of solar equipment, ensuring sustained energy production. According to Hao Shen, director and head of data products at kWh Analytics, the use of market data to enhance the financeability of a resource is an inevitable step in the maturation of the category. This quote underscores the critical role of data-driven decision-making in enhancing asset management practices, especially in the context of predictive maintenance.

- Comprehensive risk management is essential for establishing a robust framework in solar infrastructure asset management to identify potential risks associated with photovoltaic infrastructure. This includes assessing environmental impacts, anticipating regulatory changes, and staying abreast of technological advancements. A proactive approach to solar infrastructure asset management minimizes disruptions and enhances project resilience, ensuring a more stable operational environment.

- Stakeholder Engagement: Building strong relationships with stakeholders—including local communities, regulatory bodies, and investors—is vital for successful project execution. Effective communication and collaboration can lead to increased support for ongoing operations and smoother project execution. This is illustrated by case studies highlighting strategic partnerships between software providers and solar power companies, which drive growth and innovation in the sector.

Utilizing solar infrastructure asset management involves leveraging advanced technologies such as IoT and AI, which are essential for optimizing resource management processes. These innovations enhance energy production, improve maintenance scheduling, and boost operational efficiency, resulting in significant cost savings and better performance of resources. As the energy sector continues to evolve, embracing these technological advancements will be key to staying competitive and maximizing the value of renewable assets.

Integrating Sustainable Investing into Solar Infrastructure Management

Integrating sustainable investing into solar infrastructure asset management necessitates a multifaceted approach that addresses both environmental responsibility and financial viability. Here are several strategic avenues to consider:

-

Adopting ESG Criteria: Prioritizing environmental, social, and governance (ESG) criteria within investment decisions is crucial.

This entails evaluating potential investments based on their sustainability practices and their alignment with long-term environmental objectives, thereby fostering a culture of responsibility in investment choices.

-

Long-term Value Assessment: A shift from a focus on immediate financial returns to an emphasis on long-term value creation is essential.

This involves a comprehensive evaluation of projects not only concerning their profitability but also regarding their social and environmental impacts.

Such an approach cultivates a more holistic investment strategy that benefits both investors and the community. For example, the case study titled 'Carbon Reduction Targets' illustrates how 60% of global companies aim for net-zero emissions by 2050, reflecting a commitment to sustainable operations and highlighting the long-term economic benefits of such investments.

-

Stakeholder Accountability: Transparency in reporting sustainability metrics and performance is vital for ensuring accountability to stakeholders.

By providing clear and accessible information on sustainability efforts, organizations can build trust and demonstrate their commitment to responsible practices. This is increasingly important as 60% of global companies target net-zero emissions by 2050. Moreover, many governments offer incentives such as tax credits and grants to support clean energy adoption, which can further motivate organizations to invest in sustainable practices.

-

Strategic Partnerships: Strategic partnerships with investment funds that prioritize sustainability can enhance solar infrastructure asset management in the management of renewable energy resources.

These collaborations not only provide access to essential resources and expertise but also ensure that investment strategies are aligned with broader sustainability goals, reflecting current trends in sustainable investing.

-

Continuous Education and Training: Investing in staff training programs focused on sustainable practices is critical.

Informing team members about the importance of integrating sustainability into resource management fosters a cultural transformation within the organization, resulting in more creative and accountable decision-making in overseeing renewable energy resources.

As Louis Marmon aptly noted, 'Happy to discuss this with you,' emphasizing the importance of dialogue in fostering a commitment to sustainability. Ultimately, these efforts contribute to long-term economic benefits and a commitment to addressing climate change.

Optimizing Financial Performance of Solar Assets

To improve the financial performance of renewable power resources, managers should adopt several key strategies:

- Cost-Benefit Analysis: Regularly conducting cost-benefit analysis is crucial to assess the financial implications of various operational strategies. This structured evaluation aids in making informed decisions that can significantly enhance profitability.

