Overview

Energy arbitrage optimization tools represent sophisticated software solutions that significantly enhance power trading. By strategically managing electricity transactions, these tools aim to maximize financial outcomes while ensuring grid stability. They utilize advanced algorithms and real-time data analysis, enabling utilities to capitalize on market price fluctuations. This strategic approach ultimately leads to increased profitability and operational efficiency within the energy sector.

As the energy market becomes increasingly complex, the need for effective trading solutions is more critical than ever. Utilities face the challenge of navigating fluctuating prices and maintaining operational efficiency. Energy arbitrage optimization tools provide a powerful response to these challenges, allowing for informed decision-making based on real-time data.

The benefits of these tools are manifold. They not only enhance profitability but also contribute to the overall stability of the energy grid. By leveraging sophisticated analytics, utilities can respond swiftly to market changes, ensuring they are always positioned to take advantage of favorable conditions.

In conclusion, energy arbitrage optimization tools are essential for utilities aiming to thrive in a competitive landscape. By adopting these advanced solutions, organizations can enhance their operational capabilities and achieve significant financial gains. It is time for utilities to embrace these innovations and transform their trading strategies.

Introduction

In the rapidly evolving energy sector, the pursuit of efficiency and profitability presents a significant challenge. This quest has led to the emergence of energy arbitrage optimization tools, which are fundamentally transforming how utilities manage electricity transactions.

By harnessing advanced algorithms and real-time market data, these tools empower organizations to capitalize on price fluctuations. They strategically charge and discharge energy storage systems to maximize financial returns.

As the demand for renewable energy sources continues to grow, the importance of these optimization strategies becomes increasingly pronounced, offering not only economic advantages but also enhanced grid stability. Yet, the path to fully leveraging these tools is not without its challenges, ranging from technical integration hurdles to regulatory complexities.

This article explores the pivotal role of energy arbitrage optimization tools, examining their features, historical evolution, and the critical considerations necessary for successful implementation in a competitive energy landscape.

Defining Energy Arbitrage Optimization Tools

Energy arbitrage optimization tools are advanced software solutions designed to enhance power trading by optimizing the financial outcomes of storage systems through strategic management of electricity transactions in response to market price fluctuations. These sophisticated energy arbitrage optimization tools utilize cutting-edge algorithms to analyze real-time market data, identifying the ideal moments for charging and discharging storage systems. Utilities can significantly enhance their profitability by using energy arbitrage optimization tools to acquire electricity during off-peak hours at reduced prices and sell it during peak demand at elevated rates. This approach not only boosts financial returns but also employs energy arbitrage optimization tools to play a vital role in maintaining grid stability by effectively balancing supply and demand.

The market for power optimization instruments is poised for substantial growth, with projections indicating a demand for 80-160 GW of total virtual power plant capacity in the U.S. grid by 2030. Recent innovations underscore the importance of energy arbitrage optimization tools in addressing transmission bottlenecks and enhancing resource management. As Amber Mullaney notes, "Power storage systems provide a remedy for this discrepancy while creating economic advantages through resource trading, which will remain an essential asset for utilities to handle grid resources for the foreseeable future."

Nevertheless, overcoming technical challenges and cultivating regulatory support are crucial for unlocking the full potential of energy arbitrage optimization tools. Additionally, new market frameworks will be necessary to alleviate transmission bottlenecks, highlighting the critical need for innovation in energy arbitrage optimization tools for power trading strategies.

Case studies illustrate the expanding opportunities within the power trading market, emphasizing strategies such as load forecasting and demand response. These methodologies enable utilities to enhance grid sustainability and profitability, highlighting the pivotal role of energy arbitrage optimization tools in the evolving energy landscape.