- Incentive Utilization: Effectively leveraging government incentives and subsidies for renewable initiatives is vital. A comprehensive understanding of these financial tools can lead to substantial cost reductions, thereby increasing the overall feasibility of projects. Recent governmental incentives announced in 2024 further underscore the importance of staying informed about available financial support.

- Energy Pricing Strategies: Implementing dynamic pricing strategies in response to market conditions can greatly optimize revenue streams. By adjusting pricing based on real-time demand and supply fluctuations, solar infrastructure asset management enables solar asset managers to maximize their returns.

- Diversification of Revenue Streams: Exploring additional revenue opportunities, such as storage solutions and ancillary services like demand response, can create new income avenues. Diversification not only enhances financial stability but also aligns with emerging trends in the energy market.

- Financial Risk Management: Establishing a robust financial risk management framework is essential to mitigate risks associated with market volatility. This proactive method guarantees that financial results stay consistent, even when confronted with external variations.

The significance of these strategies is further backed by case studies, such as the Lawrence Berkeley National Laboratory’s examination of energy market trends. Their findings, which include comprehensive reports like 'Tracking the Sun' and 'Utility-Scale Solar,' provide valuable insights that can inform policy and investment decisions. For example, these reports outline the financial results of photovoltaic installations at various scales, demonstrating best practices that can be implemented.

Moreover, as Brazil's power matrix consists of 82% renewable sources, the importance of sunlight collection in promoting sustainability is highlighted. Experts also emphasize that optimizing financial performance in energy assets, particularly through solar infrastructure asset management, is not just about immediate gains but also about sustainable long-term strategies. Natarajan P., Professor & Head, Department of Commerce at Pondicherry University, states, 'India has made a commitment to reduce its emissions per unit GDP by 20 to 25 percent from 2005 levels by 2020,' highlighting the global sustainability goals that financial strategies in renewable sources must align with.