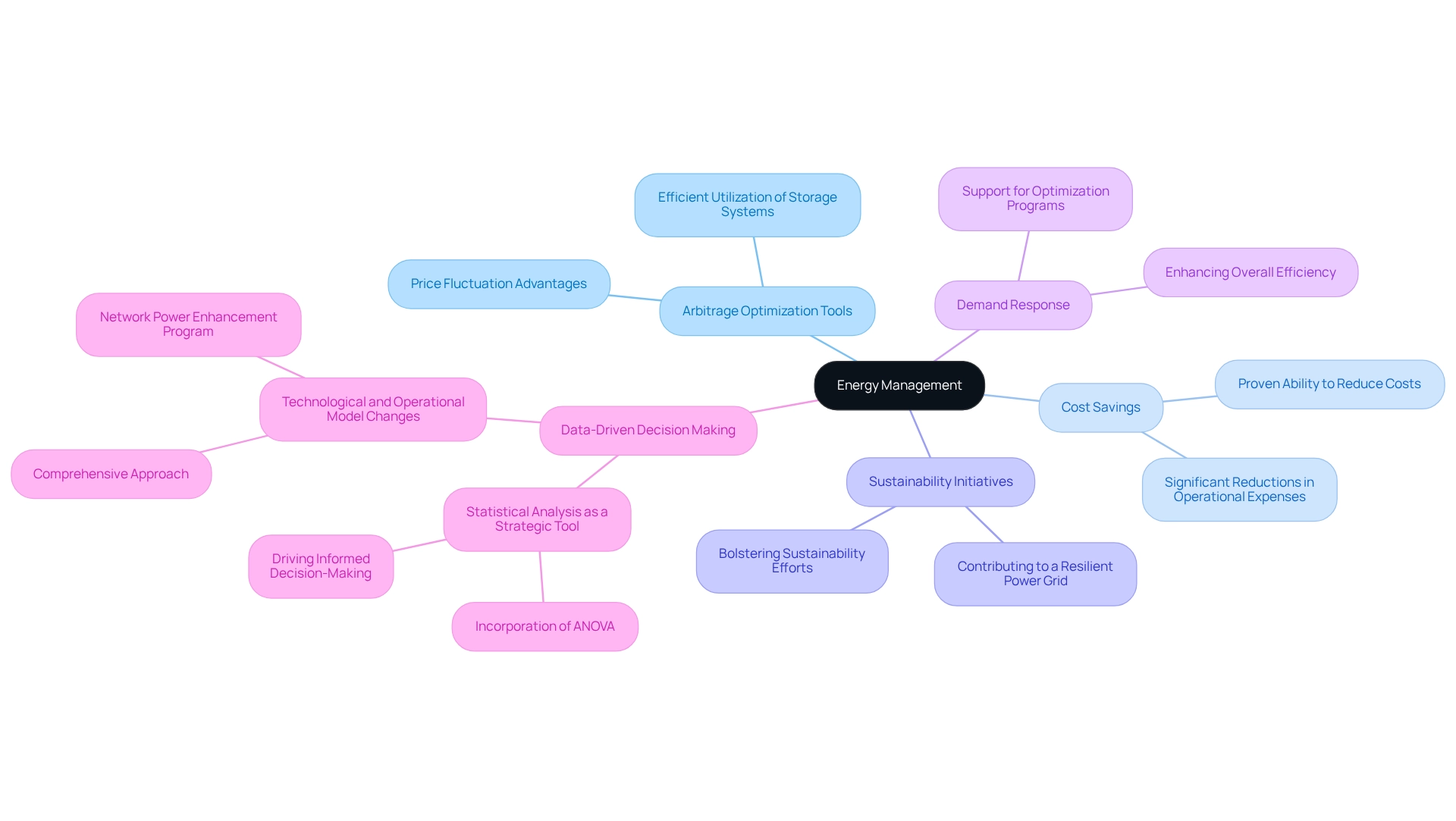

Context and Importance in Energy Management

As power expenses continue to rise and the integration of renewable sources accelerates, arbitrage optimization resources have emerged as essential assets for power managers and utility firms. Energy arbitrage optimization tools enable the efficient utilization of storage systems, allowing organizations to take advantage of price fluctuations in electricity markets. By optimizing resource consumption, companies can significantly lower operational costs and bolster their sustainability initiatives, thereby contributing to a more resilient power grid.