Enhancing Regulatory Compliance in Solar Asset Management

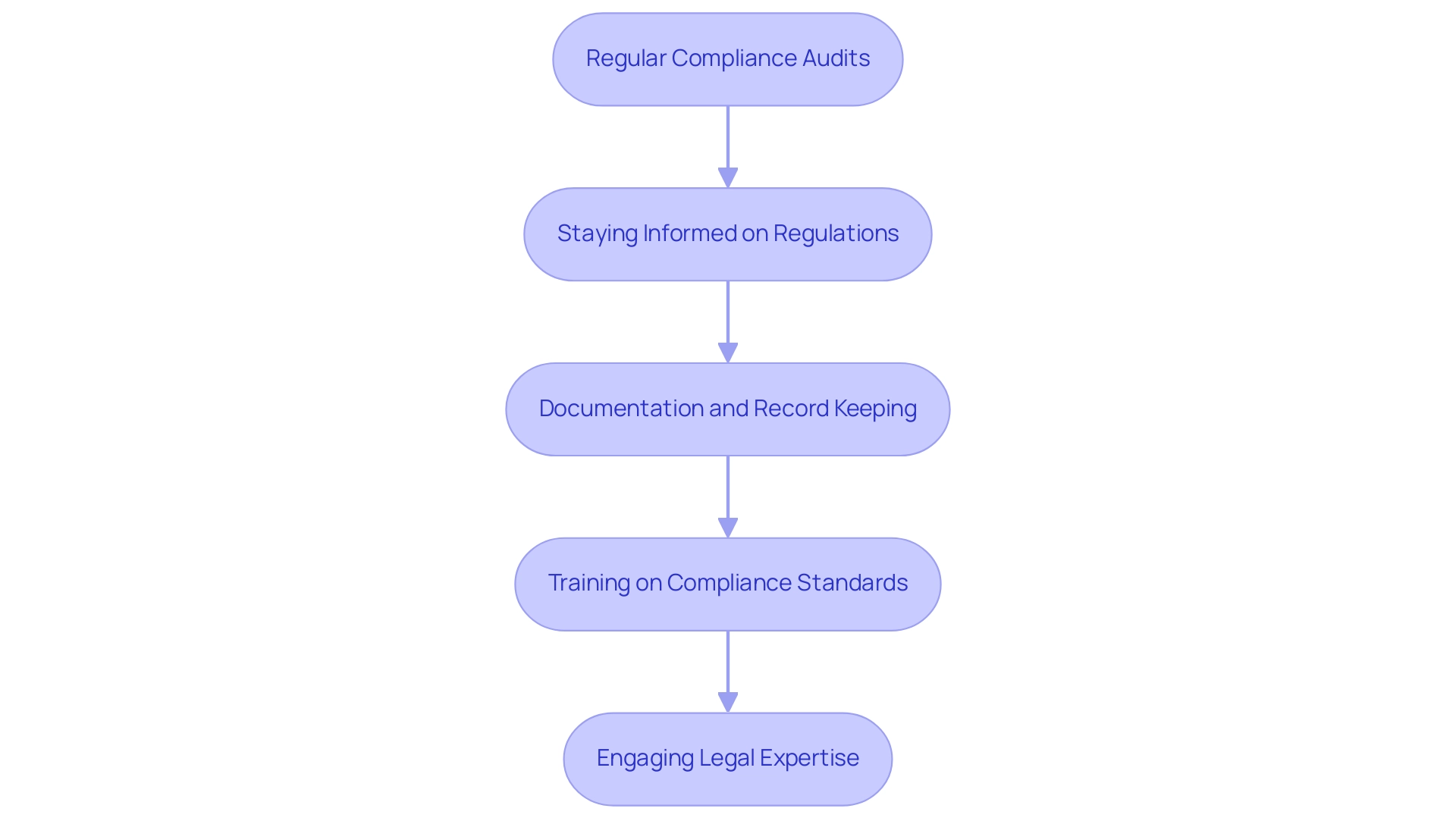

To effectively enhance regulatory compliance within solar energy projects, organizations should adopt the following best practices:

- Regular Compliance Audits: Implementing routine compliance audits is essential for assessing adherence to local, state, and federal regulations. This proactive approach not only helps identify potential gaps but also mitigates risks before they escalate into significant issues. As highlighted by a recent survey involving 44 Secureframe users, 27% of security and IT professionals cited internal audit fatigue as a major compliance challenge. This statistic highlights the necessity of systematic audits in the energy sector to combat such fatigue and maintain regulatory compliance.

- Staying Informed on Regulations: It is crucial for organizations to remain updated on legislative changes impacting renewable sources, including zoning laws, environmental regulations, and tariffs. Establishing processes to incorporate new requirements into operational practices ensures compliance remains a continuous effort, rather than a reactive measure.

- Documentation and Record Keeping: Maintaining comprehensive documentation of all compliance-related activities—such as permits obtained, inspections passed, and compliance reports filed—fosters transparency and accountability. This practice not only aids in internal audits but also demonstrates due diligence during regulatory evaluations.

- Training on Compliance Standards: Regular training sessions for staff members are vital to ensure a thorough understanding of compliance standards and their specific roles in maintaining adherence. By cultivating a culture of compliance, organizations can significantly reduce the risk of violations.

- Engaging Legal Expertise: Consulting with legal experts specializing in environmental law is advisable for navigating the complexities of regulatory environments. Their insights can help organizations implement best practices and adapt to evolving regulations effectively.

Implementing these practices not only strengthens compliance but also fosters a culture of safety and responsibility within renewable operations. For instance, the case study titled "Tips for Maintaining Safety and Compliance" illustrates that post-audit reviews and ongoing training create an environment where compliance is prioritized, ultimately ensuring that power plants remain aligned with the latest regulations. Furthermore, as highlighted by supply chain experts, 40% regard risk management and supply chain resilience as their main concern, further underscoring the significance of strong compliance measures in tackling potential challenges in the energy sector.

Implementing Advanced Technologies for Asset Management

Integrating advanced technologies into solar infrastructure asset management can drastically enhance operational efficiency. Here are several key technologies that stand out:

- IoT Sensors: The deployment of IoT sensors facilitates real-time monitoring of solar panels and equipment conditions. These sensors monitor essential metrics and provide immediate alerts to managers regarding potential issues, enabling proactive maintenance before critical failures occur. A significant advancement in this area is illustrated by the case study titled "Integration of IoT with Management Systems," which demonstrates how IoT devices enable real-time monitoring and optimization of consumption, contributing to cost reduction and emissions reduction.