The importance of these tools is further underscored by their support for demand response initiatives, which enhance overall efficiency. In 2025, the value of resource trading instruments will be highlighted by their proven ability to reduce costs, with data indicating substantial savings for organizations that embrace these optimization strategies. For instance, utility firms employing power arbitrage tools have reported significant reductions in operational expenses, demonstrating the transformative impact of these technologies on resource management.

Moreover, as Tiago Silveira, a partner at McKinsey, points out, 'Implementing a network power enhancement program should include both technological facilitators and operating model adjustments.' This statement emphasizes the necessity of a comprehensive approach to resource optimization. Additionally, the integration of statistical analysis, as detailed in the case study titled 'Statistical Analysis as a Strategic Tool,' illustrates the critical role of data-driven decision-making in operational strategies within the power sector.

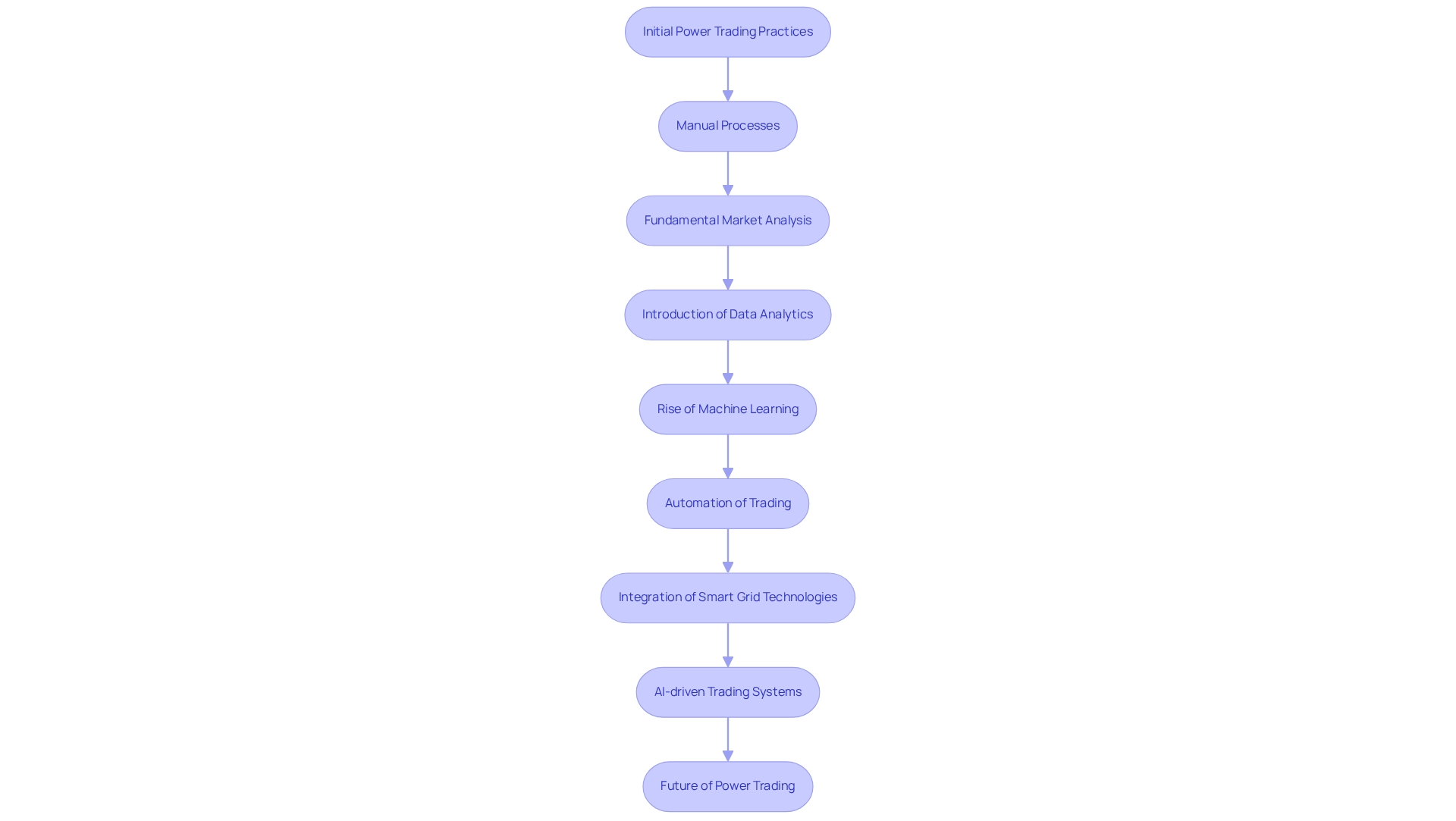

Historical Development and Technological Evolution

The evolution of power trading has been marked by significant technological advancements and shifts in market dynamics over recent decades. Initially, power arbitrage was heavily reliant on manual processes, with traders depending on fundamental market analysis and intuition to identify opportunities. However, the advent of advanced data analytics, machine learning, and artificial intelligence has revolutionized this sector, leading to the development of highly automated and efficient energy arbitrage optimization tools.

These modern resources leverage real-time data to facilitate informed decision-making, enabling more accurate and timely transactions. For example, algorithmic systems capitalize on price discrepancies across different times, locations, and markets for resource arbitrage, thereby enhancing profitability and operational efficiency. The integration of smart grid technologies has further augmented these capabilities, fostering improved communication and coordination among diverse power resources.

Historical case studies exemplify this transformation; notably, AI-driven trading systems have emerged as vital components in the power sector, tackling challenges such as market fragmentation and compliance. As Saud Alghumayjan remarked, "Using historical data from New York State and synthetic price predictions, our evaluations demonstrate that this framework can achieve good profit margins with less than 35% purchases." As the energy landscape increasingly transitions toward renewable sources, these systems are evolving to manage the inherent variability of renewables, positioning early adopters as frontrunners in trading.