- AI and Machine Learning: Leveraging AI algorithms allows for the analysis of extensive datasets aimed at optimizing performance and ensuring predictive maintenance. Machine learning technology can identify patterns in data that assist in predicting both equipment failures and production, leading to enhanced operational reliability and efficiency. As noted, "The future success of AI in renewable energy hinges not only on technological advancement but also on ethical considerations, robust regulatory frameworks, and a commitment to equitable access and sustainable practices."

- Drones for Inspections: The application of drone technology for routine assessments provides a transformative method for evaluating the state of energy installations. Drones can quickly assess the condition of photovoltaic panels and related infrastructure, greatly decreasing the time and expenses linked with conventional inspection techniques.

- Blockchain for Transparency: Exploring blockchain technology can enhance transparency in transactions and contracts associated with solar resources. By creating a secure and unchangeable ledger, blockchain promotes trust among stakeholders and simplifies operational processes, thereby enhancing the overall efficiency of resource management.

- Data Analytics Platforms: Investing in advanced data analytics platforms is crucial for aggregating and analyzing performance data. These platforms provide actionable insights that inform strategic decision-making, ultimately enhancing practices in solar infrastructure asset management and driving sustainability efforts. The integration of resource-efficient technologies like LED lighting and efficient HVAC systems can further support these efforts, helping to reduce consumption.

The integration of these advanced technologies is not only pivotal for improving efficiency but also for ensuring the sustainability of solar energy operations, particularly in the context of solar infrastructure asset management, as evidenced by recent studies highlighting their impact on energy management systems.

Conclusion

The effective management of solar assets is increasingly vital in the face of growing demand for renewable energy. Organizations must adopt a comprehensive strategy that includes:

- Regular performance monitoring

- Predictive maintenance

- Robust risk management

to optimize their solar operations. By implementing advanced technologies such as IoT, AI, and blockchain, companies can enhance efficiency and ensure sustainable practices that align with long-term environmental goals.

Furthermore, integrating sustainable investing principles and prioritizing stakeholder engagement are essential for fostering a culture of responsibility and accountability. This approach not only aids in navigating regulatory landscapes but also strengthens community relationships, ultimately contributing to the resilience of solar projects.

As the solar energy sector continues to evolve, embracing these strategies will be crucial for maximizing the financial performance of solar assets. By focusing on long-term value creation and leveraging available incentives, organizations can secure their position in a competitive market while contributing to global sustainability goals. Through a commitment to innovation and strategic management, the solar industry can pave the way for a cleaner, more sustainable energy future.

Frequently Asked Questions

What are the essential strategies for effectively managing solar resources?

The essential strategies include regular evaluation monitoring, predictive maintenance, comprehensive risk management, and stakeholder engagement.

Why is regular evaluation monitoring important in solar resource management?

Regular evaluation monitoring is crucial for tracking energy output, efficiency, and maintenance needs in real-time, allowing for rapid identification of underachieving resources and interventions to improve overall system efficiency.

How does predictive maintenance benefit solar equipment?

Predictive maintenance utilizes data analytics to forecast maintenance needs based on historical performance and environmental factors, reducing downtime and extending the lifespan of solar equipment.

What does comprehensive risk management involve in solar infrastructure asset management?

Comprehensive risk management involves identifying potential risks associated with photovoltaic infrastructure, assessing environmental impacts, anticipating regulatory changes, and staying updated on technological advancements.

Why is stakeholder engagement important in solar projects?

Building strong relationships with stakeholders, including local communities, regulatory bodies, and investors, is vital for successful project execution and can lead to increased support and smoother operations.

How do advanced technologies like IoT and AI enhance solar infrastructure asset management?