The future of power trading is characterized by efficiency, profitability, and sustainability, driven by continuous technological innovation. These advancements are expected to cultivate a more robust trading environment.

Key Features and Functionalities of Optimization Tools

Energy arbitrage optimization tools are pivotal in enhancing operational efficiency within the energy sector. Their advanced data analytics capabilities empower users to analyze historical and real-time market data, effectively identifying trends and price patterns. This capability is crucial for informed decision-making. Additionally, predictive modeling allows for accurate forecasting of future price movements, enabling proactive strategies in a volatile market.

User-friendly interfaces and customizable dashboards ensure that critical information is readily accessible, further enhancing user experience. Moreover, seamless integration with energy management systems (EMS) and other software platforms provides a comprehensive view of energy operations, amplifying the effectiveness of these instruments. Notably, certain instruments employ machine learning algorithms to consistently improve performance based on historical results.

For instance, Enverus's recent implementation of real-time pricing alerts and monitoring has significantly improved client responsiveness to market changes. This showcases the practical benefits of advanced functionalities in real-world applications. Such implementations align with the capabilities of platforms like Sphere Workflows and MarketView®, which deliver comprehensive reporting on curve building activities.

As the power industry evolves, the integration of these advanced features is expected to yield considerable operational efficiencies and cost reductions. Some firms, including a biotech company, anticipate up to 10% savings in their first year of operation. Kiana Cruz noted how a European power corporation transformed its trading approach by moving away from traditional ETRM systems with Enverus MarketView®, highlighting the efficiency of sophisticated enhancement solutions. The evolution of energy arbitrage optimization tools represents a significant step forward in addressing the complexities of the energy market.

Challenges and Considerations in Implementation

Implementing energy arbitrage optimization tools poses significant challenges for organizations. A primary concern is the integration of these resources with existing energy management systems, often necessitating extensive technical modifications. Notably, approximately 70% of organizations encounter integration issues during implementation, underscoring the complexities involved in this process. This integration is further complicated by the need for real-time data processing, as maintaining data 'freshness' is essential for dynamic decision-making. In fact, real-time data processing and orchestration frameworks are crucial for ensuring that data remains current and actionable.