IoT and AI optimize resource management processes, improve maintenance scheduling, enhance energy production, and boost operational efficiency, resulting in cost savings and better performance.

What is the role of ESG criteria in sustainable investing for solar infrastructure?

Adopting ESG criteria entails evaluating investments based on sustainability practices and alignment with long-term environmental objectives, fostering responsible investment choices.

How does long-term value assessment impact solar project evaluations?

Long-term value assessment shifts the focus from immediate financial returns to the social and environmental impacts of projects, cultivating a holistic investment strategy that benefits both investors and the community.

Why is transparency in reporting sustainability metrics important?

Transparency in reporting ensures accountability to stakeholders, builds trust, and demonstrates an organization’s commitment to responsible practices, especially as many companies aim for net-zero emissions.

What is the significance of strategic partnerships in solar infrastructure asset management?

Strategic partnerships with sustainability-focused investment funds enhance resource management and ensure investment strategies align with broader sustainability goals.

How does continuous education and training contribute to sustainable practices in organizations?

Continuous education and training inform staff about integrating sustainability into resource management, fostering a cultural transformation that leads to more accountable decision-making in overseeing renewable energy resources.

List of Sources

- Essential Strategies for Effective Solar Asset Management

- Solar Generation Index 2022: Solar Underperformance Trend Continues (https://solaranywhere.com/2023/solar-generation-index-2022-continued-p50-underperformance-highlights-need-for-accurate-data-and-greater-transparency)

- The Top KPIs to Help PM's Keep Solar Projects on Track (https://blubanyan.com/the-top-key-performance-indicators-kpis-to-help-pms-keep-solar-projects-on-track)

- Solar Generation Index — Blog — kWh Analytics (https://kwhanalytics.com/blog-archive/category/Solar+Generation+Index)

- Solar Asset Management Software Market Trends by Region: Insights and Analysis (https://linkedin.com/pulse/solar-asset-management-software-market-trends-region-ztpzc)

- Integrating Sustainable Investing into Solar Infrastructure Management

- Clean Energy Adoption: Key to ESG Success (https://carbonminus.com/clean-energy-adoption-esg-success)

- 50 ESG & Sustainability Facts & Statistics [2025] (https://digitaldefynd.com/IQ/surprising-esg-statistics)

- The Status of ESG Investing: Sustainability Revolution Continues - Advance ESG (https://advanceesg.org/status-of-esg-investing-the-sustainability-revolution-continues)

- Optimizing Financial Performance of Solar Assets

- Frontiers | Cost-benefit analysis of solar energy integration in buildings: a case study of affordable housing in Brazil (https://frontiersin.org/journals/built-environment/articles/10.3389/fbuil.2023.1255845/full)

- Utility-Scale Solar | Energy Markets & Policy (https://emp.lbl.gov/utility-scale-solar)

- (PDF) Social Cost Benefit Analysis of Solar Power Projects (https://researchgate.net/publication/277901847_Social_Cost_Benefit_Analysis_of_Solar_Power_Projects)

- Solar Energy Cost and Data Analysis (https://energy.gov/eere/solar/solar-energy-cost-and-data-analysis)

- Enhancing Regulatory Compliance in Solar Asset Management

- How to Conduct a Thorough Safety Audit for Solar Power Plant Safety Compliance - TSM TheSafetyMaster Private Limited (https://thesafetymaster.com/how-to-conduct-a-thorough-safety-audit-for-solar-power-plant-safety-compliance)

- 110 Compliance Statistics to Know for 2025 (https://secureframe.com/blog/compliance-statistics)

- Implementing Advanced Technologies for Asset Management

- (PDF) Impact of IoT on Renewable Energy (https://researchgate.net/publication/355864938_Impact_of_IoT_on_Renewable_Energy)

- Energy Management System with IoT: Benefits & Statistics (https://kaaiot.com/iot-knowledge-base/energy-management-systems-connection-with-iot)

- What Statistics Indicate AI's Impact on Solar Farm Efficiency? → Question (https://sustainability-directory.com/question/what-statistics-indicate-ais-impact-on-solar-farm-efficiency)