Moreover, the effectiveness of these resources heavily depends on the accessibility of high-quality data; inaccuracies can severely undermine their potential. As shown in the case study titled "Challenges of Managing the World's Data," organizations must confront the limitations of current systems and the escalating risks associated with data management.

Training personnel to proficiently use these tools is another critical factor. User proficiency directly impacts the success of resource trading strategies, making comprehensive training programs indispensable. Furthermore, organizations must navigate intricate regulatory frameworks governing transactions related to power. Compliance with these regulations necessitates meticulous planning and a profound understanding of the legal landscape, which can complicate implementation efforts. As Arfanuzzaman noted, "BDPA can be utilized effectively to further SDGs and meet the goals within the target deadline," emphasizing the importance of data quality and adherence in achieving arbitrage objectives.

Case studies reveal the urgent need for organizations to proactively address these challenges. As the demand for efficient energy management intensifies, the ability to successfully integrate energy arbitrage optimization tools will serve as a key differentiator in achieving operational excellence.

Conclusion

The examination of energy arbitrage optimization tools underscores their transformative impact on the energy sector, particularly in enhancing financial performance and promoting grid stability. By strategically managing electricity transactions based on real-time market data, these tools empower utilities to capitalize on price fluctuations, ultimately leading to significant profitability increases. As the demand for renewable energy sources escalates, the role of these optimization strategies becomes even more critical, highlighting the necessity for innovation in managing energy resources effectively.

However, the implementation of energy arbitrage tools presents notable challenges. Organizations must navigate technical integration hurdles, ensure high-quality data availability, and address regulatory complexities to fully harness the potential of these advanced systems. Training personnel and adapting existing energy management frameworks are essential steps in overcoming these obstacles and maximizing the effectiveness of optimization strategies.

In conclusion, energy arbitrage optimization tools represent a vital advancement in energy management, offering both economic advantages and enhanced grid stability. As the energy landscape continues to evolve, embracing these tools will not only foster profitability for utilities but also contribute to a more resilient and sustainable energy future. The ongoing commitment to overcoming implementation challenges will be crucial in realizing the full spectrum of benefits that these innovative technologies can offer.

Frequently Asked Questions

What are energy arbitrage optimization tools?

Energy arbitrage optimization tools are advanced software solutions designed to enhance power trading by optimizing the financial outcomes of storage systems through strategic management of electricity transactions in response to market price fluctuations.

How do energy arbitrage optimization tools benefit utilities?

These tools help utilities acquire electricity during off-peak hours at reduced prices and sell it during peak demand at elevated rates, significantly enhancing profitability and maintaining grid stability by balancing supply and demand.

What is the projected growth for the market of power optimization instruments?

The market for power optimization instruments is projected to see a demand for 80-160 GW of total virtual power plant capacity in the U.S. grid by 2030.

What challenges must be overcome to fully utilize energy arbitrage optimization tools?

Overcoming technical challenges and cultivating regulatory support are crucial for unlocking the full potential of these tools, along with the need for new market frameworks to alleviate transmission bottlenecks.

How do energy arbitrage optimization tools contribute to sustainability?

By enabling efficient utilization of storage systems and optimizing resource consumption, these tools help organizations lower operational costs and bolster sustainability initiatives, contributing to a more resilient power grid.

What role do energy arbitrage optimization tools play in demand response initiatives?

These tools support demand response initiatives, enhancing overall efficiency and proving their ability to reduce costs for organizations that implement these optimization strategies.

What impact have power arbitrage tools had on operational expenses for utility firms?

Utility firms employing power arbitrage tools have reported significant reductions in operational expenses, demonstrating a transformative impact on resource management.

What is emphasized by Tiago Silveira regarding resource optimization?

Tiago Silveira emphasizes that implementing a network power enhancement program should include both technological facilitators and operating model adjustments for effective resource optimization.

How does statistical analysis contribute to operational strategies in the power sector?

Statistical analysis plays a critical role in data-driven decision-making, as illustrated in case studies that showcase its importance in operational strategies within the power sector.